Types Of Vehicle Insurance

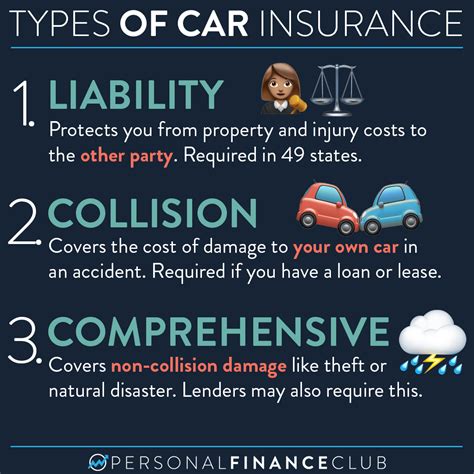

Vehicle insurance, also known as auto insurance or car insurance, is an essential financial safeguard for vehicle owners. It provides protection against financial losses and liabilities arising from road accidents, theft, and other unforeseen events. The insurance industry offers a wide range of coverage options to cater to the diverse needs of vehicle owners, and understanding these types of insurance is crucial for making informed decisions about your policy.

Comprehensive Vehicle Insurance

Comprehensive insurance is the most extensive form of vehicle coverage. It offers protection against a wide range of risks, including:

- Collision Coverage: Pays for damages to your vehicle if you are involved in an accident, regardless of fault.

- Comprehensive Coverage: Covers non-collision related incidents such as theft, vandalism, fire, natural disasters, and animal collisions.

- Medical Payments: Provides coverage for medical expenses incurred by you or your passengers in an accident, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance.

- Personal Injury Protection (PIP): Covers medical expenses, lost wages, and other related costs, regardless of fault.

Key Benefits of Comprehensive Insurance

Comprehensive insurance offers the highest level of protection, providing peace of mind for vehicle owners. It covers a broad range of incidents, ensuring that you are financially protected in almost any scenario. Additionally, comprehensive insurance often includes perks like rental car coverage, roadside assistance, and glass repair, further enhancing your protection and convenience.

| Coverage Type | Description |

|---|---|

| Collision | Repairs or replaces your vehicle after an accident. |

| Comprehensive | Covers non-accident related incidents like theft and natural disasters. |

| Medical Payments | Pays for medical expenses for you and your passengers. |

Liability-Only Vehicle Insurance

Liability-only insurance, as the name suggests, provides coverage for legal liabilities arising from an accident caused by you. This type of insurance is mandatory in most states and is the minimum level of coverage required by law. It includes:

- Bodily Injury Liability: Covers medical expenses and lost wages for the other party involved in an accident caused by you.

- Property Damage Liability: Pays for repairs or replacement of the other party’s vehicle or property damaged in an accident caused by you.

Key Benefits of Liability-Only Insurance

Liability-only insurance is an affordable option for vehicle owners who want to meet the legal requirements for insurance. It is particularly beneficial for those who drive older, lower-value vehicles and are primarily concerned with covering the legal liabilities associated with an accident. However, it’s important to note that liability-only insurance does not cover any damage to your own vehicle or any other losses you might incur.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for the other party. |

| Property Damage Liability | Pays for repairs or replacement of the other party's property. |

Collision-Only Vehicle Insurance

Collision-only insurance is a step up from liability-only insurance, providing coverage for damage to your vehicle caused by an accident. It covers repairs or replacement of your vehicle if you are involved in a collision, regardless of fault. This type of insurance is ideal for those who want to protect their vehicle but don’t require the extensive coverage of comprehensive insurance.

Key Benefits of Collision-Only Insurance

Collision-only insurance offers a balanced approach to vehicle coverage. It provides protection for your vehicle in the event of an accident, ensuring that you are not left with costly repair bills. However, it’s important to note that collision-only insurance does not cover non-collision incidents, so it may not be suitable for those who live in areas prone to theft, vandalism, or natural disasters.

| Coverage Type | Description |

|---|---|

| Collision | Repairs or replaces your vehicle after an accident, regardless of fault. |

Gap Insurance

Gap insurance, or Guaranteed Asset Protection insurance, is a unique type of coverage that bridges the gap between the actual cash value of your vehicle and the amount you still owe on your loan or lease. It is particularly useful for those who have financed or leased their vehicle, as it provides financial protection in the event of a total loss or theft.

Key Benefits of Gap Insurance

Gap insurance is a valuable addition to your vehicle insurance policy, especially if you have a loan or lease on your vehicle. It ensures that, in the event of a total loss, you are not left with a large financial burden. This type of insurance is often recommended for those who have a significant loan balance or are leasing a vehicle, as it provides peace of mind and financial protection.

| Coverage Type | Description |

|---|---|

| Gap Insurance | Covers the difference between the actual cash value of your vehicle and the amount owed on your loan or lease. |

Additional Coverages

Beyond the primary types of vehicle insurance, there are several additional coverages that can be added to your policy to enhance your protection:

- Roadside Assistance: Provides help in case of emergencies like flat tires, dead batteries, or running out of gas.

- Rental Car Coverage: Covers the cost of renting a vehicle while yours is being repaired after an accident.

- Glass Coverage: Provides specialized coverage for damaged windshields and windows, often with no deductible.

- Custom Parts and Equipment Coverage: Protects any custom parts or modifications made to your vehicle.

Key Considerations for Additional Coverages

These additional coverages can significantly enhance your vehicle insurance policy, providing extra protection and peace of mind. However, it’s important to carefully consider your needs and the value of these additions to your policy. Some of these coverages may already be included in your comprehensive or collision insurance, so it’s essential to review your policy thoroughly to avoid duplicate coverage.

| Coverage Type | Description |

|---|---|

| Roadside Assistance | Provides emergency services for common vehicle breakdowns. |

| Rental Car Coverage | Covers the cost of a rental car while your vehicle is being repaired. |

| Glass Coverage | Specialized coverage for windshields and windows, often with no deductible. |

| Custom Parts and Equipment Coverage | Protects modifications and custom parts on your vehicle. |

Conclusion: Choosing the Right Vehicle Insurance

Selecting the right vehicle insurance is a crucial decision that can have a significant impact on your financial security. By understanding the different types of vehicle insurance and their specific coverages, you can make an informed choice that aligns with your needs and budget. Remember, while it’s essential to have adequate insurance coverage, it’s equally important to review your policy regularly and make adjustments as your circumstances change.

Consider your specific needs, the value of your vehicle, and your budget when choosing your vehicle insurance. Whether you opt for comprehensive coverage, liability-only insurance, or a tailored combination of coverages, ensuring you have the right protection is a key step towards peace of mind on the road.

What is the difference between comprehensive and collision insurance?

+Comprehensive insurance covers a wide range of incidents, including collision, while collision insurance only covers damage to your vehicle caused by an accident, regardless of fault. Comprehensive insurance is more extensive and includes non-collision related incidents like theft and natural disasters.

Is liability-only insurance sufficient for my needs?

+Liability-only insurance is the minimum level of coverage required by law in most states. It covers legal liabilities arising from an accident caused by you. However, it does not cover damage to your own vehicle or any other losses you might incur. If you want protection for your vehicle, you’ll need to consider collision or comprehensive insurance.

When is gap insurance necessary?

+Gap insurance is particularly important if you have financed or leased your vehicle. It covers the difference between the actual cash value of your vehicle and the amount you still owe on your loan or lease. This ensures that, in the event of a total loss, you are not left with a large financial burden.

How can I determine the right coverage for my vehicle?

+Determining the right coverage involves considering your specific needs, the value of your vehicle, and your budget. If you have a high-value vehicle or are concerned about a wide range of potential incidents, comprehensive insurance might be the best choice. For those on a budget or with older vehicles, liability-only or collision-only insurance could be more suitable. It’s also important to review your policy regularly and adjust your coverage as your circumstances change.