Term Life Insurance Vs Life Insurance

Unveiling the Differences: Term Life Insurance vs. Life Insurance

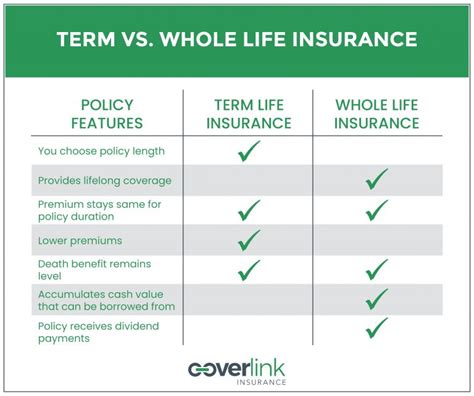

When it comes to safeguarding your loved ones' financial future, understanding the nuances between term life insurance and life insurance is crucial. These two types of policies, often referred to interchangeably, have distinct features and serve different purposes. Let's delve into the details and explore how these insurance options can impact your life and that of your beneficiaries.

Term Life Insurance: A Timely Protection

Term life insurance, as the name suggests, provides coverage for a specified period, typically ranging from 10 to 30 years. It's designed to offer financial protection during a particular life stage, such as when you have young children or a mortgage to pay off. Here's a closer look at the key aspects of term life insurance:

Coverage Period and Renewal

Term life insurance policies come with a defined term, often referred to as the “coverage period.” During this period, the policy provides a death benefit to your beneficiaries if you pass away. At the end of the term, you have the option to renew the policy, but the premiums may increase, reflecting your age and any changes in health status.

Affordability and Flexibility

One of the most appealing aspects of term life insurance is its affordability. Premiums are generally lower compared to whole life or universal life policies. This makes it an attractive option for those on a budget who still want substantial coverage. Additionally, term life insurance offers flexibility. You can choose the coverage amount and term length that aligns with your needs, whether it’s 10, 20, or 30 years.

Guaranteed Acceptance

Some term life insurance policies offer guaranteed acceptance, which means you don’t need to undergo a medical exam or provide health information. This feature makes it accessible to individuals with pre-existing health conditions who may have difficulty obtaining traditional life insurance.

Real-Life Example: Term Life Insurance in Action

Consider a 35-year-old parent with two young children. They opt for a 20-year term life insurance policy with a 500,000 death benefit. During the term, if the parent passes away, the policy will provide the beneficiaries with the full 500,000. This amount can help cover expenses like child care, education costs, and paying off the mortgage, ensuring the family’s financial stability.

Life Insurance: A Lifetime of Protection

Life insurance, often referred to as permanent life insurance, offers coverage for your entire life, provided you continue paying the premiums. It's designed to provide long-term financial security and often includes a cash value component. Here's an in-depth look at life insurance:

Coverage and Cash Value

Life insurance policies offer a death benefit to your beneficiaries when you pass away, similar to term life insurance. However, they also include a cash value component, which is an investment account that grows over time. You can borrow against this cash value or use it to pay premiums, providing flexibility and additional financial benefits.

| Life Insurance Types | Description |

|---|---|

| Whole Life Insurance | A type of permanent life insurance with a fixed premium and guaranteed death benefit. The cash value grows at a guaranteed rate. |

| Universal Life Insurance | Offers flexibility in premium payments and death benefit amounts. The cash value is invested and can fluctuate based on market performance. |

| Variable Life Insurance | Similar to universal life, but the cash value is invested in mutual funds, allowing for potentially higher returns but also carries more risk. |

Long-Term Financial Planning

Life insurance is an excellent tool for long-term financial planning. The cash value component can be used to fund retirement, pay for a child’s education, or even start a business. It provides a way to build wealth over time while ensuring your loved ones are protected.

Tax Advantages

Life insurance policies often offer tax advantages. The cash value grows tax-deferred, and death benefits are typically tax-free. This can make life insurance an attractive component of your overall financial strategy.

Life Insurance for Estate Planning

Life insurance can be a crucial part of estate planning. It can help pay estate taxes, ensuring your heirs receive the full value of your estate. Additionally, it can provide liquidity for your beneficiaries, allowing them to maintain their standard of living.

Choosing Between Term Life and Life Insurance

The decision between term life insurance and life insurance depends on your unique circumstances and financial goals. Term life insurance is ideal for those seeking temporary coverage at an affordable price. It's particularly beneficial for individuals with specific financial responsibilities, such as a mortgage or young dependents.

On the other hand, life insurance is a more comprehensive solution, offering lifetime coverage and the potential for wealth accumulation. It's a suitable choice for individuals who want to ensure their financial legacy and provide long-term security for their loved ones.

Factors to Consider

- Your Age and Health: Younger individuals may find term life insurance more affordable, while older adults may benefit from the lifetime coverage of life insurance.

- Financial Responsibilities: Consider your current and future financial obligations. Term life insurance is ideal for covering specific needs, while life insurance offers a more holistic solution.

- Budget: Evaluate your financial capabilities. Term life insurance is generally more budget-friendly, but life insurance provides long-term value.

- Investment Goals: If you’re interested in building wealth and have a long-term financial plan, life insurance with its cash value component can be advantageous.

The Impact of Term Life and Life Insurance on Your Financial Journey

Both term life insurance and life insurance play a significant role in your financial journey. They provide peace of mind, knowing that your loved ones are financially secure, even in the event of your untimely passing. Whether you choose term life insurance for its affordability and flexibility or opt for life insurance's long-term benefits and wealth-building potential, these policies are essential components of a comprehensive financial plan.

As you navigate the world of insurance, it's important to consult with financial advisors and insurance professionals who can guide you toward the right choice based on your unique needs and circumstances. Remember, the right insurance policy can make a world of difference in securing your family's future.

Can I convert my term life insurance policy to a life insurance policy?

+

Yes, many term life insurance policies allow you to convert them to permanent life insurance without a medical exam. This is a great option if your needs change and you want the lifetime coverage and cash value benefits of life insurance.

What happens if I outlive my term life insurance policy?

+

If you outlive your term life insurance policy, the coverage will simply expire. You’ll no longer have the death benefit, and the policy will terminate. It’s important to consider your long-term needs and plan accordingly.

How do I know if I need term life or life insurance?

+

Your insurance needs depend on your life stage and financial goals. If you have specific financial responsibilities for a set period, term life insurance is a good choice. For long-term financial security and wealth building, life insurance is often recommended.

Are there any tax implications with life insurance cash value?

+

The tax treatment of life insurance cash value depends on the type of policy and how it’s used. Generally, the cash value grows tax-deferred, and death benefits are tax-free. However, if you withdraw cash value or surrender the policy, there may be tax consequences.