Shop Car Insurance Rates

Explore the World of Car Insurance: Understanding Rates and Coverage

In the realm of automotive ownership, one of the most important yet often daunting tasks is securing adequate car insurance. The process of shop car insurance rates involves navigating a complex landscape of policies, providers, and coverage options. This comprehensive guide aims to demystify the process, empowering you to make informed decisions about your car insurance coverage.

Car insurance is a critical aspect of vehicle ownership, offering financial protection in the event of accidents, theft, or other unforeseen circumstances. However, with numerous insurance providers and a myriad of coverage options available, finding the right policy at the right price can be challenging. This guide will provide you with the knowledge and tools to effectively shop for car insurance rates, ensuring you obtain the coverage you need at a competitive price.

Understanding Car Insurance Rates: Key Factors and Variables

Car insurance rates are influenced by a multitude of factors, each playing a role in determining the cost of your policy. These factors include:

- Vehicle Type and Usage: The make, model, and year of your vehicle significantly impact insurance rates. Additionally, how and where you use your car can affect your premium. For instance, driving in urban areas with high traffic density or using your car for business purposes may result in higher rates.

- Driver Profile: Your driving history and personal details are crucial in determining insurance rates. Factors such as age, gender, driving experience, and claims history all contribute to the assessment of risk by insurance providers.

- Coverage Options: The level and type of coverage you choose impact your insurance rates. Comprehensive coverage, which includes protection against damage, theft, and natural disasters, typically costs more than liability-only coverage, which covers injuries and damages caused to others in an accident for which you are at fault.

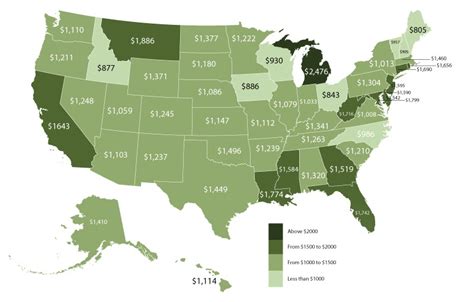

- Location: The geographic area where you reside and drive plays a significant role in insurance rates. Areas with high crime rates or frequent natural disasters may have higher premiums.

- Discounts and Bundles: Many insurance providers offer discounts for safe driving records, loyalty, or bundling multiple policies (e.g., car and home insurance) with the same provider. Taking advantage of these discounts can significantly reduce your insurance rates.

The Process of Shopping for Car Insurance Rates

Shopping for car insurance rates involves a systematic approach to ensure you find the best coverage at the most competitive price. Here's a step-by-step guide to help you navigate the process:

Assess Your Coverage Needs

Before you begin comparing insurance rates, it's crucial to understand your coverage needs. Consider the following:

- Minimum Legal Requirements: Research the minimum car insurance coverage required by your state or country. This typically includes liability coverage for bodily injury and property damage.

- Vehicle Value: Assess the value of your vehicle. If your car is older or has low resale value, you may opt for liability-only coverage, as comprehensive and collision coverage may not be cost-effective.

- Personal Preferences: Determine the level of coverage you feel comfortable with. Do you want comprehensive protection, including coverage for theft, natural disasters, and medical expenses? Or are you more comfortable with a basic liability policy?

Research Insurance Providers

Once you have a clear understanding of your coverage needs, it's time to research insurance providers. Consider the following factors:

- Reputation and Financial Stability: Choose reputable insurance providers with a solid financial standing. This ensures that they will be able to pay out claims in the event of an accident or other covered incident.

- Coverage Options: Review the range of coverage options offered by each provider. Ensure they offer the specific types of coverage you require, such as liability, comprehensive, collision, medical payments, and uninsured/underinsured motorist coverage.

- Customer Service and Claims Handling: Read reviews and seek recommendations to assess the quality of customer service and claims handling. A provider with a good reputation for prompt and fair claims settlement can provide peace of mind.

Compare Rates and Coverage

Now it's time to compare insurance rates and coverage from multiple providers. Utilize online quote tools or directly contact insurance providers to obtain quotes. Ensure you are comparing similar coverage levels to get an accurate comparison.

Consider the following when comparing rates:

- Premium Cost: Compare the annual or monthly premium costs for similar coverage levels. Keep in mind that the lowest premium may not always be the best option, as it may indicate a lack of sufficient coverage.

- Coverage Limits: Review the coverage limits for each policy. Higher limits typically provide more protection but may cost more.

- Deductibles: Compare deductibles, which are the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles can lower your premium, but consider whether you can afford the deductible in the event of a claim.

- Discounts: Look for opportunities to save money through discounts. Many providers offer discounts for safe driving records, loyalty, or bundling multiple policies.

Evaluate Additional Benefits and Services

Beyond basic coverage and rates, consider the additional benefits and services offered by insurance providers. These can include:

- Roadside Assistance: Many insurance providers offer roadside assistance as an add-on or included in their policies. This can provide peace of mind in case of emergencies like flat tires or running out of gas.

- Rental Car Coverage: If you frequently rent cars, consider providers that offer rental car coverage as part of your policy. This can save you money and provide convenience when you need a rental.

- Digital Services: In today's digital age, many insurance providers offer online or app-based services for policy management, claims filing, and other interactions. These digital services can streamline your insurance experience and provide added convenience.

Read the Fine Print

Before finalizing your car insurance decision, carefully review the policy documents. Pay close attention to the exclusions and limitations outlined in the policy. Understand what is and isn't covered, and ensure the policy aligns with your coverage needs.

Finalize Your Choice

Once you have thoroughly evaluated your options, choose the insurance provider and policy that best meets your coverage needs and budget. Remember to periodically review your coverage and shop around for new rates, especially when your policy is up for renewal.

Maximizing Your Car Insurance Savings

In addition to shopping around for the best rates, there are several strategies you can employ to maximize your car insurance savings. These include:

- Safe Driving Practices: Maintain a clean driving record by practicing safe driving habits. Insurance providers reward safe drivers with lower premiums, so avoid traffic violations and accidents to keep your rates down.

- Bundling Policies: If you have multiple insurance needs, such as home, renters, or business insurance, consider bundling your policies with one provider. Bundling often results in significant savings and simplifies your insurance management.

- Increase Your Deductible: Opting for a higher deductible can lower your premium. However, ensure you can afford the higher deductible in the event of a claim.

- Review Your Coverage Regularly: Your insurance needs may change over time. Regularly review your coverage to ensure it aligns with your current situation and make adjustments as necessary.

The Future of Car Insurance: Emerging Trends and Technologies

The car insurance industry is continually evolving, driven by technological advancements and changing consumer needs. Here are some emerging trends and technologies that are shaping the future of car insurance:

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of sensors and GPS to track driving behavior, is gaining popularity. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, uses telematics data to assess driving risk and set insurance rates. This approach rewards safe drivers with lower premiums, as it provides a more accurate assessment of individual driving habits.

Connected Car Technology

The increasing integration of connectivity features in modern vehicles is influencing the car insurance landscape. Connected car technology allows vehicles to communicate with insurance providers, providing real-time data on driving behavior, vehicle diagnostics, and location. This data can be used to offer more personalized insurance rates and services, as well as improve road safety.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are being utilized by insurance providers to enhance various aspects of their operations, including risk assessment, fraud detection, and claims processing. These technologies enable insurance companies to analyze vast amounts of data more efficiently, leading to more accurate risk assessments and improved customer experiences.

Blockchain Technology

Blockchain technology, known for its secure and transparent nature, is being explored by insurance providers to enhance data security and streamline various processes. By utilizing blockchain, insurance companies can improve data sharing, reduce fraud, and streamline claims processing, leading to more efficient and secure operations.

Personalized Insurance Policies

With the advent of new technologies and data analytics, insurance providers are increasingly able to offer personalized insurance policies tailored to individual needs and circumstances. By analyzing data on driving behavior, vehicle usage, and other factors, insurers can provide more precise risk assessments and offer coverage options that better meet the unique needs of each policyholder.

Conclusion: Empowering Your Car Insurance Decision

Shopping for car insurance rates involves a careful balance of understanding your coverage needs, researching providers, and comparing rates and coverage. By following the steps outlined in this guide and staying informed about emerging trends and technologies, you can make an empowered decision about your car insurance coverage, ensuring you have the protection you need at a competitive price.

Remember, car insurance is a critical aspect of vehicle ownership, and it's essential to stay informed and proactive in managing your coverage. Regularly review your policy, shop around for the best rates, and take advantage of opportunities to maximize your savings. With the right knowledge and approach, you can navigate the car insurance landscape with confidence and peace of mind.

What is the best way to shop for car insurance rates online?

+To shop for car insurance rates online effectively, start by understanding your coverage needs and researching reputable insurance providers. Use online quote tools or directly contact providers to obtain quotes, comparing similar coverage levels. Evaluate additional benefits and services, read the fine print, and finalize your choice based on your coverage needs and budget.

How can I save money on my car insurance premium?

+There are several strategies to save money on your car insurance premium. Maintain a clean driving record by practicing safe driving habits. Bundle your policies with one provider to take advantage of multi-policy discounts. Consider increasing your deductible to lower your premium, but ensure you can afford it in the event of a claim. Regularly review your coverage to ensure it aligns with your needs and make adjustments as necessary.

What is usage-based insurance, and how does it work?

+Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is an approach that uses telematics technology to track driving behavior and set insurance rates. This technology allows insurance providers to assess driving risk based on real-time data, rewarding safe drivers with lower premiums. It provides a more accurate assessment of individual driving habits and can lead to significant savings for safe drivers.