Want Cheap Car Insurance

Finding affordable car insurance is a priority for many vehicle owners, especially those on a tight budget. With the right approach and knowledge, it's possible to secure cheap car insurance without compromising on essential coverage. This comprehensive guide will delve into the world of affordable car insurance, providing expert insights and practical tips to help you navigate the process effectively.

Understanding Car Insurance Costs

The cost of car insurance can vary significantly based on numerous factors, including your personal details, driving history, and the type of vehicle you own. By understanding these factors, you can make informed decisions to reduce your insurance premiums.

Personal Factors

Your age, gender, and marital status are some of the personal details that insurers consider when calculating your premium. Generally, younger drivers tend to pay more due to their perceived higher risk. However, factors like your credit score and occupation can also impact your insurance rates.

Driving History

A clean driving record is crucial when it comes to car insurance. Insurers reward safe drivers with lower premiums. If you’ve had accidents or received traffic violations in the past, your insurance costs will likely be higher. Maintaining a safe driving record is key to securing cheap car insurance.

Vehicle Type

The make, model, and age of your vehicle play a significant role in determining your insurance costs. Sports cars and luxury vehicles often carry higher insurance premiums due to their higher repair costs and theft risks. On the other hand, standard sedans and compact cars are generally more affordable to insure.

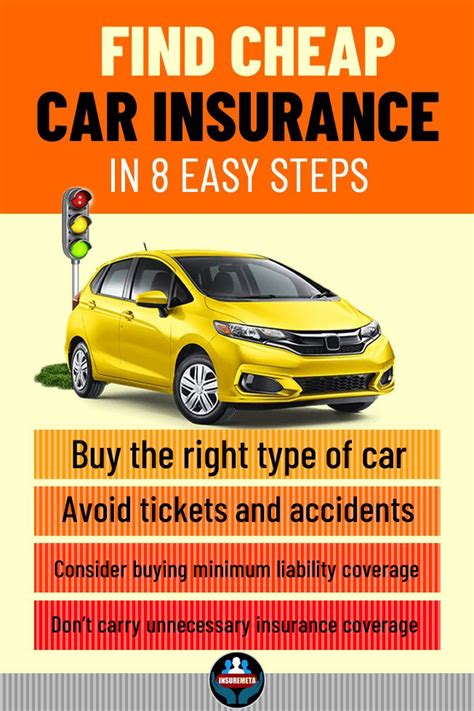

Tips for Getting Cheap Car Insurance

Now that we’ve covered the factors that influence car insurance costs, let’s explore some practical strategies to help you find affordable coverage.

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare rates from multiple insurers. You can use online comparison tools or directly contact insurance providers to request quotes. By comparing options, you can identify the most affordable coverage for your needs.

Bundle Your Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same insurer. Many insurance companies offer discounts when you combine multiple policies, which can significantly reduce your overall insurance costs.

Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can lower your insurance premiums. However, it’s essential to choose a deductible amount that you can afford in case of an accident or claim.

Maintain a Good Credit Score

Your credit score is a significant factor in determining your insurance rates. Insurers often view individuals with higher credit scores as more responsible and less likely to file claims. Therefore, maintaining a good credit score can lead to lower insurance premiums.

Choose a Higher Coverage Limit

While it may seem counterintuitive, choosing a higher coverage limit can sometimes result in lower insurance premiums. This is because insurers may offer discounts for higher coverage limits, as it reduces their risk exposure. However, it’s crucial to ensure that the coverage limit aligns with your financial situation and risk tolerance.

Explore Discounts and Rewards

Insurance companies often offer various discounts and rewards to attract and retain customers. These can include safe driver discounts, loyalty discounts, student discounts, and more. Be sure to inquire about the available discounts when shopping for insurance and take advantage of those that apply to your situation.

Consider Telematics Insurance

Telematics insurance, also known as usage-based insurance, uses a device or an app to monitor your driving behavior. By installing a telematics device or using a telematics app, you can provide real-time data on your driving habits to the insurer. If you’re a safe and cautious driver, you may qualify for lower insurance premiums with this type of insurance.

Keep a Clean Driving Record

As mentioned earlier, a clean driving record is crucial for affordable car insurance. Avoid accidents and traffic violations by practicing safe driving habits. Additionally, if you have a history of violations or accidents, consider taking defensive driving courses to improve your driving skills and potentially reduce your insurance costs.

Understand Your Coverage Needs

Before purchasing car insurance, it’s essential to understand your coverage needs. Assess your financial situation and determine the level of coverage that’s right for you. While it’s tempting to opt for the cheapest option, ensure that the coverage meets your needs and provides adequate protection in case of an accident or claim.

The Future of Affordable Car Insurance

The insurance industry is continuously evolving, and technological advancements are playing a significant role in shaping the future of car insurance. Here are some trends and innovations that may impact the availability and affordability of car insurance in the coming years.

Autonomous Vehicles

The rise of autonomous vehicles is expected to revolutionize the insurance industry. With self-driving cars, the risk of human error-related accidents could significantly decrease. This shift could potentially lead to lower insurance premiums as the frequency and severity of accidents decline.

Advanced Safety Features

Many modern vehicles are equipped with advanced safety features, such as lane departure warning systems, automatic emergency braking, and adaptive cruise control. These features can reduce the likelihood of accidents, making vehicles safer on the road. Insurers may offer discounts for vehicles with such safety features, encouraging their adoption and potentially reducing insurance costs.

Usage-Based Insurance

Usage-based insurance, or telematics insurance, is gaining popularity as a more accurate way to assess driving behavior and risk. By analyzing real-time data, insurers can offer more personalized insurance rates based on an individual’s actual driving habits. This trend is expected to continue, providing opportunities for safe drivers to access affordable car insurance.

Data Analytics and Machine Learning

Insurance companies are increasingly leveraging data analytics and machine learning to improve risk assessment and pricing accuracy. By analyzing vast amounts of data, insurers can identify patterns and trends, leading to more efficient and precise pricing models. This advancement can benefit consumers by offering more tailored insurance options and potentially reducing costs.

Collaboration Between Insurers and Automakers

Insurers and automakers are forming partnerships to develop innovative insurance solutions. By sharing data and collaborating on safety features, they can work together to reduce risks and offer more affordable insurance options. This collaboration may lead to the development of new insurance products and services tailored to the evolving automotive landscape.

Conclusion

Finding cheap car insurance is not only possible but achievable with the right knowledge and strategies. By understanding the factors that influence insurance costs and implementing practical tips, you can secure affordable coverage without compromising on essential protection. Remember to shop around, explore discounts, and stay informed about industry trends to make the most of your insurance options.

How often should I review my car insurance policy and rates?

+It’s a good practice to review your car insurance policy and rates annually or whenever you experience significant life changes, such as a move to a new location, a change in marital status, or the addition of a teen driver to your household. Regular reviews ensure that your coverage and premiums remain aligned with your current needs and circumstances.

Can I get car insurance without a driver’s license?

+Obtaining car insurance without a valid driver’s license can be challenging. Most insurance companies require proof of a valid license as part of their underwriting process. However, some insurers may offer non-owner car insurance policies, which cover you if you occasionally borrow or rent a vehicle. It’s best to check with insurance providers to understand their specific requirements.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the United States varies significantly based on factors such as location, age, driving history, and the type of vehicle. According to recent data, the national average for car insurance premiums is around $1,674 per year. However, rates can range from a few hundred dollars to several thousand dollars, depending on individual circumstances.