Travel Insurance Comparison

Travel insurance is an essential aspect of any trip, offering peace of mind and financial protection to travelers. With numerous providers and policies available, it can be challenging to choose the right coverage. This comprehensive guide will delve into the world of travel insurance, comparing various options, and providing insights to help you make an informed decision.

Understanding Travel Insurance Policies

Travel insurance policies are designed to cover a range of potential issues that may arise during your trip, including medical emergencies, trip cancellations, lost luggage, and more. These policies are tailored to the specific needs of travelers, providing coverage for both domestic and international journeys. Let’s explore the key components and benefits of travel insurance.

Medical Expense Coverage

One of the primary concerns for travelers is medical emergencies. Travel insurance policies typically offer coverage for unexpected medical expenses, including hospital stays, doctor visits, and prescription medications. This coverage can be especially crucial when traveling abroad, as healthcare costs can vary significantly and may not be covered by your domestic health insurance.

For instance, let’s consider a traveler, Emily, who slipped and injured her ankle while hiking in the Swiss Alps. Without travel insurance, she would have faced significant out-of-pocket expenses for her treatment and evacuation. However, with a comprehensive travel insurance policy, Emily’s medical expenses were covered, ensuring she received the necessary care without financial strain.

Trip Cancellation and Interruption

Travel insurance policies often include provisions for trip cancellation and interruption. This coverage protects you in the event of unforeseen circumstances, such as severe weather, natural disasters, or personal emergencies, that force you to cancel or cut short your trip.

Take the case of David, who had to cancel his family vacation to Hawaii due to a sudden illness in the family. With trip cancellation coverage, David was able to recover a significant portion of the prepaid expenses for his trip, including flights, accommodations, and tour packages.

Baggage and Personal Effects

Travel insurance policies also provide coverage for lost, stolen, or damaged baggage and personal effects. This coverage can be a lifesaver, especially when valuable items or essential travel documents are involved.

Imagine Sophia, a business traveler whose laptop containing critical work files was stolen during her stay in a foreign city. Without travel insurance, Sophia would have had to bear the financial burden of replacing the laptop and dealing with the consequences of lost data. However, with baggage coverage, she was able to claim a substantial amount towards the replacement cost.

Emergency Assistance and Evacuation

Some travel insurance policies offer additional benefits, such as emergency assistance and evacuation services. These services can provide crucial support in remote or dangerous situations, ensuring you receive the necessary help and transportation to safety.

For example, Mark, an adventurer exploring the Amazon rainforest, found himself in need of urgent medical attention due to a severe allergic reaction. With emergency assistance coverage, Mark was able to receive prompt medical care and was evacuated to a nearby medical facility, ensuring his safety and well-being.

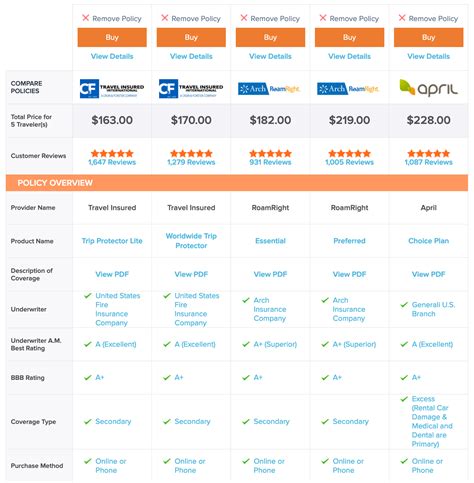

Comparing Travel Insurance Providers

With a solid understanding of the benefits of travel insurance, let’s delve into a comparison of leading travel insurance providers and their offerings.

Provider A: Comprehensive Coverage

Provider A is known for its comprehensive travel insurance policies, offering extensive coverage for a wide range of travel scenarios. Here’s a breakdown of their key features:

- Medical Coverage: Provider A offers up to 500,000</strong> in medical expense coverage, ensuring travelers receive the necessary care without financial worries.</li> <li><strong>Trip Cancellation:</strong> With a <strong>100% refund</strong> guarantee for covered reasons, Provider A's policy provides peace of mind for travelers facing unforeseen circumstances.</li> <li><strong>Baggage Protection:</strong> Travelers can claim up to <strong>2,000 for lost or damaged baggage, covering a wide range of personal items.

- Emergency Assistance: Provider A’s policy includes 24⁄7 emergency assistance, providing travelers with access to medical and travel support services worldwide.

Provider B: Affordable Options

Provider B focuses on providing affordable travel insurance options without compromising on essential coverage. Here’s what they offer:

- Medical Coverage: While offering a more budget-friendly option, Provider B still provides up to 250,000</strong> in medical expense coverage, ensuring travelers receive necessary treatment.</li> <li><strong>Trip Cancellation:</strong> With a <strong>50% refund</strong> policy for covered reasons, Provider B's plan offers a cost-effective solution for travelers concerned about trip cancellations.</li> <li><strong>Baggage Protection:</strong> Travelers can claim up to <strong>1,500 for lost or damaged baggage, providing adequate coverage for most personal items.

- Travel Assistance: Provider B’s policy includes basic travel assistance services, such as emergency hotline access and travel document replacement support.

Provider C: Specialized Coverage

Provider C specializes in providing customized travel insurance plans tailored to specific travel needs. Here’s an overview of their offerings:

- Medical Coverage: Provider C offers up to 1 million</strong> in medical expense coverage, making it an excellent choice for travelers with complex medical needs or those venturing into remote areas.</li> <li><strong>Trip Cancellation:</strong> With a <strong>100% refund</strong> policy for covered reasons, Provider C's plan provides comprehensive protection for trip cancellations.</li> <li><strong>Baggage Protection:</strong> Travelers can claim up to <strong>3,000 for lost or damaged baggage, ensuring valuable items and electronics are adequately covered.

- Adventure Activities: Provider C’s policy includes coverage for a wide range of adventure activities, such as skiing, hiking, and water sports, making it ideal for active travelers.

Analyzing the Benefits and Choosing the Right Policy

When comparing travel insurance policies, it’s essential to consider your specific travel needs and preferences. Here are some factors to keep in mind:

Medical Coverage

Evaluate the level of medical coverage offered by each provider. Consider your health status, destination, and the potential risks associated with your trip. If you have pre-existing medical conditions or are traveling to remote areas, opt for policies with higher medical expense limits.

Trip Cancellation and Interruption

Review the trip cancellation and interruption coverage to ensure it aligns with your concerns. Look for policies that provide a refund for a wide range of covered reasons, including personal emergencies, severe weather, and travel advisories.

Baggage and Personal Effects

Assess the baggage coverage limits to ensure they match the value of your personal items. If you’re carrying valuable electronics or jewelry, opt for policies with higher limits to ensure adequate protection.

Additional Benefits

Consider the additional benefits offered by each provider. Emergency assistance and evacuation services can be crucial in certain situations, providing timely support and transportation to safety.

Price and Value

While comparing prices is important, ensure you’re also evaluating the overall value of the policy. A slightly higher premium may be worth it if it provides comprehensive coverage and peace of mind.

FAQs

What is the average cost of travel insurance?

+

The cost of travel insurance can vary widely depending on factors such as the duration of your trip, your destination, and the level of coverage you require. On average, you can expect to pay between 4% and 8% of your total trip cost for travel insurance. However, it’s important to carefully review the policy details to ensure you’re getting the coverage you need.

Can I purchase travel insurance after my trip has started?

+

While it’s possible to purchase travel insurance after your trip has started, most policies have restrictions on when you can enroll. It’s generally recommended to purchase travel insurance as soon as you book your trip to ensure you’re covered from the beginning. However, some providers may offer policies that allow enrollment during the trip, but with limited coverage.

What should I do if I need to make a claim?

+

If you need to make a claim, it’s important to follow the procedures outlined in your policy. Typically, you’ll need to provide documentation and evidence of the loss or expense. Contact your insurance provider as soon as possible to initiate the claims process and ensure a smooth and timely resolution.