Virginia Marketplace Insurance

The Virginia Marketplace Insurance platform is a vital component of the state's healthcare system, offering residents access to affordable and comprehensive health insurance plans. With the implementation of the Affordable Care Act (ACA), also known as Obamacare, the marketplace has played a crucial role in providing insurance coverage to millions of Americans, including Virginians. In this comprehensive guide, we will delve into the intricacies of the Virginia Marketplace Insurance, exploring its history, the plans it offers, the enrollment process, and its impact on the healthcare landscape of the state.

A Brief History of Virginia Marketplace Insurance

The Virginia Marketplace Insurance, officially known as the Virginia Health Benefit Exchange (VHBE), was established in 2013 as a result of the Affordable Care Act. The primary goal of the VHBE was to create a competitive marketplace where individuals and small businesses could compare and purchase health insurance plans, ensuring access to affordable and quality healthcare.

The marketplace has evolved significantly since its inception. Initially, it faced challenges such as limited plan options and technical glitches during the enrollment period. However, over the years, the VHBE has improved its infrastructure, expanded its network of insurance providers, and streamlined the enrollment process to provide a seamless experience for users.

One of the key achievements of the Virginia Marketplace Insurance was its ability to attract a diverse range of insurance carriers, ensuring competition and a wide variety of plan choices for consumers. This has resulted in more affordable premiums and an increase in the number of insured individuals in the state.

Understanding Virginia Marketplace Insurance Plans

Virginia Marketplace Insurance offers a range of health insurance plans to cater to the diverse needs of its residents. These plans are categorized into metal tiers, namely Bronze, Silver, Gold, and Platinum, based on the level of coverage and out-of-pocket costs.

Bronze Plans

Bronze plans are the most affordable option in the marketplace. They typically have lower monthly premiums but higher deductibles and out-of-pocket expenses. These plans are ideal for individuals who are generally healthy and do not require frequent medical care.

Silver Plans

Silver plans strike a balance between cost and coverage. They offer a good mix of affordable premiums and reasonable out-of-pocket costs. Many Silver plans also come with cost-sharing reductions, which can further lower the expenses for eligible individuals.

Gold Plans

Gold plans provide comprehensive coverage with moderate premiums. They are suitable for individuals who anticipate frequent doctor visits or require access to specialized medical services. Gold plans often have lower deductibles and out-of-pocket maximums.

Platinum Plans

Platinum plans offer the highest level of coverage with the lowest out-of-pocket expenses. These plans are designed for individuals who require extensive medical care and want maximum financial protection. While they come with the highest premiums, they provide the most comprehensive benefits.

| Metal Tier | Average Premium | Deductible Range |

|---|---|---|

| Bronze | $350 - $400/month | $4,000 - $6,000 |

| Silver | $400 - $500/month | $2,500 - $4,500 |

| Gold | $550 - $650/month | $2,000 - $3,500 |

| Platinum | $700 - $850/month | $1,500 - $2,500 |

Enrollment Process and Deadlines

The Virginia Marketplace Insurance operates on an annual enrollment period, allowing residents to select or change their health insurance plans. This period typically runs from November 1st to December 15th each year, with coverage starting on January 1st of the following year.

During the enrollment period, individuals can create an account on the VHBE website, compare plans based on their needs and preferences, and enroll in the chosen plan. It's crucial to note that missing the deadline may result in limited coverage options until the next enrollment period.

However, the marketplace also offers a Special Enrollment Period (SEP) for qualifying life events such as marriage, birth or adoption of a child, loss of other health coverage, or changes in income. These SEPs allow individuals to enroll outside of the regular enrollment period, ensuring continuous coverage.

Assistance and Subsidies

Virginia Marketplace Insurance understands that health insurance can be expensive, especially for low-income households. To make coverage more accessible, the marketplace provides financial assistance in the form of subsidies and cost-sharing reductions.

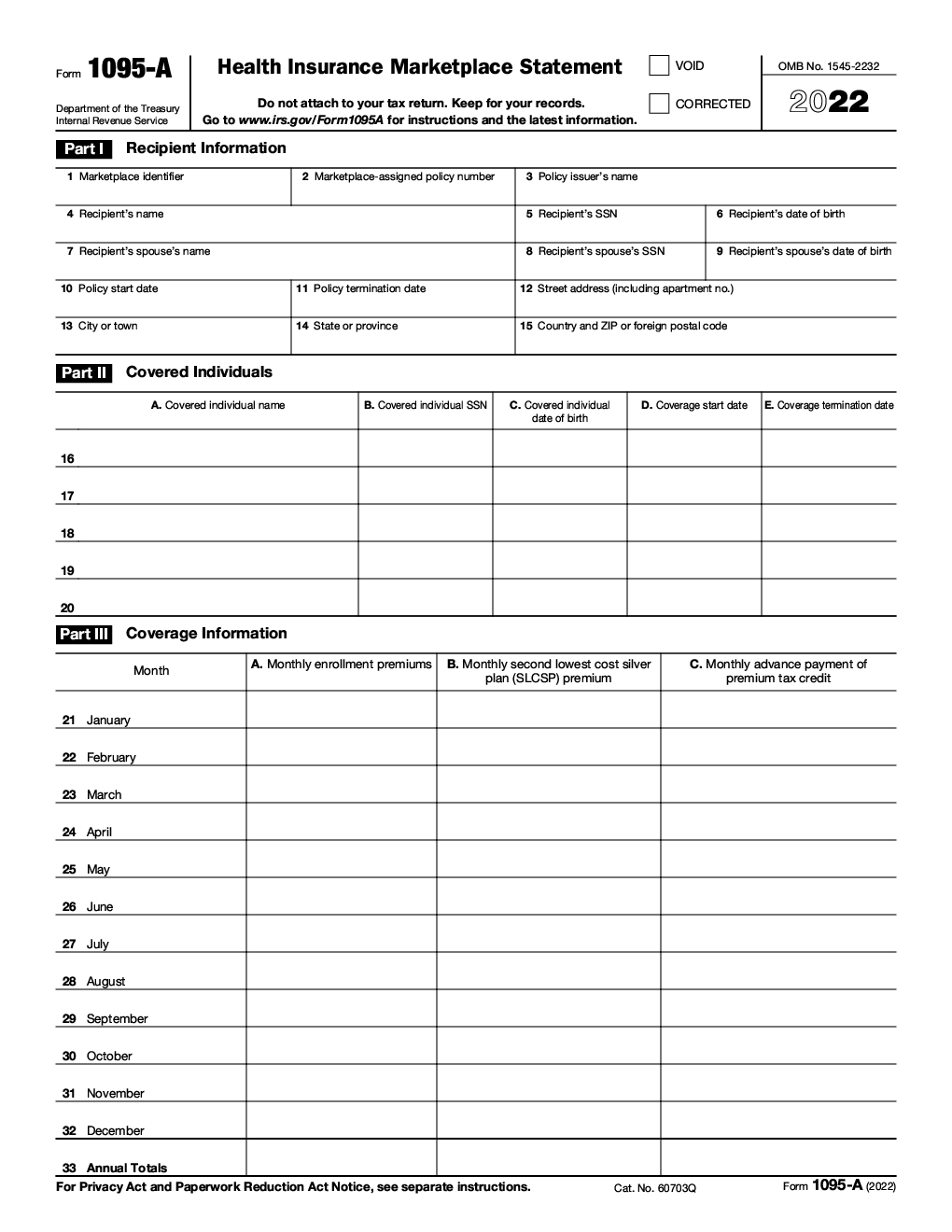

Subsidies, also known as premium tax credits, are available to individuals and families with incomes between 100% and 400% of the Federal Poverty Level. These subsidies reduce the monthly premium, making insurance more affordable. The amount of subsidy depends on the individual's income and the cost of the benchmark Silver plan in their area.

Cost-sharing reductions further lower out-of-pocket expenses for eligible individuals. These reductions can significantly decrease deductibles, copayments, and coinsurance, making healthcare more financially manageable.

Network of Providers and Coverage

Virginia Marketplace Insurance has partnered with a wide network of healthcare providers to ensure that insured individuals have access to quality care. These providers include hospitals, doctors, specialists, and other healthcare professionals.

The marketplace's plans typically offer both in-network and out-of-network coverage. In-network providers are those who have contracted with the insurance carrier, and using their services generally results in lower out-of-pocket costs. Out-of-network providers may also be covered, but at a higher cost.

It's essential for individuals to review the provider networks of the plans they are considering to ensure their preferred healthcare providers are included. The marketplace's website provides tools to search for in-network providers based on location and specialty.

Impact on Virginia’s Healthcare Landscape

The introduction of Virginia Marketplace Insurance has had a significant impact on the state’s healthcare landscape. By providing an accessible platform for insurance enrollment, the marketplace has increased the number of insured individuals, leading to improved overall health outcomes.

The marketplace's efforts to attract insurance carriers and expand plan options have resulted in increased competition, driving down premiums and improving the overall value of insurance plans. This has made healthcare more affordable for many Virginians, especially those with lower incomes.

Additionally, the availability of subsidies and cost-sharing reductions has further reduced financial barriers to healthcare access. This has not only improved the physical health of individuals but also their financial well-being, as they are less likely to face catastrophic medical expenses.

Navigating the Future of Virginia Marketplace Insurance

As the healthcare industry continues to evolve, so too will the Virginia Marketplace Insurance. The marketplace is committed to adapting to the changing needs of its residents and ensuring that healthcare remains accessible and affordable.

Looking ahead, the marketplace may explore strategies to further expand its provider network, particularly in underserved areas. This could involve partnering with community health centers or negotiating with additional insurance carriers to increase plan options and improve coverage for all Virginians.

Furthermore, as the state's population demographics shift, the marketplace will need to adapt its plans and enrollment strategies to meet the diverse needs of its residents. This may involve offering more language options, providing targeted outreach to specific communities, and ensuring that information is accessible and understandable to all.

What is the Virginia Marketplace Insurance?

+The Virginia Marketplace Insurance, officially known as the Virginia Health Benefit Exchange (VHBE), is a platform that allows individuals and small businesses to compare and purchase health insurance plans. It was established in 2013 as a result of the Affordable Care Act.

When is the enrollment period for Virginia Marketplace Insurance?

+The annual enrollment period typically runs from November 1st to December 15th each year, with coverage starting on January 1st of the following year. However, there are also Special Enrollment Periods for qualifying life events.

How do I know which plan is right for me?

+Choosing the right plan depends on your individual needs and preferences. Consider factors such as your expected healthcare usage, budget, and the importance of specific benefits. It’s also helpful to compare plans side by side and review their provider networks.

Can I get financial assistance for my insurance plan?

+Yes, Virginia Marketplace Insurance offers financial assistance in the form of subsidies and cost-sharing reductions. Subsidies reduce your monthly premium, while cost-sharing reductions lower your out-of-pocket expenses. Eligibility depends on your income and other factors.