What Is The Average Cost Of Medical Insurance

Medical insurance, also known as health insurance, is a vital component of modern healthcare systems, providing individuals and families with financial protection and access to essential medical services. With rising healthcare costs, understanding the average expenses associated with medical insurance is crucial for individuals and policymakers alike. In this comprehensive analysis, we delve into the intricacies of medical insurance costs, exploring various factors that influence premiums, coverage options, and the financial implications for individuals and societies.

Understanding Medical Insurance Costs

The cost of medical insurance is a complex topic influenced by numerous variables. While there is no one-size-fits-all answer to the question of average expenses, we can examine the key factors that contribute to the overall price of health coverage.

Premium Factors

Premiums, the regular payments made by policyholders to maintain their insurance coverage, are the primary expense associated with medical insurance. These premiums can vary significantly based on several critical factors:

- Age: Generally, younger individuals pay lower premiums, as they are statistically less likely to require extensive medical care. Premiums tend to increase with age, reflecting the higher probability of health issues as individuals grow older.

- Geographic Location: The cost of living and healthcare services can vary significantly between regions. Consequently, insurance premiums may be higher in areas with more expensive healthcare facilities or a higher concentration of specialized medical providers.

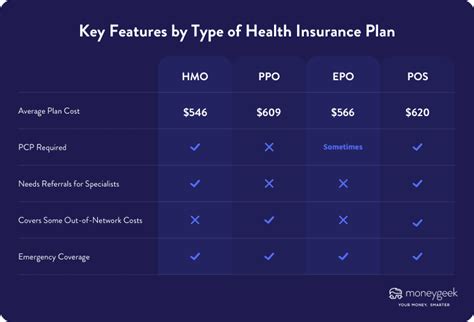

- Policy Type: Different types of insurance policies offer varying levels of coverage. Basic plans with limited benefits may have lower premiums, while comprehensive plans with extensive coverage and lower out-of-pocket costs often come at a higher price.

- Family Size: Family plans, which cover multiple individuals under one policy, typically have higher premiums than individual plans. The number of dependents and their respective ages can influence the overall cost.

- Pre-existing Conditions: Individuals with pre-existing medical conditions may face higher premiums or be subject to medical underwriting, where insurance companies assess the risk associated with their health status. This practice is becoming less common as many countries adopt community rating systems.

Out-of-Pocket Expenses

In addition to premiums, individuals must consider out-of-pocket expenses when evaluating the cost of medical insurance. These expenses include deductibles, copayments, and coinsurance, which are paid directly by the policyholder when accessing healthcare services.

- Deductibles: A deductible is the amount an individual must pay out of pocket before the insurance coverage kicks in. Higher deductibles often correspond to lower premiums, as policyholders assume more financial responsibility before the insurance coverage takes effect.

- Copayments: Copayments, or copays, are fixed amounts paid by the policyholder for specific services, such as doctor visits or prescription medications. These payments are typically made at the time of service and vary depending on the type of care received.

- Coinsurance: Coinsurance refers to the percentage of the total cost of a medical service that the policyholder must pay after meeting the deductible. For instance, if the coinsurance is 20%, the policyholder pays 20% of the service cost, while the insurance company covers the remaining 80%.

Average Medical Insurance Costs: A Global Perspective

The average cost of medical insurance varies significantly across countries and regions, influenced by factors such as healthcare system structure, government policies, and the overall cost of living.

United States

In the United States, the average cost of health insurance varies depending on the type of coverage and the individual’s circumstances. According to a report by the Kaiser Family Foundation, the average annual premium for employer-sponsored family coverage in 2021 was 22,221, with employees paying an average of 6,235 towards their coverage. For individual coverage, the average premium was 7,739 annually, with employees contributing an average of 1,290.

It’s important to note that these averages can vary significantly based on factors such as geographic location, employer size, and the specific plan chosen. Additionally, the introduction of the Affordable Care Act (ACA) has expanded access to health insurance and provided subsidies for low- and middle-income individuals, reducing the financial burden for many Americans.

Europe

European countries typically have more comprehensive and universal healthcare systems, often funded through taxes or mandatory insurance contributions. As a result, the average cost of medical insurance can be significantly lower than in countries with private insurance-based systems.

For example, in the United Kingdom, which operates a National Health Service (NHS), residents do not typically pay premiums for their healthcare coverage. Instead, healthcare services are funded through general taxation. However, there may be some out-of-pocket expenses for certain medications or dental care.

In countries like Germany and France, which have a mix of public and private insurance systems, the average cost of insurance can vary. According to the OECD Health Statistics, the average annual out-of-pocket expenditure per capita in Germany was around €848 in 2020, while in France, it was approximately €1,079.

Asia and Other Regions

Asia and other regions around the world also exhibit diverse healthcare systems and insurance models. For instance, in Singapore, which has a combination of public and private healthcare, the average cost of medical insurance can be influenced by factors such as age, pre-existing conditions, and the level of coverage desired. The country’s Ministry of Health provides guidelines for insurance premiums, ensuring affordability and accessibility.

Analyzing Performance and Impact

Understanding the average cost of medical insurance is just one aspect of evaluating its performance and impact on individuals and societies. It is essential to consider the broader implications and potential outcomes associated with different healthcare financing models.

Financial Accessibility

One of the primary goals of healthcare systems is to ensure financial accessibility to medical services. High insurance premiums and out-of-pocket expenses can create barriers to healthcare access, especially for low-income individuals and families. Governments and healthcare policymakers must strike a balance between affordable coverage and sustainable financing to achieve universal healthcare coverage.

Quality of Care

The cost of medical insurance is not solely determined by premiums and out-of-pocket expenses. The quality of healthcare services, including access to specialized care, timely treatment, and advanced medical technologies, is also a crucial factor. Healthcare systems must balance financial considerations with the delivery of high-quality, patient-centered care to ensure positive health outcomes.

Population Health and Prevention

Medical insurance systems play a vital role in promoting population health and preventive care. By providing coverage for routine check-ups, vaccinations, and chronic disease management, insurance plans can help prevent costly complications and reduce the overall burden of healthcare costs. Effective prevention strategies can lead to healthier populations and lower long-term healthcare expenses.

Economic Impact

The cost of medical insurance has significant economic implications. For individuals, high healthcare expenses can lead to financial strain, medical debt, and even bankruptcy. From a macroeconomic perspective, healthcare spending can influence economic growth, employment, and overall productivity. Governments and policymakers must carefully consider the economic impact of healthcare financing to ensure sustainable development.

Future Implications and Innovations

As healthcare systems evolve, there is a growing focus on innovation and reform to improve accessibility, affordability, and quality of care. Here are some potential future implications and developments in the field of medical insurance:

Digital Health Solutions

The integration of digital health technologies, such as telemedicine and remote monitoring, has the potential to revolutionize healthcare delivery. These solutions can improve access to care, especially in remote or underserved areas, and reduce the need for in-person visits, thus lowering healthcare costs.

Value-Based Care Models

Value-based care models, which focus on outcomes and patient-centered care, are gaining traction. These models aim to improve the quality of healthcare while controlling costs. By incentivizing providers to deliver efficient and effective care, value-based models can lead to more sustainable healthcare financing.

Universal Health Coverage Initiatives

Many countries are working towards achieving universal health coverage, ensuring that all citizens have access to essential healthcare services without financial hardship. This involves expanding coverage, improving affordability, and addressing healthcare disparities. Universal health coverage initiatives can lead to more equitable and efficient healthcare systems.

Data-Driven Personalized Medicine

Advances in genomics and data analytics are paving the way for personalized medicine, where treatment plans are tailored to an individual’s genetic makeup and health history. This precision medicine approach has the potential to improve treatment outcomes and reduce unnecessary healthcare costs.

Conclusion

In conclusion, the average cost of medical insurance is a multifaceted topic influenced by a myriad of factors. While premiums and out-of-pocket expenses are essential considerations, the broader context of healthcare systems, government policies, and global trends must also be taken into account. By understanding the complexities of medical insurance costs and their implications, individuals, policymakers, and healthcare professionals can work together to build more accessible, affordable, and effective healthcare systems for all.

How do I choose the right medical insurance plan for my needs?

+When selecting a medical insurance plan, consider factors such as your age, health status, family size, and budget. Assess your healthcare needs and choose a plan that offers adequate coverage for your anticipated medical expenses. Compare different plans and their premiums, deductibles, and copayments to find the best fit for your circumstances.

Are there any government subsidies or programs to assist with medical insurance costs?

+Many countries offer government subsidies or programs to help individuals and families afford medical insurance. For example, in the United States, the Affordable Care Act provides subsidies for low- and middle-income individuals. Similarly, some European countries have universal healthcare systems funded through taxes, ensuring access to healthcare for all residents. Research your local government programs to explore potential financial assistance options.

How can I reduce my out-of-pocket expenses for medical care?

+To minimize out-of-pocket expenses, consider choosing a medical insurance plan with a lower deductible and higher copayments. Additionally, take advantage of preventive care services covered by your insurance, such as annual check-ups and vaccinations, to catch potential health issues early and avoid more costly treatments later on. Finally, be mindful of your healthcare choices and consider cost-effective options when seeking medical care.