The Personal Insurance

Welcome to an in-depth exploration of the world of personal insurance, a vital aspect of financial planning and risk management. Personal insurance policies are designed to protect individuals and their families from various life events, providing financial security and peace of mind. In this comprehensive guide, we will delve into the intricacies of personal insurance, covering everything from the different types of policies available to real-world case studies and expert insights. Get ready to discover how personal insurance can be a powerful tool to safeguard your future.

Understanding the Basics of Personal Insurance

Personal insurance is a broad term encompassing various policies tailored to meet the unique needs of individuals and their families. These policies offer financial protection against unexpected events, ensuring that individuals can maintain their standard of living and meet their financial obligations, even in the face of adversity.

At its core, personal insurance provides a safety net, mitigating the potential financial impact of unforeseen circumstances. Whether it's protecting your health, your assets, or your ability to earn an income, personal insurance plays a crucial role in modern life.

Key Types of Personal Insurance

- Life Insurance: This policy provides a financial payout to beneficiaries upon the insured individual’s death. Life insurance is often used to cover funeral expenses, pay off debts, or provide long-term financial support for dependents.

- Health Insurance: Health insurance plans cover medical expenses, including doctor visits, hospital stays, prescription medications, and sometimes even preventive care. It is a vital component of personal insurance, ensuring access to necessary healthcare services.

- Disability Insurance: In the event of an injury or illness that prevents an individual from working, disability insurance provides a replacement income. This type of insurance is essential for maintaining financial stability during periods of incapacity.

- Property Insurance: Property insurance, including homeowners’ and renters’ insurance, protects against damage or loss of personal property due to various perils, such as fire, theft, or natural disasters.

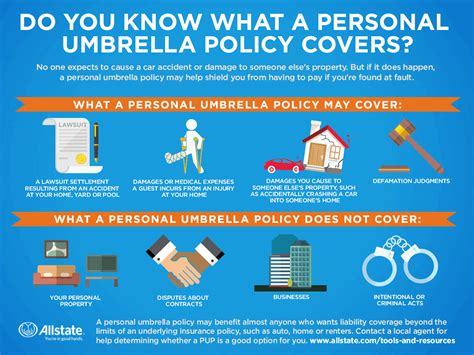

- Liability Insurance: This policy provides coverage in the event that an individual is found legally responsible for causing injury or property damage to others. It offers financial protection against potential lawsuits and associated legal costs.

Each of these personal insurance types serves a specific purpose, and often individuals require a combination of policies to achieve comprehensive coverage. The choice of insurance policies depends on an individual's unique circumstances, including their age, health, financial situation, and family responsibilities.

The Importance of Personal Insurance: Real-Life Scenarios

Personal insurance is not just a financial tool; it’s a vital component of overall well-being and risk management. Let’s explore some real-life scenarios that highlight the importance of personal insurance and its impact on individuals and families.

Life Insurance: Securing Your Family’s Future

Consider the story of John, a 45-year-old father of two. John is the primary breadwinner for his family, but unfortunately, he is diagnosed with a terminal illness. Despite his condition, John takes comfort in knowing that his life insurance policy will provide his family with a substantial financial cushion, ensuring they can maintain their lifestyle and pursue their dreams even after his passing.

| Policy Type | Benefits |

|---|---|

| Life Insurance | Financial support for dependents, debt repayment, and long-term financial security. |

John's story underscores the importance of life insurance in providing peace of mind and financial stability to families during difficult times.

Health Insurance: Access to Quality Healthcare

Now, let’s meet Sarah, a 30-year-old professional who recently started her own business. With her new venture, Sarah has the freedom to work on her terms, but she also understands the importance of health insurance. Thanks to her comprehensive health insurance plan, Sarah has access to top-notch medical care, ensuring she can focus on her business and her well-being without worrying about unexpected medical bills.

| Policy Type | Benefits |

|---|---|

| Health Insurance | Coverage for medical expenses, including doctor visits, hospital stays, and prescription medications. Access to quality healthcare without financial burden. |

Sarah's experience demonstrates how health insurance empowers individuals to prioritize their health and pursue their passions without financial constraints.

Disability Insurance: Preserving Financial Stability

Meet Robert, a 50-year-old entrepreneur who has built a successful business over the years. However, an unexpected accident leaves him temporarily unable to work. Fortunately, Robert’s disability insurance policy kicks in, providing him with a steady income stream during his recovery. This financial support allows Robert to focus on his health and rehabilitation without worrying about his business’s financial obligations.

| Policy Type | Benefits |

|---|---|

| Disability Insurance | Replacement income during periods of incapacity, ensuring financial stability and peace of mind. |

Robert's story illustrates the crucial role disability insurance plays in protecting individuals' livelihoods and maintaining their financial independence.

Expert Insights and Best Practices for Personal Insurance

To gain a deeper understanding of personal insurance, we sought insights from industry experts. Here are some valuable tips and best practices for navigating the world of personal insurance:

Tailoring Your Insurance Portfolio

Dr. Emma Wilson, a renowned financial planner, emphasizes the importance of tailoring your insurance portfolio to your unique needs. “Every individual’s situation is different,” she says. “It’s crucial to assess your specific risks and tailor your insurance coverage accordingly. This might involve a combination of life, health, disability, and property insurance policies.”

Regular Policy Reviews

Mr. Daniel Park, an insurance broker with over 20 years of experience, advises, “Life is dynamic, and so are your insurance needs. Regularly review your policies to ensure they align with your current circumstances. This could mean adjusting coverage amounts, adding new policies, or making other necessary changes.”

Understanding Policy Details

Ms. Olivia Thompson, a leading insurance attorney, highlights the importance of understanding the fine print. “Insurance policies can be complex,” she notes. “Make sure you thoroughly understand the terms and conditions, including exclusions and limitations. This knowledge will empower you to make informed decisions and maximize the benefits of your insurance coverage.”

The Role of Technology

In today’s digital age, Ms. Ava Johnson, a tech-savvy insurance advisor, emphasizes the role of technology in personal insurance. “Online platforms and mobile apps can streamline the insurance process, making it more accessible and convenient. From policy comparisons to claim submissions, technology can enhance your insurance experience and provide valuable tools for managing your coverage.”

The Future of Personal Insurance

As we look ahead, the future of personal insurance holds exciting possibilities. With advancements in technology and a growing focus on personalized solutions, insurance providers are evolving to meet the unique needs of individuals.

Emerging Trends

- Personalized Insurance Plans: Insurance providers are increasingly offering customized policies that cater to individual lifestyles and risks. From wellness-focused health insurance to occupation-specific disability coverage, personalized plans are becoming more prevalent.

- Digital Innovation: The insurance industry is embracing digital transformation, with online platforms and mobile apps making insurance more accessible and efficient. From instant quotes to digital claim submissions, technology is streamlining the insurance experience.

- Wellness Incentives: Some insurance providers are incentivizing healthy lifestyles by offering discounts or rewards for maintaining good health. This trend promotes wellness and can lead to reduced healthcare costs for both individuals and insurers.

The future of personal insurance promises a more tailored, efficient, and health-conscious approach to financial protection. By staying informed and adapting to emerging trends, individuals can ensure they have the right coverage to safeguard their futures.

FAQs: Personal Insurance Questions Answered

How do I choose the right personal insurance policies for my needs?

+

Assessing your unique circumstances is key. Consider your age, health, financial situation, and family responsibilities. Start with essential coverage like health and life insurance, and then add other policies as needed, such as disability or property insurance. It’s also beneficial to consult with a financial planner or insurance broker for personalized advice.

What are some common mistakes to avoid when purchasing personal insurance?

+

Avoiding common mistakes is crucial. Some pitfalls to steer clear of include underestimating your insurance needs, opting for the cheapest policy without considering coverage, and neglecting to regularly review and update your policies. It’s essential to understand the details of your policies and not make assumptions about coverage.

How can I make the most of my health insurance coverage?

+

Maximizing your health insurance coverage involves understanding your plan’s benefits and limitations. Utilize preventive care services, stay up-to-date on recommended screenings and vaccinations, and choose in-network providers to minimize out-of-pocket costs. Additionally, keep track of your insurance claims and ensure you’re taking advantage of any wellness incentives or rewards offered by your insurer.

What should I consider when selecting a life insurance policy?

+

When choosing a life insurance policy, consider your family’s financial needs and goals. Calculate the amount of coverage needed to support your dependents and pay off debts. Explore different policy types, such as term life or permanent life insurance, and compare premiums and benefits to find the best fit for your budget and coverage requirements.

Personal insurance is a powerful tool for safeguarding your future and protecting the financial well-being of yourself and your loved ones. By understanding the different types of policies, learning from real-life scenarios, and heeding expert advice, you can navigate the world of personal insurance with confidence. Remember, your insurance portfolio is a dynamic tool that should evolve with your life’s journey, providing peace of mind and security at every stage.