Traveler Medical Insurance

Traveler Medical Insurance is an essential consideration for anyone planning a trip abroad. With the rise in international travel and the increasing awareness of healthcare costs, having adequate medical coverage is crucial to ensure a safe and stress-free journey. This comprehensive guide will delve into the world of traveler medical insurance, providing you with all the information you need to make informed decisions and protect yourself while exploring the globe.

Understanding Traveler Medical Insurance

Traveler Medical Insurance, also known as travel health insurance or travel medical coverage, is a specialized type of insurance designed to provide medical protection for individuals traveling outside their home country. It offers a safety net for unexpected medical emergencies that may arise during your travels, ensuring that you have access to quality healthcare services without incurring excessive financial burdens.

This insurance is particularly vital for travelers who are not eligible for or covered by their home country's healthcare system while abroad. It bridges the gap between your regular health insurance and the healthcare services available in the country you are visiting, ensuring continuity of care and financial protection.

Key Benefits of Traveler Medical Insurance

Traveler Medical Insurance offers a range of benefits that cater to the unique needs of travelers. These benefits typically include:

- Emergency Medical Expenses: Coverage for unexpected illnesses or injuries that require immediate medical attention, including doctor visits, hospital stays, and necessary medications.

- Medical Evacuation: In case of a severe medical emergency, this insurance covers the costs of transporting you to the nearest appropriate medical facility, which can be crucial when specialized care is required.

- Repatriation: Assistance with returning to your home country if you are unable to continue your journey due to a medical condition. This benefit ensures that you receive the necessary medical care in a familiar environment.

- Prescription Medications: Coverage for the cost of prescribed medications, ensuring that you have access to the drugs you need during your travels.

- Emergency Dental Care: In the event of a dental emergency, traveler medical insurance can cover the costs of urgent dental procedures.

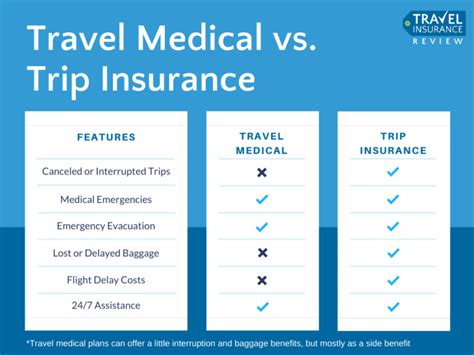

Additionally, some policies offer optional benefits such as coverage for pre-existing conditions, trip cancellation or interruption due to medical reasons, and even lost or stolen luggage. These optional add-ons can provide an extra layer of protection and peace of mind for travelers.

Choosing the Right Traveler Medical Insurance

When selecting a traveler medical insurance plan, it’s essential to consider various factors to ensure you get the coverage that best suits your needs. Here are some key considerations:

Coverage Limits and Deductibles

Insurance plans come with different coverage limits, which determine the maximum amount the insurer will pay for your medical expenses. It’s crucial to choose a plan with sufficient limits to cover potential emergencies. Additionally, be mindful of deductibles, which are the out-of-pocket expenses you must pay before the insurance coverage kicks in. A higher deductible may lower your premium, but it also means you’ll have to pay more upfront in case of a medical incident.

Pre-Existing Conditions

If you have any pre-existing medical conditions, it’s vital to check if the insurance plan covers them. Some policies may exclude certain conditions, while others may offer coverage with additional premiums. Disclosing your medical history accurately is essential to avoid any surprises later on.

Length of Coverage

Consider the duration of your trip and choose a plan that provides coverage for the entire period. Some policies offer single-trip coverage, while others provide multi-trip or annual plans, which can be more cost-effective for frequent travelers.

Destination and Activities

Take into account the destination you’re traveling to and the activities you plan to engage in. Certain countries may have higher healthcare costs, and some adventure activities like skiing or scuba diving may require specialized coverage. Ensure your insurance plan covers the specific risks associated with your travel plans.

Reputation and Financial Strength

Research the reputation and financial stability of the insurance provider. Choose a reputable company with a solid track record of paying claims promptly. Look for customer reviews and ratings to ensure you’re dealing with a trustworthy insurer.

Comparison and Quotations

Compare different insurance plans to find the best fit for your needs. Online platforms and brokers can provide quotations from various insurers, allowing you to assess coverage, premiums, and benefits side by side. This comparison ensures you get the most value for your money.

Traveler Medical Insurance in Action

Let’s take a look at a real-life scenario to understand how traveler medical insurance can make a difference during your travels.

Imagine you're on a hiking trip in the Swiss Alps when you accidentally twist your ankle, causing a severe sprain. You're in a remote area, and the nearest medical facility is an hour away by ambulance. Without traveler medical insurance, you'd have to pay for the emergency transport and treatment out of pocket, which could easily exceed several thousand dollars.

However, with a comprehensive traveler medical insurance plan, the insurer would cover the costs of the ambulance ride and the necessary medical treatment, including X-rays, medication, and any follow-up care required. This insurance provides financial protection and peace of mind, allowing you to focus on recovering without worrying about the financial burden.

| Insurance Coverage | Actual Costs Covered |

|---|---|

| Ambulance Transport | $1,500 |

| Hospital Stay | $2,000 |

| X-rays and Medical Tests | $800 |

| Prescription Medication | $300 |

| Total Covered | $4,600 |

As you can see, traveler medical insurance not only provides financial protection but also ensures that you receive the necessary medical attention promptly. It's a crucial investment for any traveler, offering security and peace of mind during your adventures.

Conclusion

Traveler Medical Insurance is an indispensable tool for anyone venturing beyond their borders. By providing comprehensive coverage for medical emergencies, it ensures that your travels remain safe, enjoyable, and financially manageable. With the right insurance plan, you can explore the world with confidence, knowing that you’re protected no matter where your adventures take you.

Frequently Asked Questions

Can I purchase traveler medical insurance after I’ve already started my trip?

+

While it’s ideal to purchase traveler medical insurance before your trip, some insurers offer policies that can be purchased during your travels. However, these policies may have limitations and higher premiums. It’s best to plan ahead and secure coverage before your departure.

What happens if I need medical attention but don’t have traveler medical insurance?

+

Without traveler medical insurance, you would be responsible for paying all medical expenses out of pocket. This can result in significant financial strain, especially if you require emergency treatment or hospitalization. Having insurance provides financial protection and ensures you receive the necessary care without worrying about the costs.

Are there any exclusions or limitations in traveler medical insurance policies?

+

Yes, traveler medical insurance policies often have exclusions and limitations. These may include pre-existing conditions, high-risk activities like skydiving or extreme sports, and certain countries or regions with known health risks. It’s important to carefully review the policy’s terms and conditions to understand any exclusions and ensure your activities and destinations are covered.

Can I extend my traveler medical insurance if my trip duration changes?

+

Most insurance providers offer the option to extend your policy if your trip duration changes. However, extensions may be subject to additional premiums or policy adjustments. It’s best to contact your insurer as soon as you know your travel plans have changed to discuss your options and ensure continuous coverage.

How do I file a claim with my traveler medical insurance provider?

+

The process of filing a claim varies depending on the insurance provider. Typically, you’ll need to submit a claim form along with supporting documentation, such as medical reports, receipts, and any other relevant information. Some insurers offer online claim submission, while others may require you to contact them directly. It’s advisable to review your policy’s claim process and keep all necessary documents handy.