What Is Cobra Medical Insurance

In the realm of healthcare coverage, the acronym "COBRA" often arises, especially when discussing insurance options for individuals and families. COBRA medical insurance, formally known as the Consolidated Omnibus Budget Reconciliation Act, is a federal law that provides a safety net for those who find themselves unexpectedly without health insurance coverage.

This comprehensive guide aims to demystify COBRA medical insurance, exploring its origins, how it works, and its critical role in ensuring continuous healthcare access. We will delve into the specifics, providing a clear understanding of this essential insurance option.

The History and Purpose of COBRA Medical Insurance

COBRA medical insurance was introduced as part of the larger COBRA legislation in 1985. The act’s primary goal was to address the gap in health insurance coverage that often occurs when individuals experience life changes such as job loss, divorce, or the death of a spouse.

Before COBRA, these life events could lead to a sudden lack of health insurance, leaving individuals and their families vulnerable to the high costs of medical care. COBRA aimed to bridge this gap by offering a temporary extension of group health benefits, ensuring continuity of coverage during these transitional periods.

How COBRA Medical Insurance Works

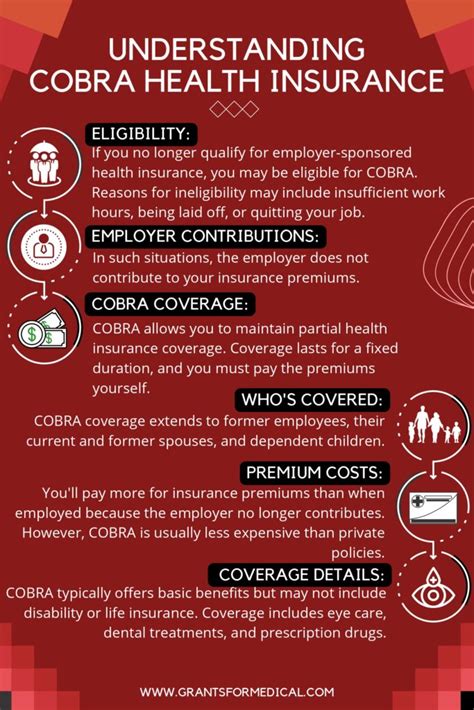

COBRA insurance operates by allowing individuals and their families to continue their group health insurance coverage for a limited period after a qualifying event, such as the aforementioned life changes.

Qualifying Events

Several events can trigger COBRA eligibility, including:

- Employment Termination: Losing one’s job can lead to a loss of employer-sponsored health insurance. COBRA provides a way to maintain coverage during the job search.

- Divorce or Legal Separation: When a couple separates, the spouse who was covered under the other’s health insurance plan may need to continue coverage through COBRA.

- Death of a Spouse: In the unfortunate event of a spouse’s death, COBRA ensures that the surviving spouse and dependents can maintain health insurance.

- Reduction of Work Hours: If an employee’s work hours are reduced to the extent that they no longer qualify for employer-sponsored health insurance, COBRA can provide a solution.

Enrollment and Coverage Period

Upon a qualifying event, eligible individuals have a set timeframe, typically 60 days, to elect COBRA coverage. Once enrolled, the coverage period can last for a maximum of 18 months. In certain circumstances, such as a disability or if a second qualifying event occurs, the coverage period can be extended further.

Cost of COBRA Insurance

COBRA insurance is not free; it requires the individual to pay the full premium, including the portion previously covered by the employer. This premium can be expensive, as individuals are often responsible for both the employee and employer shares of the premium.

However, it's important to note that COBRA coverage often provides a more affordable option compared to individual health insurance plans, especially for those with pre-existing conditions.

Benefits and Limitations of COBRA Medical Insurance

COBRA insurance offers several advantages, including:

- Continuous Coverage: COBRA ensures that individuals and their families maintain health insurance coverage during transitional periods, providing peace of mind and access to necessary medical care.

- Portability: COBRA allows individuals to keep their coverage regardless of their geographical location or employment status, making it particularly beneficial for those in transition.

- Pre-existing Condition Protection: COBRA coverage cannot be denied due to pre-existing conditions, a significant benefit for those with ongoing health issues.

However, COBRA insurance also has its limitations:

- Cost: As mentioned, the full premium can be costly, especially for those on a tight budget.

- Timeframe: The 18-month coverage period may not be sufficient for some individuals, especially if they are unable to secure new employment or health insurance coverage within that time.

- Limited Coverage: COBRA typically provides the same coverage as the original group health plan, which may not be as comprehensive as other insurance options.

Alternatives to COBRA Medical Insurance

While COBRA can be a lifesaver for many, it's not the only option available. Here are some alternatives to consider:

- Individual Health Insurance Plans: These plans are purchased directly from an insurance provider and can offer more flexibility and potentially lower costs.

- Medicaid or Medicare: Depending on income and age, individuals may qualify for government-sponsored health insurance programs.

- Short-Term Health Insurance: For those in need of temporary coverage, short-term plans can provide a cost-effective solution, though they often come with limitations.

- State-Based Health Insurance Programs: Some states offer their own health insurance programs, which may have different eligibility criteria and benefits.

The Future of COBRA Medical Insurance

The Affordable Care Act (ACA), also known as Obamacare, has had a significant impact on COBRA insurance. The ACA introduced new options for health insurance coverage, making it easier for individuals to find affordable plans and reducing the need for COBRA in certain situations.

However, COBRA remains a vital safety net for those who may not qualify for other insurance options or who require continuous coverage during a transitional period. As healthcare policies evolve, COBRA's role may continue to adapt, but its importance in ensuring access to healthcare remains undeniable.

Conclusion

COBRA medical insurance serves as a crucial safeguard for individuals and families facing unexpected changes in their lives. While it may not be the ideal solution for everyone, its existence ensures that no one is left without healthcare coverage during challenging times. Understanding COBRA’s role and limitations empowers individuals to make informed decisions about their health insurance options.

What happens if I miss the COBRA enrollment deadline?

+Missing the enrollment deadline can result in a loss of COBRA eligibility. However, certain circumstances, such as extenuating personal situations, may warrant an extension or reconsideration of the deadline. It’s crucial to communicate with your insurance provider or COBRA administrator promptly if you miss the deadline to discuss your options.

Can I add dependents to my COBRA coverage?

+Yes, you can typically add or remove dependents from your COBRA coverage as needed. This is particularly relevant in cases of divorce or the birth/adoption of a child. It’s important to inform your COBRA administrator about any changes in your family situation to ensure accurate coverage.

Are there any tax implications for COBRA insurance?

+COBRA premiums are generally considered taxable income, as you are paying the full premium yourself. This can impact your tax liability, so it’s essential to consult with a tax professional to understand the specific implications for your situation.