Unemployment Insurance Definition

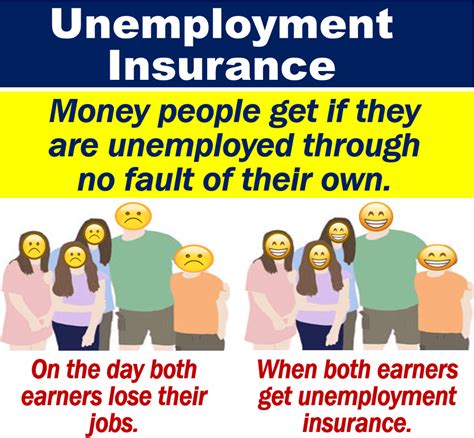

Unemployment insurance is a crucial social safety net designed to provide financial support to individuals who have lost their jobs through no fault of their own. This government-sponsored program aims to alleviate the economic burden on unemployed workers and their families, offering temporary income support during periods of unemployment. With roots dating back to the early 20th century, unemployment insurance has evolved into a complex system, varying across jurisdictions, to address the challenges faced by job seekers and the broader economy.

Understanding Unemployment Insurance: An Overview

Unemployment insurance, often referred to as UI, is a critical component of the social security framework in many countries. It serves as a temporary income replacement for workers who become unemployed due to factors beyond their control, such as company closures, layoffs, or other economic downturns. The primary goal is to ensure that individuals can maintain a basic standard of living while seeking new employment opportunities.

The concept of unemployment insurance is rooted in the idea that economic security is a fundamental right, and that society has a responsibility to support its members during periods of involuntary joblessness. By providing a safety net, UI not only assists individuals and families but also contributes to the stability of the economy by reducing the negative impacts of unemployment on consumer spending and market confidence.

Key Principles of Unemployment Insurance

- Eligibility Criteria: Eligibility for UI benefits typically depends on factors such as the reason for unemployment, the individual’s prior employment history, and their efforts to find new work. In most jurisdictions, workers must have a certain amount of prior earnings and must be actively seeking employment to qualify.

- Benefit Amounts: The amount of UI benefits an individual receives is usually calculated based on their previous earnings, with a maximum and minimum benefit amount set by the relevant government body. This ensures that benefits are proportional to the individual’s prior earnings, providing a more sustainable financial support system.

- Duration of Benefits: The duration for which an individual can receive UI benefits varies, often depending on the unemployment rate in the jurisdiction and the individual’s circumstances. In some cases, benefits may be extended during periods of high unemployment to provide longer-term support.

- Funding Sources: Unemployment insurance programs are typically funded through payroll taxes levied on employers. These taxes are used to create a dedicated fund to support unemployed workers. In some cases, additional funding may come from government budgets or loans.

The Impact of Unemployment Insurance

Unemployment insurance plays a significant role in mitigating the economic impacts of job loss. It provides a financial cushion for unemployed workers, allowing them to meet their basic needs, such as housing, food, and healthcare, while they search for new employment. This support can reduce the stress and anxiety associated with unemployment, improving overall well-being and potentially increasing the chances of finding suitable work.

Moreover, UI can have a positive impact on the economy as a whole. By maintaining consumer spending power, unemployment insurance can help sustain economic growth and stability. It also plays a role in reducing poverty and inequality, providing a safety net for those who are most vulnerable during economic downturns.

| Key Statistic | Data |

|---|---|

| Number of UI Programs Worldwide | Over 180 countries have unemployment insurance or similar programs |

| Average UI Benefit Replacement Rate | Around 50-70% of previous earnings |

| UI Programs' Contribution to GDP | Estimated to be around 0.5-1% of GDP in many countries |

Unemployment Insurance Around the Globe

The concept of unemployment insurance has gained widespread acceptance globally, with variations in implementation and coverage depending on the country and its economic structure. While the core principles remain consistent, the specific eligibility criteria, benefit amounts, and duration of support can differ significantly.

Unemployment Insurance in the United States

In the United States, unemployment insurance is a joint federal-state program. Each state operates its own UI program, with funding coming from a combination of federal and state sources. The federal government sets broad guidelines, while states have the flexibility to design their programs, including benefit amounts, duration, and eligibility criteria.

The US system is notable for its emphasis on state-level administration, allowing for a certain degree of customization to local economic conditions. However, this also leads to significant variations in UI benefits across the country, with some states offering more generous support than others.

European Unemployment Insurance Models

European countries have a range of unemployment insurance models, often integrated with broader social security systems. Many European nations offer more comprehensive coverage, with longer benefit durations and higher replacement rates compared to the US. For instance, countries like Denmark, Sweden, and Finland have robust unemployment insurance systems that provide extensive support to job seekers.

In these countries, unemployment insurance is often seen as a part of a broader social welfare state, aiming to provide a strong safety net for citizens. This approach is reflective of the social democratic principles that guide many European societies.

Unemployment Insurance in Developing Economies

Developing economies face unique challenges in implementing unemployment insurance programs. Limited resources and a large informal sector can make it difficult to administer and fund such programs. However, many countries are recognizing the importance of social safety nets and are making efforts to establish or enhance unemployment insurance systems.

For example, countries like Brazil, India, and South Africa have implemented various forms of unemployment insurance or social assistance programs to support their populations. These initiatives often face challenges related to coverage, funding, and administration, but they represent important steps towards building more resilient and inclusive economies.

The Future of Unemployment Insurance

As economies evolve and the nature of work changes, unemployment insurance programs are also undergoing transformations. The rise of the gig economy and the increasing prevalence of non-traditional employment arrangements are challenging traditional UI models, which were largely designed for a more stable and predictable labor market.

Adapting to the Gig Economy

The gig economy, characterized by short-term contracts, freelancing, and independent work, is a growing segment of the labor force. Many workers in this sector do not fit the traditional criteria for unemployment insurance eligibility, as they often lack the consistent employment history required. This has led to calls for reforms to extend UI coverage to these workers, ensuring that they too have access to a safety net during periods of joblessness.

Enhancing Technology Integration

Technology is playing an increasingly significant role in unemployment insurance systems. Digital platforms are being utilized to streamline the application and benefits management process, making it more efficient and accessible for claimants. Additionally, data analytics and machine learning are being leveraged to improve the accuracy of benefit calculations and fraud detection.

Addressing Long-Term Unemployment

Long-term unemployment, defined as being unemployed for 27 weeks or more, is a persistent challenge in many countries. UI programs are often designed to provide short-term support, leaving those who face long-term unemployment without adequate assistance. To address this issue, some countries are exploring ways to extend benefits or provide additional support services for this vulnerable population.

| Statistical Snapshot | Data |

|---|---|

| Global UI Coverage | Around 40% of the global workforce is covered by some form of unemployment insurance |

| Average Duration of UI Benefits | Varies widely, from 6 months to over 2 years, depending on the country and economic conditions |

| Percentage of UI Recipients Finding Employment | Estimates suggest that around 60-70% of UI recipients find new employment within the benefit period |

How does unemployment insurance impact the economy as a whole?

+

Unemployment insurance plays a crucial role in stabilizing the economy during periods of high unemployment. By providing financial support to job seekers, UI helps maintain consumer spending power, which is essential for economic growth. It also reduces the risk of poverty and social unrest, contributing to overall economic stability and societal well-being.

What are the eligibility criteria for unemployment insurance benefits?

+

Eligibility criteria vary by jurisdiction but generally include factors such as the reason for unemployment (usually involuntary), a certain amount of prior earnings, and a requirement to actively seek new employment. In some cases, additional criteria like residency or specific work history may also apply.

How are unemployment insurance benefits calculated?

+

UI benefits are typically calculated as a percentage of the individual’s prior earnings, with a maximum and minimum benefit amount set by the relevant government body. The specific formula can vary, but it often takes into account the individual’s highest-earning quarters or years, ensuring that benefits are proportional to their previous income.