Trip Insurance Comparisons

Trip insurance is an essential aspect of travel planning, offering travelers peace of mind and financial protection in case of unforeseen circumstances. With numerous providers and plans available, it's crucial to make informed choices to ensure you're adequately covered. In this comprehensive guide, we delve into the world of trip insurance, comparing different policies, benefits, and providers to help you make the right decision for your travels.

Understanding Trip Insurance: Coverage and Benefits

Trip insurance policies provide a safety net for travelers, covering a range of unexpected events that may disrupt your journey. These policies typically offer protection against trip cancellations, trip interruptions, medical emergencies, baggage loss or delay, and more. The benefits and coverage limits can vary significantly between providers, so it’s essential to understand what each policy offers.

For instance, let's consider a hypothetical scenario where you've planned a dream vacation to the Swiss Alps. Unfortunately, due to a family emergency, you have to cancel your trip just a few days before departure. With the right trip insurance policy, you can claim reimbursement for non-refundable expenses such as flight tickets, accommodation, and even tour packages. This ensures that your financial loss is minimized, and you can plan a new trip with confidence.

Key Factors to Consider When Comparing Trip Insurance

When comparing trip insurance options, several critical factors come into play. These include the scope of coverage, policy exclusions, claim process, and the reputation of the insurance provider.

Coverage and Policy Limits

The coverage offered by trip insurance policies can vary widely. Some policies may provide comprehensive coverage, including trip cancellation, emergency medical, and baggage protection, while others might offer more specialized plans tailored to specific needs. It’s crucial to assess your travel plans and potential risks to determine the type of coverage you require.

| Policy Type | Coverage Highlights |

|---|---|

| Comprehensive Plan | Covers trip cancellation, interruption, medical emergencies, baggage loss, and more. |

| Medical-Only Plan | Focuses on emergency medical coverage, ideal for travelers with existing health conditions. |

| Cancel-for-Any-Reason (CFAR) Plan | Allows cancellation for any reason, but may have specific terms and conditions. |

Policy Exclusions and Fine Print

While the coverage provided by trip insurance is essential, it’s equally crucial to understand what is not covered. Policy exclusions can vary, and some may be specific to certain travel scenarios. For example, some policies may exclude coverage for pre-existing medical conditions or high-risk activities like skydiving or mountaineering. Reading the fine print and understanding these exclusions is vital to ensure you’re not caught off guard.

Claim Process and Timeliness

The claim process is a critical aspect of trip insurance. You want to ensure that the provider has a straightforward and efficient process for submitting claims and receiving reimbursements. Look for policies that offer clear guidelines, easy-to-use online portals, and timely responses to inquiries. Delays in claim processing can cause unnecessary stress and financial strain, so choose a provider with a proven track record of prompt claim settlements.

Reputation and Financial Stability

When selecting a trip insurance provider, it’s essential to consider their reputation and financial stability. Opt for established companies with a strong track record in the industry. Check customer reviews and ratings to gauge their reliability and responsiveness. A financially stable provider ensures that they will be able to honor your claims even if there’s a surge in claims due to a widespread event like a natural disaster or pandemic.

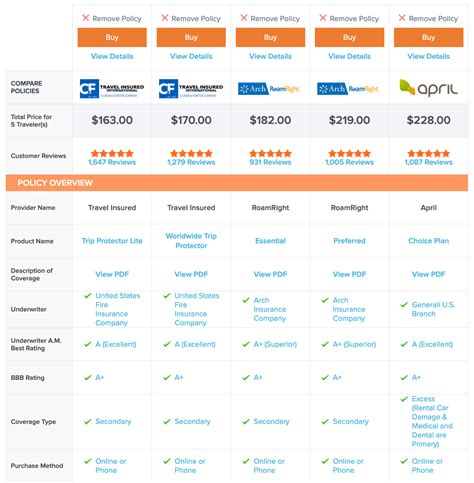

Comparing Leading Trip Insurance Providers

In the market, several reputable trip insurance providers offer a range of plans to suit different travel needs. Here, we compare some of the leading providers, highlighting their unique features and benefits.

Provider A: Comprehensive Coverage and Personalized Plans

Provider A offers a wide range of trip insurance plans, catering to various travel scenarios. Their flagship plan, Ultimate Travel Protect, provides comprehensive coverage for trip cancellations, interruptions, and medical emergencies. Additionally, they offer specialized plans for adventure travel, business trips, and family vacations.

One unique feature of Provider A is their customizable plans. Travelers can choose specific add-ons to tailor their coverage, such as rental car collision coverage, trip interruption for bad weather, or even coverage for sporting equipment.

Furthermore, Provider A has a user-friendly online platform that allows travelers to easily compare plans, get instant quotes, and purchase coverage within minutes. Their claims process is streamlined, with a dedicated claims team that aims to resolve claims within 10 business days.

Provider B: Focus on Medical Coverage and Travel Assistance

Provider B specializes in providing robust medical coverage for travelers. Their plans, such as TravelCare, offer extensive medical benefits, including coverage for pre-existing conditions (with certain terms and conditions), emergency medical evacuation, and repatriation of remains. They also provide 24⁄7 travel assistance services, offering support for lost luggage, missed connections, and even legal referrals if needed.

What sets Provider B apart is their global network of medical providers. With their extensive network, travelers can access quality medical care in over 180 countries, ensuring peace of mind regardless of their destination. Their plans also include coverage for mental health emergencies, which is an increasingly important aspect of travel insurance.

Provider C: Budget-Friendly Options and Quick Claims Settlement

Provider C is known for its budget-friendly trip insurance plans, making comprehensive coverage accessible to a wider range of travelers. Their basic plan, Smart Traveler, offers essential coverage for trip cancellations, interruptions, and medical emergencies at an affordable price point.

Despite their budget-friendly approach, Provider C does not compromise on quality. They have a fast and efficient claims settlement process, with an average resolution time of just 5 business days. Their online portal provides real-time claim tracking, allowing travelers to monitor the status of their claims with ease.

Real-Life Scenarios: How Trip Insurance Comes to the Rescue

Let’s explore some real-life scenarios where trip insurance played a crucial role in protecting travelers.

Scenario 1: Medical Emergency Abroad

Imagine you’re on a solo backpacking trip through Southeast Asia when you suddenly fall ill. You’re diagnosed with a severe infection and need immediate medical attention. With the right trip insurance policy, you can access quality healthcare without worrying about the financial burden. The policy covers your medical expenses, emergency transportation, and even provides support for arranging your return home.

Scenario 2: Trip Cancellation Due to Natural Disaster

You’ve planned a winter getaway to a ski resort, but a major blizzard hits the region just before your departure. With roads blocked and flights canceled, you have no choice but to cancel your trip. Fortunately, your trip insurance policy covers trip cancellations due to weather-related events. You can file a claim and receive reimbursement for your non-refundable expenses, allowing you to plan a new trip with confidence.

Scenario 3: Lost or Delayed Baggage

On your way to a business conference, your checked baggage gets lost in transit. You arrive at your destination with no clothing, presentation materials, or even your toiletries. With trip insurance that includes baggage protection, you can file a claim for the value of your lost items and receive reimbursement. This coverage ensures you can quickly replace essential items and focus on your business commitments without financial strain.

Future Trends and Innovations in Trip Insurance

The trip insurance industry is continuously evolving to meet the changing needs of travelers. Here are some emerging trends and innovations that are shaping the future of travel protection.

Digital Transformation and Personalized Experiences

With the rise of digital technologies, trip insurance providers are leveraging data analytics and machine learning to offer more personalized experiences. These innovations allow providers to tailor policies based on individual travel preferences, destinations, and potential risks. Travelers can expect more intuitive online platforms, streamlined claim processes, and even real-time travel alerts and recommendations.

Expanded Coverage for Emerging Risks

As travel patterns evolve and new risks emerge, trip insurance providers are expanding their coverage to address these concerns. For instance, with the rise of remote work and digital nomadism, providers are offering specialized plans for long-term travel and extended stays. These plans may include coverage for remote work-related injuries or even digital device protection.

Focus on Sustainability and Ethical Travel

The travel industry is increasingly embracing sustainability and ethical practices. Trip insurance providers are following suit by offering eco-conscious travel protection. These plans may include carbon offset programs, support for sustainable travel initiatives, or even coverage for travelers engaging in volunteer work or eco-tourism activities.

Conclusion: Making an Informed Choice for Your Travel Protection

Trip insurance is an essential aspect of responsible travel planning. By understanding the coverage options, comparing leading providers, and considering real-life scenarios, you can make an informed decision to protect your travels. Remember, the right trip insurance policy provides peace of mind, financial protection, and the freedom to explore the world with confidence.

What is the average cost of trip insurance?

+The cost of trip insurance can vary depending on several factors, including the duration of your trip, the destination, your age, and the level of coverage you choose. On average, trip insurance can range from 4% to 10% of your total trip cost. It’s essential to compare quotes from different providers to find the best value for your needs.

Can I purchase trip insurance after I’ve already booked my trip?

+In most cases, you can purchase trip insurance within a certain timeframe after booking your trip. However, it’s best to buy it as soon as possible to ensure you’re covered for any unexpected events that may occur before your departure. Some policies may have specific deadlines for purchasing coverage, so check the terms and conditions carefully.

What should I look for in a trip insurance provider’s reputation and financial stability?

+When assessing a provider’s reputation, consider factors such as customer reviews, ratings from independent agencies, and their track record in the industry. For financial stability, look for providers with strong financial ratings from reputable agencies like A.M. Best or Moody’s. This ensures that the provider is financially sound and can honor your claims.

How do I choose the right coverage limits for my trip insurance policy?

+Determining the right coverage limits depends on your individual needs and the potential risks associated with your trip. Consider the cost of your trip, the value of your belongings, and the potential medical expenses you might incur. It’s always a good idea to opt for higher limits to ensure you’re adequately protected, but balance it with your budget and the level of risk you’re comfortable with.