Walmart Insurance Plans

Walmart, one of the largest retailers in the world, has expanded its offerings beyond retail to provide a range of services to its customers. Among these services is the Walmart Insurance Plan, which aims to offer comprehensive coverage options to individuals and families. This article delves into the intricacies of Walmart's insurance plans, exploring their features, benefits, and impact on the insurance landscape.

Unveiling Walmart’s Insurance Strategy

Walmart’s foray into the insurance industry is a strategic move to enhance its customer base and provide a one-stop solution for various consumer needs. The company’s insurance plans are designed to cater to a diverse range of customers, from those seeking basic coverage to individuals with more complex insurance requirements.

One of the key aspects of Walmart's insurance strategy is its focus on affordability and accessibility. The plans are structured to offer competitive rates, making insurance more attainable for a broader audience. This approach aligns with Walmart's mission to make essential services accessible to all.

Coverage Options: A Comprehensive Overview

Walmart’s insurance plans encompass a wide array of coverage types, ensuring that customers can find a plan tailored to their specific needs. Here’s a breakdown of the primary coverage options available:

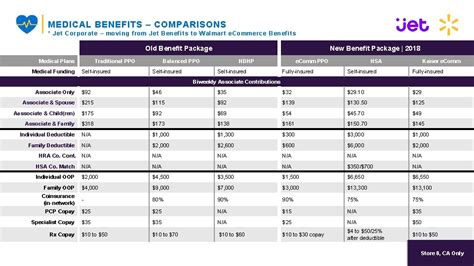

- Health Insurance: Walmart's health insurance plans provide comprehensive medical coverage, including access to a network of healthcare providers and facilities. These plans offer various levels of coverage, from basic to premium, allowing individuals to choose the option that best suits their healthcare requirements.

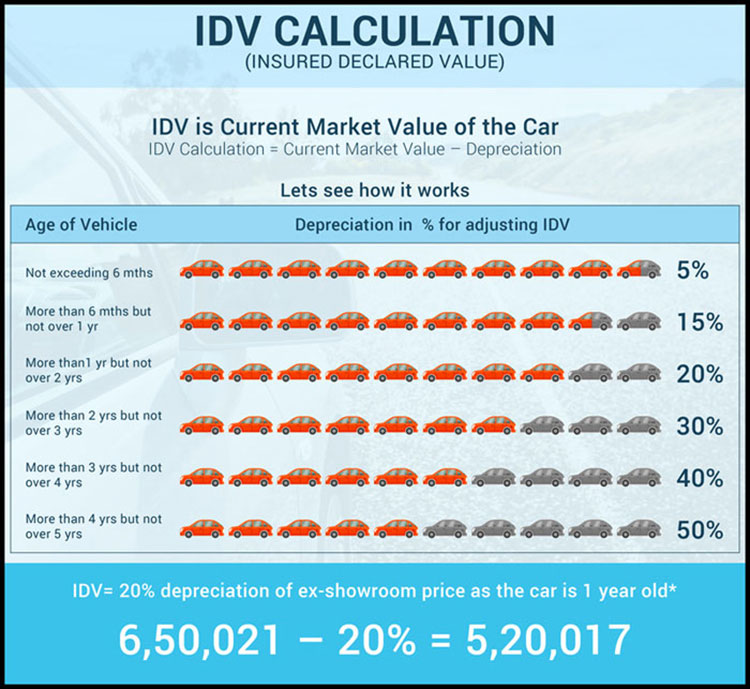

- Auto Insurance: For vehicle owners, Walmart's auto insurance plans offer protection against a range of potential risks. These plans cover liability, collision, and comprehensive insurance, ensuring that policyholders are financially protected in the event of accidents, theft, or other vehicle-related incidents.

- Homeowners/Renters Insurance: Recognizing the diverse housing situations of its customers, Walmart offers both homeowners and renters insurance. These plans provide coverage for personal property, liability, and additional living expenses, ensuring peace of mind for individuals, whether they own or rent their residence.

- Life Insurance: Walmart's life insurance plans offer financial protection to policyholders' loved ones in the event of their passing. The plans are designed to provide a range of coverage amounts, allowing individuals to choose an option that aligns with their financial goals and family's needs.

- Travel Insurance: Given the increasing demand for travel insurance, Walmart has introduced plans that cover trip cancellations, medical emergencies, and other travel-related risks. These plans aim to provide travelers with the necessary protection and peace of mind during their journeys.

Each of these coverage options is further customizable, allowing customers to select add-ons or additional riders to enhance their protection. Walmart's insurance plans are designed to be flexible, ensuring that customers can create a policy that aligns with their unique circumstances.

| Coverage Type | Average Premium |

|---|---|

| Health Insurance | $250 - $500/month |

| Auto Insurance | $150 - $300/month |

| Homeowners Insurance | $100 - $250/month |

| Renters Insurance | $20 - $50/month |

| Life Insurance | $50 - $200/month |

| Travel Insurance | $50 - $150/trip |

These premium ranges are estimates and can vary based on individual circumstances, coverage levels, and location.

The Impact on the Insurance Landscape

Walmart’s entry into the insurance market has had a significant impact on the industry. The company’s focus on affordability and accessibility has disrupted traditional insurance models, challenging established players to reevaluate their pricing strategies and customer service approaches.

Furthermore, Walmart's insurance plans have attracted a new demographic of customers who may have previously been priced out of the market or hesitant to navigate the complex world of insurance. By simplifying the insurance process and offering competitive rates, Walmart has made insurance more accessible to a wider audience, potentially increasing insurance coverage rates across the board.

Customer Experience and Digital Innovation

Walmart’s insurance plans are underpinned by a commitment to delivering a seamless customer experience. The company has invested in digital innovation, leveraging technology to streamline the insurance purchasing process. Customers can easily compare plans, obtain quotes, and purchase coverage online, removing the need for extensive paperwork and in-person interactions.

Additionally, Walmart's customer service team is trained to provide comprehensive support, offering guidance and assistance throughout the insurance journey. This focus on customer experience sets Walmart apart and aligns with its overall strategy of providing exceptional service across all its business ventures.

Partnerships and Expansion

To enhance its insurance offerings, Walmart has formed strategic partnerships with leading insurance providers. These partnerships allow Walmart to leverage the expertise and resources of established insurers, ensuring that its customers receive the highest quality coverage and support.

Furthermore, Walmart is continually expanding its insurance portfolio, exploring new coverage options and enhancing existing plans. This commitment to innovation ensures that Walmart's insurance plans remain relevant and competitive in an ever-evolving insurance landscape.

Future Implications and Industry Outlook

Walmart’s insurance plans have the potential to shape the future of the insurance industry. As the company continues to innovate and expand its offerings, it may inspire other retailers to follow suit, leading to increased competition and further disruption within the insurance market.

Moreover, Walmart's focus on affordability and accessibility could drive a shift towards more inclusive insurance models, benefiting consumers across the board. The company's success in this domain may encourage established insurers to reevaluate their pricing structures and customer engagement strategies, ultimately leading to a more consumer-centric insurance industry.

In conclusion, Walmart's insurance plans represent a significant development in the insurance landscape. By offering a range of coverage options, focusing on affordability, and prioritizing customer experience, Walmart has positioned itself as a formidable player in the insurance market. As the company continues to grow and innovate, its impact on the industry is likely to be felt for years to come.

Can I purchase Walmart insurance plans online, or do I need to visit a physical store?

+Walmart offers a seamless online purchasing process for its insurance plans. Customers can compare plans, obtain quotes, and purchase coverage directly from the Walmart website or mobile app. However, for those who prefer in-person assistance, Walmart stores often have dedicated insurance agents available to provide guidance and support.

How do Walmart’s insurance plans compare in terms of pricing and coverage compared to traditional insurance providers?

+Walmart’s insurance plans are designed to be competitively priced, often offering lower premiums compared to traditional insurance providers. The company’s focus on affordability allows it to attract a broader customer base. Additionally, Walmart’s plans are structured to provide comprehensive coverage, ensuring that policyholders receive adequate protection.

Are there any discounts or promotions available for Walmart insurance plans?

+Walmart periodically offers discounts and promotions on its insurance plans. These incentives may include discounts for bundling multiple insurance policies, loyalty rewards for long-term customers, or special promotions during specific periods. It’s advisable to check Walmart’s website or contact their customer service for the latest offers.