Term Life Insurance Cost

Term life insurance is a popular and affordable option for many individuals and families seeking financial protection during specific periods of their lives. The cost of term life insurance can vary significantly based on several factors, including the policyholder's age, health status, lifestyle choices, and the coverage amount selected. Understanding these variables is crucial for anyone considering this type of insurance to make an informed decision.

Factors Influencing Term Life Insurance Costs

The premium rates for term life insurance are determined by a combination of personal and policy-related factors. Here’s an in-depth look at the key elements that influence the cost of term life coverage.

Age and Health Status

Age is one of the most significant factors affecting term life insurance premiums. Generally, younger individuals pay lower premiums as they are considered to be at a lower risk of developing serious health conditions or passing away during the term of the policy. As individuals age, the risk increases, leading to higher premiums.

Health status is another critical factor. Insurers assess an applicant’s health through medical examinations and questionnaires. Pre-existing medical conditions, such as diabetes, heart disease, or cancer, can result in higher premiums or even policy denials. Additionally, certain lifestyle choices like smoking or engaging in high-risk activities can increase the cost of term life insurance.

Coverage Amount and Term Length

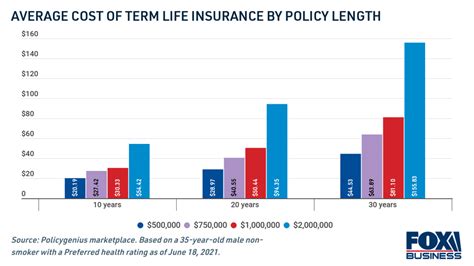

The amount of coverage selected, also known as the death benefit, directly impacts the premium. Higher coverage amounts typically result in higher premiums. It’s essential to choose a coverage amount that aligns with your financial needs and responsibilities, such as outstanding debts, mortgage payments, or future college expenses for children.

The term length of the policy is another crucial consideration. Term life insurance policies are available for various durations, typically ranging from 10 to 30 years. Longer term lengths provide coverage for a more extended period but often come with higher premiums. It’s essential to select a term length that corresponds to your specific needs and financial goals.

| Coverage Amount ($) | Premium (Monthly) |

|---|---|

| 250,000 | 35 |

| 500,000 | 70 |

| 1,000,000 | 140 |

Smoking and Lifestyle Factors

Smoking is a significant risk factor for insurers, and smokers often pay considerably higher premiums for term life insurance. The increased risk of health complications and a shorter life expectancy associated with smoking result in higher costs. Quitting smoking can lead to more favorable rates over time.

Other lifestyle factors that can influence term life insurance costs include hazardous hobbies or occupations. For instance, individuals engaged in extreme sports or high-risk professions like firefighting may face higher premiums due to the increased likelihood of injury or death.

Medical and Family History

Medical history plays a crucial role in determining term life insurance premiums. A history of serious health conditions, such as heart disease, cancer, or diabetes, can lead to higher premiums or even policy denials. Similarly, a family history of genetic disorders or certain diseases can impact the cost of coverage.

Obtaining Competitive Term Life Insurance Rates

Shopping around and comparing quotes from multiple insurers is essential to securing competitive term life insurance rates. Online comparison tools and insurance brokers can provide a comprehensive view of the market, helping you identify the most cost-effective options.

It’s also beneficial to review your policy periodically to ensure it aligns with your changing needs and financial circumstances. As your life situation evolves, you may need to adjust your coverage amount or term length to maintain adequate protection.

Best Practices for Term Life Insurance

- Choose a reputable insurer with a strong financial rating to ensure the stability and reliability of your policy.

- Consider the financial strength and reputation of the insurer when selecting a policy.

- Review your policy annually and update it as necessary to reflect significant life changes.

- If your financial situation allows, consider purchasing a larger coverage amount while you’re younger and healthier, as this can provide more comprehensive protection at a lower cost.

Term Life Insurance vs. Whole Life Insurance

When considering life insurance options, it’s essential to understand the differences between term life insurance and whole life insurance. Term life insurance provides coverage for a specified period, while whole life insurance offers lifetime coverage. Whole life insurance policies also include a cash value component, which term life insurance policies lack.

Whole life insurance policies are generally more expensive than term life insurance due to the permanent coverage and cash value features. However, term life insurance can be a more affordable option for individuals seeking temporary coverage to protect their families during specific life stages, such as while they have young children or outstanding debts.

Key Differences

| Term Life Insurance | Whole Life Insurance |

|---|---|

| Coverage for a specified term (e.g., 10, 20, or 30 years) | Lifetime coverage |

| Lower premiums compared to whole life insurance | Higher premiums due to permanent coverage and cash value |

| No cash value accumulation | Builds cash value over time |

| May not be renewable or convertible after the term ends | Typically renewable and convertible to another policy |

Conclusion

Understanding the factors that influence the cost of term life insurance is essential for making informed decisions about your financial protection. By considering your age, health status, coverage amount, term length, and lifestyle factors, you can choose a policy that provides the necessary coverage at a reasonable cost. Remember to periodically review your policy and shop around for the best rates to ensure you maintain adequate protection throughout your life stages.

Frequently Asked Questions

Can I get term life insurance if I have a pre-existing medical condition?

+

Yes, individuals with pre-existing medical conditions can still obtain term life insurance. However, it may result in higher premiums or certain policy exclusions. It’s essential to disclose all relevant medical information during the application process.

How often should I review my term life insurance policy?

+

It’s recommended to review your term life insurance policy annually or whenever significant life changes occur, such as marriage, the birth of a child, or a substantial change in financial responsibilities.

Are term life insurance policies renewable?

+

Renewability depends on the specific policy and insurer. Some term life insurance policies offer the option to renew, while others may require a new application and potentially higher premiums due to the policyholder’s increased age.

What happens if I stop paying my term life insurance premiums?

+

If you stop paying your term life insurance premiums, your coverage will typically lapse, and you will no longer have protection. It’s crucial to maintain timely premium payments to ensure continuous coverage.

Can I convert my term life insurance policy to a whole life policy?

+

Many term life insurance policies offer a conversion option, allowing policyholders to convert their term policy to a whole life policy without undergoing a new medical exam. However, conversion may result in higher premiums due to the policyholder’s increased age.