What An Average Car Insurance Payment

Car insurance is an essential aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. The cost of car insurance varies significantly based on numerous factors, making it challenging to determine an exact average payment. However, understanding the key elements that influence insurance rates can help provide a clearer picture of the typical expenses associated with this vital coverage.

Factors Influencing Car Insurance Rates

The premium you pay for car insurance is a unique figure tailored to your specific circumstances and the coverage options you choose. Several key factors contribute to the determination of your insurance rate, including:

- Location: Insurance rates can vary significantly based on where you live. Urban areas often have higher premiums due to increased traffic congestion, accident rates, and potential for vehicle theft.

- Vehicle Type: The make, model, and year of your vehicle play a role in determining your insurance costs. Sports cars and luxury vehicles, for instance, typically have higher insurance rates due to their increased repair costs and higher risk of theft.

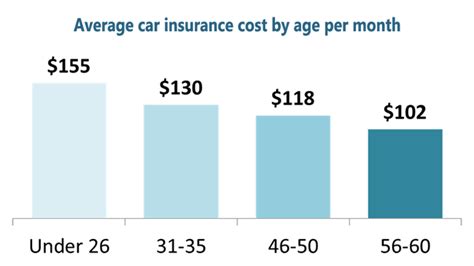

- Driver Profile: Your driving history and personal details are significant factors. Younger drivers and those with a history of accidents or traffic violations may face higher premiums. Gender and marital status can also influence rates, with unmarried males under 25 often paying the highest premiums.

- Coverage and Deductibles: The level of coverage you choose impacts your premium. Comprehensive and collision coverage options provide more protection but cost more. Additionally, higher deductibles can lower your premium, but you'll pay more out of pocket if you need to make a claim.

- Discounts: Insurance companies offer various discounts, such as those for safe driving, bundling policies, or completing defensive driving courses. These discounts can significantly reduce your overall insurance costs.

Average Car Insurance Payments by Region

The average cost of car insurance varies considerably across different regions in the United States. According to recent data, the national average for annual car insurance premiums is approximately $1,674. However, this figure is just an estimate, and the actual cost can deviate significantly depending on the factors mentioned earlier.

To provide a more detailed picture, here's a breakdown of average annual car insurance premiums by region, based on data from leading insurance providers:

| Region | Average Annual Premium |

|---|---|

| Northeast | $1,915 |

| Midwest | $1,560 |

| South | $1,517 |

| West | $1,652 |

These regional averages highlight the significant variations in car insurance costs across the country. It's important to note that even within these regions, premiums can differ substantially based on specific locations and individual circumstances.

Tips for Reducing Car Insurance Costs

While you can’t control certain factors influencing your car insurance rates, there are strategies you can employ to potentially reduce your premiums. Here are some tips to consider:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates for your circumstances. Online comparison tools can be particularly useful for this.

- Maintain a Clean Driving Record: A clean driving history is crucial for keeping your insurance premiums low. Avoid accidents and traffic violations to prevent your rates from increasing.

- Choose a Higher Deductible: Selecting a higher deductible can lower your monthly premium. However, be aware that you'll pay more out of pocket if you need to make a claim.

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as car and home insurance, with them.

- Consider Usage-Based Insurance: Some insurers offer usage-based insurance plans that track your driving habits and reward safe driving with lower premiums.

- Ask About Discounts: Insurance providers offer various discounts, including those for safe driving, good grades (for young drivers), and loyalty. Be sure to inquire about all applicable discounts.

The Future of Car Insurance Premiums

The car insurance industry is constantly evolving, and several trends are likely to impact premiums in the future. Autonomous vehicles, for instance, are expected to reduce accident rates, potentially leading to lower insurance costs over time. Additionally, the increasing adoption of telematics and usage-based insurance policies could provide more accurate risk assessments, resulting in more tailored and potentially reduced premiums for safer drivers.

However, it's important to note that other factors, such as rising healthcare costs and an increase in severe weather events, could offset these potential savings. The future of car insurance premiums remains uncertain, but staying informed about industry trends and shopping around for the best rates can help you navigate these changes effectively.

Conclusion

Determining an average car insurance payment is a complex task due to the multitude of factors that influence premiums. While regional averages can provide a starting point, your specific circumstances will ultimately determine your insurance costs. By understanding the key factors that impact your rates and employing strategies to reduce your premiums, you can ensure you’re getting the best value for your car insurance coverage.

Frequently Asked Questions

How often should I review my car insurance policy and rates?

+It’s a good idea to review your car insurance policy and rates annually, or whenever your circumstances change significantly. This ensures you’re still getting the best value and coverage for your needs.

Can I get car insurance if I have a poor driving record?

+Yes, you can still obtain car insurance with a poor driving record, but you may face higher premiums. Some insurance companies specialize in high-risk drivers and can offer coverage at competitive rates.

Are there any discounts available for senior drivers?

+Many insurance companies offer discounts for senior drivers, particularly those over the age of 55. These discounts can include safe driver discounts, loyalty discounts, and even discounts for taking defensive driving courses.

What factors determine my car insurance deductible options?

+Your car insurance deductible options are typically determined by your insurance provider and the coverage levels you choose. Generally, you can select deductibles ranging from 250 to 1,000 or more. Higher deductibles can lower your premium, but it’s essential to choose an amount you’re comfortable paying if you need to make a claim.