What Health Insurance Should I Get

The Essential Guide to Choosing the Right Health Insurance Plan

Health insurance is an essential aspect of modern life, providing financial protection and access to vital healthcare services. With a myriad of options available, selecting the right health insurance plan can be daunting. This comprehensive guide aims to demystify the process and empower you to make an informed decision that aligns with your unique needs and circumstances.

In today's dynamic healthcare landscape, the importance of health insurance cannot be overstated. It acts as a safety net, ensuring that you and your loved ones receive the medical care you deserve without incurring overwhelming financial burdens. Whether you're a young professional, a family head, or a retiree, understanding your health insurance options is crucial to maintaining your well-being and peace of mind.

Understanding Your Health Insurance Needs

The first step in choosing the right health insurance plan is to assess your individual needs. Consider the following factors:

- Your age and health status: Are you generally healthy, or do you have pre-existing conditions that require regular medical attention? Your age and health profile will significantly influence the type of coverage you require.

- Your family's health needs: If you have a family, their healthcare requirements must be taken into account. This includes the number of family members, their ages, and any specific medical conditions they may have.

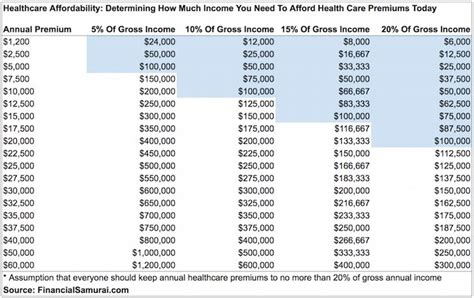

- Your financial situation: Health insurance can be a significant expense, so it's essential to choose a plan that fits within your budget. Consider your disposable income and any financial constraints you may have.

- Your preferred healthcare providers: Do you have a primary care physician or specialists you regularly visit? Ensuring that your chosen plan includes them in its network can be crucial for convenience and continuity of care.

- Your prescription medication needs: If you take prescription medications regularly, it's vital to choose a plan that covers these medications at a reasonable cost.

Types of Health Insurance Plans

Once you've assessed your needs, it's time to explore the different types of health insurance plans available. The most common types include:

Health Maintenance Organization (HMO)

- Overview: HMOs provide comprehensive coverage but require you to select a primary care physician (PCP) within their network. This PCP acts as a gatekeeper, coordinating all your healthcare needs and referring you to specialists within the HMO network.

- Pros: Typically, HMOs offer lower premiums and out-of-pocket costs. They’re an excellent choice if you’re generally healthy and prefer a more structured healthcare approach.

- Cons: The network of providers can be limited, and you may need referrals to see specialists. Out-of-network care is usually not covered, and you may have to pay higher costs.

Preferred Provider Organization (PPO)

- Overview: PPOs offer more flexibility in choosing healthcare providers. You can visit any in-network or out-of-network provider, although using in-network providers is more cost-effective.

- Pros: PPOs provide greater freedom to choose your healthcare providers and specialists without requiring referrals. They often cover a wider range of services.

- Cons: PPO plans typically have higher premiums and out-of-pocket costs compared to HMOs. The cost of out-of-network care can be substantial.

Exclusive Provider Organization (EPO)

- Overview: EPOs are similar to PPOs but with a more restricted network. You can only visit in-network providers without referrals, and out-of-network care is not covered.

- Pros: EPO plans often have lower premiums and out-of-pocket costs than PPOs. They can be a good choice if you’re comfortable using a limited network of providers.

- Cons: The lack of out-of-network coverage can be a significant limitation, especially if you travel frequently or require specialized care outside your network.

Point-of-Service (POS) Plan

- Overview: POS plans combine elements of HMOs and PPOs. You select a PCP within the network, but you can also visit out-of-network providers with higher out-of-pocket costs.

- Pros: POS plans offer flexibility in choosing providers and specialists, similar to PPOs. They often cover a wide range of services.

- Cons: POS plans can have higher premiums and out-of-pocket costs compared to HMOs. Out-of-network care can be costly, and you may need referrals to see specialists.

Key Considerations for Choosing a Health Insurance Plan

Beyond the type of plan, several other factors influence your decision. These include:

- Premiums: The amount you pay monthly for your health insurance coverage. Higher premiums often correspond to more comprehensive coverage.

- Deductibles: The amount you pay out of pocket before your insurance coverage kicks in. Lower deductibles mean you pay more in premiums, while higher deductibles can save you money on premiums but may require a larger upfront payment when using healthcare services.

- Copayments (Copays): Fixed amounts you pay for covered healthcare services, such as doctor visits or prescriptions. Copays can vary based on the type of service and whether you use in-network or out-of-network providers.

- Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage. For instance, you might pay 20% of the cost, while your insurance covers the remaining 80%.

- Out-of-Pocket Maximum: The maximum amount you'll pay out of pocket in a year for covered services. This includes deductibles, copays, and coinsurance. Once you reach this limit, your insurance covers 100% of the costs for covered services.

- Network of Providers: The group of healthcare providers, such as doctors, hospitals, and specialists, that your insurance plan has contracted with. Using in-network providers is generally more cost-effective.

- Coverage for Pre-existing Conditions: Ensure that your chosen plan covers any pre-existing conditions you or your family members may have. The Affordable Care Act (ACA) guarantees this coverage, but it's essential to verify.

- Preventive Care Coverage: Many plans cover preventive services like annual check-ups, vaccinations, and screenings at no cost to you. This can be a significant benefit for maintaining your health.

Shopping for Health Insurance

When shopping for health insurance, consider the following steps:

- Research and Compare Plans: Use online tools and resources to compare different plans based on your needs. Look at premiums, deductibles, provider networks, and coverage details.

- Check Your Employer's Offerings: If you're employed, check the health insurance options provided by your employer. They often offer group plans with competitive rates and additional benefits.

- Explore Government Programs: Depending on your income and family size, you may qualify for government-sponsored health insurance programs like Medicaid or the Children's Health Insurance Program (CHIP). These programs provide comprehensive coverage at low or no cost.

- Use Insurance Brokers or Agents: Consider working with a licensed insurance broker or agent who can guide you through the process and help you find the best plan for your needs. They can provide personalized advice and handle the paperwork.

- Read the Fine Print: Carefully review the plan's summary of benefits and coverage to understand what's included and excluded. Pay attention to any limitations or restrictions.

- Consider Short-Term Plans: If you're between jobs or facing a temporary gap in coverage, short-term health insurance plans can provide temporary protection. However, they often have limited coverage and may not cover pre-existing conditions.

Common Questions about Health Insurance

What is the difference between a deductible and a copayment?

+A deductible is the amount you pay out of pocket before your insurance coverage begins, while a copayment is a fixed amount you pay for covered services, like a doctor's visit. For instance, you might have a $2,000 deductible and a $20 copay for a primary care physician visit.

Do all health insurance plans cover prescription medications?

+Most health insurance plans include prescription drug coverage, but the specific medications covered and the cost-sharing requirements can vary. Some plans have preferred drug lists, while others may require prior authorization for certain medications. It's essential to review your plan's drug coverage carefully.

What happens if I exceed my out-of-pocket maximum?

+Once you reach your out-of-pocket maximum, your insurance plan covers 100% of the costs for covered services for the rest of the year. This protection ensures you won't face excessive financial burdens for necessary medical care.

Can I change my health insurance plan during the year?

+Generally, you can only change your health insurance plan during specific enrollment periods, such as the annual open enrollment period or if you experience a qualifying life event like marriage, divorce, or the birth of a child.

How can I save money on health insurance premiums?

+To reduce your premiums, consider choosing a plan with a higher deductible and out-of-pocket maximum. You can also explore plans with health savings accounts (HSAs) or flexible spending accounts (FSAs), which allow you to set aside pre-tax dollars for healthcare expenses.

Remember, choosing the right health insurance plan is a personal decision that requires careful consideration of your needs and circumstances. By understanding your options and shopping wisely, you can ensure you have the coverage you need to maintain your health and financial well-being.