What Is Tenants Insurance

Tenants insurance, often referred to as renters insurance, is a type of insurance policy designed specifically for individuals who rent their living space, whether it's an apartment, condo, house, or any other type of dwelling. This essential coverage protects tenants against various risks and liabilities that may arise during their tenancy, offering financial security and peace of mind.

In today's world, where renting is a common lifestyle choice for many, understanding tenants insurance is crucial. It safeguards renters against potential losses and provides coverage for their personal belongings, liability, and additional living expenses in case of unforeseen events. This article will delve into the intricacies of tenants insurance, exploring its benefits, coverage options, and the importance it holds for individuals who rent their homes.

Understanding Tenants Insurance: A Comprehensive Overview

Tenants insurance is a vital component of financial planning for renters, as it offers protection against a wide range of risks. Here’s a detailed look at what tenants insurance entails and why it’s an essential consideration for anyone living in a rental property.

Protection for Your Belongings

One of the primary benefits of tenants insurance is the coverage it provides for your personal property. This includes your furniture, electronics, clothing, and other valuable items. In the unfortunate event of a loss due to theft, fire, or other covered perils, tenants insurance steps in to reimburse you for the cost of replacing or repairing your belongings.

For instance, imagine a fire breaks out in your apartment complex, damaging your unit and destroying your possessions. With tenants insurance, you can file a claim to receive compensation for the replacement value of your lost items, ensuring you can rebuild your life and replace essential belongings.

| Coverage Type | Description |

|---|---|

| Actual Cash Value | Reimburses you for the current value of your belongings, accounting for depreciation. |

| Replacement Cost | Provides coverage for the cost of replacing your belongings without deducting for depreciation. |

Liability Protection

Tenants insurance also offers liability coverage, which is crucial for protecting yourself against potential lawsuits and legal expenses. If someone is injured in your rental unit or if you accidentally cause damage to the property, tenants insurance can provide financial assistance to cover these unexpected costs.

Consider a scenario where a guest slips and falls in your apartment, resulting in a serious injury. Without tenants insurance, you might be held personally liable for their medical expenses and potential legal fees. However, with liability coverage, your insurance policy can help mitigate these financial burdens.

Additional Living Expenses

In the event that your rental unit becomes uninhabitable due to a covered loss, tenants insurance provides coverage for additional living expenses. This means that if you need to temporarily relocate while your apartment is being repaired or rebuilt, your insurance policy will cover the cost of temporary housing, meals, and other necessary expenses.

For example, if a severe storm causes significant damage to your apartment complex, rendering your unit unlivable, tenants insurance can reimburse you for the cost of staying in a hotel or rental until your home is restored.

Personalized Coverage Options

Tenants insurance policies can be tailored to meet your specific needs and budget. Insurance providers offer various coverage limits and additional endorsements to enhance your protection. You can choose the level of coverage that aligns with the value of your belongings and your desired level of financial security.

Some common coverage options include:

- Increased personal property limits for high-value items like jewelry or art.

- Coverage for specific perils, such as flood or earthquake, in areas prone to natural disasters.

- Identity theft protection and credit monitoring services.

- Loss assessment coverage for your share of expenses in a condominium or co-op building.

The Importance of Tenants Insurance

Renting a home comes with inherent risks, and tenants insurance is an essential tool to mitigate these risks. Here’s why it’s crucial for renters to have this type of insurance coverage:

Peace of Mind

Knowing that you have tenants insurance provides a sense of security and peace of mind. You can rest assured that, should an unexpected event occur, you have the financial support to recover and rebuild. This protection allows you to focus on your daily life without constant worry about potential losses.

Financial Security

Tenants insurance offers financial security by protecting your personal belongings and assets. In the event of a loss, you won’t have to bear the full financial burden alone. Instead, your insurance policy will provide the necessary funds to replace or repair your possessions, ensuring you can quickly get back on your feet.

Legal Protection

Liability coverage under tenants insurance is especially important for protecting yourself against legal claims. In today’s litigious society, accidents and injuries can lead to costly lawsuits. With liability coverage, you have an added layer of protection, ensuring that your personal assets are safeguarded in the event of such claims.

Easy and Affordable Coverage

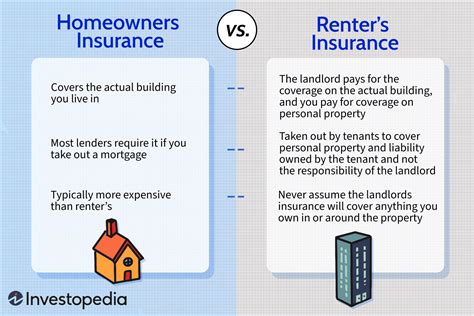

Tenants insurance is typically more affordable than other types of insurance, such as homeowners insurance. Insurance providers offer competitive rates and flexible payment options, making it accessible for renters on various budgets. Additionally, many insurance companies provide discounts for bundling tenants insurance with other policies, such as auto insurance.

How to Choose the Right Tenants Insurance

When selecting a tenants insurance policy, it’s essential to consider your specific needs and circumstances. Here are some key factors to keep in mind:

Assess Your Valuables

Take inventory of your personal belongings and estimate their value. This will help you determine the appropriate coverage limits for your policy. Consider the cost of replacing or repairing items like electronics, furniture, and appliances.

Understand Coverage Options

Familiarize yourself with the different coverage options available, including actual cash value and replacement cost coverage for personal property. Choose the option that best aligns with your needs and budget. Additionally, review the policy’s exclusions and limitations to ensure you understand what is and isn’t covered.

Liability Coverage Limits

Evaluate your liability coverage limits to ensure they are sufficient for your situation. Consider factors such as your financial assets and the potential risks associated with your rental unit. Higher liability limits provide greater protection in case of lawsuits or property damage claims.

Additional Endorsements

Review the available endorsements or add-ons that can enhance your coverage. These may include coverage for specific perils, identity theft protection, or personal injury liability. Assess your unique needs and choose the endorsements that offer the most value for your insurance policy.

Compare Providers and Rates

Shop around and compare insurance providers to find the best coverage and rates. Obtain quotes from multiple companies to ensure you’re getting a competitive price. Consider factors such as the insurer’s financial stability, customer service reputation, and claim handling process when making your decision.

Real-Life Examples of Tenants Insurance in Action

To further illustrate the importance and benefits of tenants insurance, let’s explore a couple of real-life scenarios where this coverage made a significant difference in the lives of renters.

Burglary and Theft Protection

Sarah, a tenant in an apartment building, experienced a break-in while she was away on vacation. Thieves stole her laptop, jewelry, and other valuable items. With tenants insurance, Sarah was able to file a claim and receive compensation for the replacement cost of her stolen belongings. This coverage helped her quickly recover from the loss and replace her valuable items.

Water Damage and Flooding

John, a renter in a ground-floor apartment, encountered a severe flooding incident due to a burst pipe in the building. The water damage affected his personal belongings and made his unit uninhabitable. Fortunately, John had tenants insurance with additional coverage for water damage and flood. His insurance policy covered the cost of repairing his belongings and provided temporary housing expenses while his apartment was being restored.

Future Implications and Considerations

As the rental market continues to grow and evolve, tenants insurance remains a crucial aspect of financial planning for renters. Here are some future implications and considerations to keep in mind:

Rising Rental Costs

With increasing rental prices, tenants insurance becomes even more vital. As the cost of replacing personal belongings rises, having adequate coverage ensures that renters can afford to rebuild their lives in the event of a loss.

Natural Disasters and Climate Change

The increasing frequency and severity of natural disasters, such as hurricanes, floods, and wildfires, highlight the importance of tenants insurance. Renters should consider adding coverage for specific perils like flood or earthquake to their policies, especially if they live in high-risk areas.

Identity Theft and Cyber Risks

In today’s digital age, identity theft and cyber risks are prevalent concerns. Tenants insurance policies that include identity theft protection and credit monitoring services can provide an added layer of security for renters, helping them mitigate the financial and personal impacts of such crimes.

Sharing Economy and Short-Term Rentals

With the rise of the sharing economy and short-term rentals, tenants insurance takes on a new dimension. Renters who use platforms like Airbnb or VRBO should ensure they have appropriate coverage for their belongings and liabilities, especially if they rent their property to others.

How much does tenants insurance cost on average?

+The cost of tenants insurance can vary based on several factors, including the coverage limits, location, and the insurance provider. On average, renters can expect to pay between 15 to 30 per month for a basic policy. However, it’s essential to shop around and obtain quotes from multiple insurers to find the best rates for your specific needs.

Does tenants insurance cover my roommate’s belongings as well?

+In most cases, tenants insurance policies cover the personal property of the named insured and their family members living in the same household. However, if you have a roommate who is not a family member, it’s advisable for them to obtain their own tenants insurance policy to protect their belongings. Each roommate can then file separate claims for their losses.

What should I do if I need to file a claim under my tenants insurance policy?

+If you experience a covered loss, such as theft or damage to your belongings, you should contact your insurance provider as soon as possible to initiate the claims process. They will guide you through the necessary steps, which typically involve providing documentation of the loss and estimating the value of the damaged or stolen items. It’s essential to cooperate with the insurer and provide accurate information to ensure a smooth claims process.