What Is Recommended For Car Insurance Coverage

When it comes to protecting your vehicle and ensuring financial security, car insurance is an essential aspect of vehicle ownership. The recommended coverage for car insurance can vary depending on several factors, including your location, the value of your vehicle, and your personal circumstances. In this comprehensive guide, we will delve into the various aspects of car insurance coverage, exploring the types of policies, the factors influencing coverage recommendations, and how to tailor your insurance plan to meet your specific needs.

Understanding Car Insurance Coverage

Car insurance coverage refers to the types of risks and liabilities that your insurance policy will protect you against. It is crucial to understand the different components of coverage to make informed decisions about your policy.

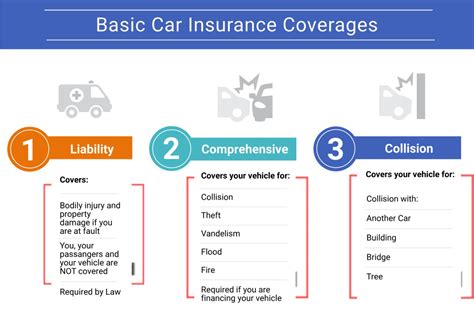

Liability Coverage

Liability coverage is a fundamental aspect of car insurance. It provides protection in the event that you are found at fault for an accident resulting in property damage, injuries, or fatalities. This coverage is designed to cover the costs associated with repairing or replacing damaged property, as well as medical expenses and legal fees incurred by the other party involved in the accident.

Within liability coverage, there are typically two main components: bodily injury liability and property damage liability. Bodily injury liability covers the medical costs and any associated legal fees if the accident results in injuries to others. Property damage liability, on the other hand, covers the cost of repairing or replacing damaged property, such as other vehicles, fences, or structures.

Collision and Comprehensive Coverage

Collision and comprehensive coverage offer protection for your own vehicle. Collision coverage comes into play when your car is damaged in an accident, regardless of fault. It covers the cost of repairs or the replacement value of your vehicle if it is deemed a total loss. Comprehensive coverage, on the other hand, provides protection against non-accident-related incidents, such as theft, vandalism, natural disasters, or damage caused by animals.

Personal Injury Protection (PIP) and Medical Payments

Personal Injury Protection (PIP) and Medical Payments coverage focus on providing medical coverage for you and your passengers, regardless of fault. PIP covers a wide range of medical expenses, including doctor visits, hospital stays, rehabilitation, and even lost wages. Medical Payments coverage, while similar, typically has a lower coverage limit and may not cover as extensive a range of expenses.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is an important aspect of car insurance, especially in cases where the at-fault driver does not have sufficient insurance coverage. This coverage protects you and your passengers if you are involved in an accident with an uninsured or underinsured driver. It covers medical expenses, property damage, and in some cases, pain and suffering.

Additional Coverages

Depending on your location and personal needs, there may be additional coverages available, such as rental car reimbursement, gap insurance, or custom parts and equipment coverage. These optional coverages can provide extra protection and peace of mind in specific situations.

Factors Influencing Recommended Coverage

The recommended car insurance coverage for an individual will depend on several key factors, each playing a crucial role in determining the optimal level of protection.

State Laws and Minimum Requirements

Every state has its own set of laws regarding car insurance, including mandatory minimum coverage requirements. These minimums vary from state to state and typically include liability coverage. It is essential to understand the specific requirements of your state to ensure you meet the legal obligations.

For example, in the state of California, the minimum liability coverage required is 15,000 for bodily injury per person, 30,000 for bodily injury per accident, and $5,000 for property damage. However, these minimums may not provide sufficient protection, especially if you own a valuable vehicle or have significant assets to protect.

Vehicle Value and Replacement Cost

The value of your vehicle is a critical factor in determining the recommended coverage. If you own a newer or more expensive car, it is generally advisable to opt for comprehensive and collision coverage to ensure your vehicle is protected against a wide range of risks. These coverages can help cover the cost of repairs or provide the funds to replace your vehicle if it is deemed a total loss.

Consider the example of a luxury sports car valued at $100,000. In this case, having comprehensive and collision coverage is crucial to protect your investment. Without these coverages, you may be left with significant out-of-pocket expenses if your vehicle is damaged or stolen.

Personal Financial Situation

Your personal financial situation is an important consideration when determining the recommended coverage. If you have significant assets or a high net worth, you may want to consider higher liability limits to protect your financial well-being in the event of a severe accident. Additionally, if you have a history of accidents or traffic violations, you may need to adjust your coverage to ensure adequate protection.

For instance, if you own a portfolio of real estate properties and have a high net worth, you may want to increase your liability coverage to $1 million or more. This provides an extra layer of protection against potential lawsuits and ensures your assets are shielded from financial risks.

Driving Habits and Risks

Your driving habits and the risks associated with your daily commute or travel patterns can influence the recommended coverage. If you frequently drive in high-risk areas or have a long daily commute, you may want to consider additional coverages to provide comprehensive protection.

For example, if you live in an area with a high rate of car thefts or vandalism, adding comprehensive coverage to your policy can provide peace of mind. Additionally, if you frequently travel long distances or drive in adverse weather conditions, collision coverage becomes even more crucial to protect against potential accidents.

Personal Preferences and Peace of Mind

Ultimately, the recommended car insurance coverage should take into account your personal preferences and the level of peace of mind you desire. Some individuals may prioritize comprehensive protection and opt for higher coverage limits, while others may prefer a more cost-effective approach with basic coverage.

It is important to strike a balance between your budget and your peace of mind. Assessing your risk tolerance and understanding your financial situation will help you make an informed decision about the recommended coverage.

Tailoring Your Car Insurance Coverage

Once you have a clear understanding of the factors influencing recommended coverage, it’s time to tailor your car insurance policy to meet your specific needs. Here are some key considerations to keep in mind:

Assess Your Risks

Take the time to evaluate your unique circumstances and the risks you face on the road. Consider factors such as your driving history, the value of your vehicle, your daily commute, and any specific concerns you may have. This assessment will help you identify the coverages that are most relevant to your situation.

Understand Your Coverage Limits

Review your policy’s coverage limits, including liability, collision, and comprehensive coverage. Ensure that these limits align with your needs and provide adequate protection. Consider increasing your coverage limits if you have a higher-value vehicle or if you have significant assets to protect.

Explore Optional Coverages

Many car insurance providers offer a range of optional coverages that can enhance your protection. These may include rental car reimbursement, gap insurance, roadside assistance, or custom parts and equipment coverage. Evaluate these options and consider adding them to your policy if they address specific concerns or provide additional peace of mind.

Compare Quotes and Providers

Obtain quotes from multiple insurance providers to compare coverage options and premiums. Different providers may offer varying levels of coverage and pricing, so it’s essential to shop around to find the best fit for your needs. Consider factors such as the provider’s reputation, customer service, and financial stability when making your decision.

Regularly Review and Adjust Your Coverage

Car insurance needs can change over time, so it’s important to regularly review and update your coverage. Life events such as buying a new vehicle, moving to a different location, or experiencing a change in financial circumstances can all impact your insurance needs. Stay proactive and make adjustments to your policy as necessary to ensure you always have the right level of protection.

Making Informed Decisions

When it comes to car insurance coverage, making informed decisions is crucial. By understanding the different types of coverage, the factors influencing recommendations, and how to tailor your policy, you can ensure that you have the right protection in place. Remember, car insurance is not a one-size-fits-all solution, and it’s essential to customize your coverage to fit your unique circumstances.

Take the time to research, compare, and consult with insurance professionals to find the best car insurance coverage for your needs. With the right protection in place, you can drive with confidence, knowing that you and your vehicle are well-protected.

FAQ

How much car insurance coverage do I need?+

The amount of car insurance coverage you need depends on various factors, including your state’s minimum requirements, the value of your vehicle, your personal financial situation, and your driving habits. It’s recommended to consult with an insurance professional to assess your specific needs and determine the appropriate coverage limits.

What happens if I have an accident and my coverage is insufficient?+

If you have an accident and your coverage is insufficient, you may be left with out-of-pocket expenses to cover the costs not covered by your insurance. It’s important to regularly review your coverage and adjust it as needed to ensure you have adequate protection.

Are there any discounts available for car insurance coverage?+

Yes, many insurance providers offer discounts for various reasons, such as safe driving records, multiple policy discounts (bundling home and auto insurance), good student discounts, and loyalty discounts. It’s worth exploring these options to potentially reduce your insurance premiums.

How often should I review and update my car insurance coverage?+

It’s recommended to review your car insurance coverage annually or whenever there are significant changes in your life, such as buying a new vehicle, moving to a different location, or experiencing a change in financial circumstances. Regular reviews ensure that your coverage remains up-to-date and adequate.

Can I switch car insurance providers if I’m not satisfied with my current coverage?+

Absolutely! You have the freedom to switch car insurance providers at any time. If you feel that your current coverage is not meeting your needs or if you find a better deal elsewhere, it’s worth exploring other options and making a change to ensure you have the right protection.