Whole And Term Life Insurance

In the world of personal finance and insurance, understanding the nuances of different life insurance policies is crucial. Two of the most common types are whole life insurance and term life insurance, each with its own set of features, benefits, and considerations. This comprehensive guide aims to delve into these two policies, providing an in-depth analysis to help readers make informed decisions about their financial protection.

Whole Life Insurance: A Comprehensive Financial Tool

Whole life insurance, often referred to as permanent life insurance, is a type of coverage that provides financial protection throughout an individual’s entire life. It is designed to offer not just a death benefit to beneficiaries but also a range of additional features that make it a versatile financial tool.

Key Characteristics of Whole Life Insurance

Whole life insurance policies typically include the following key components:

- Lifetime Coverage: As the name suggests, whole life insurance provides coverage for the insured’s entire life, ensuring financial protection no matter the age.

- Guaranteed Death Benefit: The policy guarantees a specified payout upon the insured’s death, which can provide financial security for loved ones.

- Cash Value Accumulation: One of the unique features is the accumulation of cash value over time. A portion of the premiums paid goes into a cash value account, which earns interest and can be borrowed against or withdrawn tax-free.

- Premium Stability: Premiums for whole life insurance remain level throughout the policy, providing predictability and ease of budgeting.

- Flexible Premiums: While premiums are fixed, some policies offer the flexibility to adjust premiums or coverage amounts as life circumstances change.

Benefits and Considerations

Whole life insurance offers several advantages, including:

- Long-Term Financial Planning: The policy’s cash value accumulation can be a valuable tool for retirement planning, estate building, or funding major life events.

- Guaranteed Death Benefit: The death benefit provides peace of mind, knowing that loved ones will receive a substantial payout in the event of the insured’s passing.

- Tax Benefits: The cash value growth within the policy is tax-deferred, and withdrawals or loans against the cash value are generally tax-free.

- Flexibility: Whole life policies often allow for policy riders, which can enhance coverage for specific needs like long-term care or critical illness.

However, it's important to consider the following:

- Higher Costs: Whole life insurance premiums are typically higher than term life policies due to the added benefits and cash value accumulation.

- Long-Term Commitment: Whole life insurance is a long-term financial commitment, and canceling the policy may result in the loss of accumulated cash value.

- Limited Investment Potential: The cash value growth within the policy is often modest compared to other investment options.

Term Life Insurance: A Focused Protection Strategy

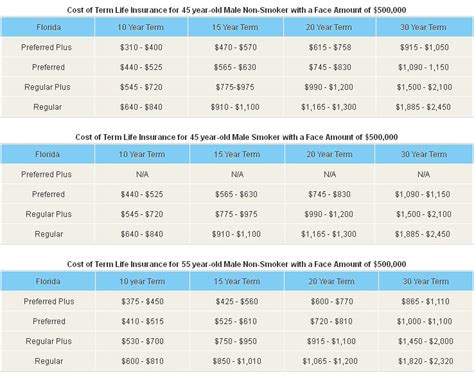

Term life insurance, as the name implies, provides coverage for a specified term or period, typically ranging from 10 to 30 years. It is designed to offer a more focused and cost-effective solution for those seeking financial protection during specific life stages.

Key Characteristics of Term Life Insurance

Term life insurance policies are characterized by the following:

- Specific Term: Coverage is provided for a defined period, after which the policy expires.

- Level Premiums: Premiums remain the same throughout the term, ensuring affordability and predictability.

- Death Benefit: The policy pays out a specified amount to beneficiaries upon the insured’s death during the term.

- Renewable or Convertible: Many term life policies offer the option to renew or convert to permanent life insurance without a medical exam, ensuring continued coverage.

Benefits and Considerations

Term life insurance offers several advantages, including:

- Affordability: Term life policies are often more cost-effective than whole life insurance, making them accessible to a wider range of individuals.

- Flexibility: The ability to choose the term length allows individuals to tailor coverage to their specific needs and life stages.

- Simplicity: Term life policies are straightforward, with clear terms and conditions, making it easy to understand and manage.

- Renewal Options: The renewal or conversion feature ensures that individuals can maintain coverage even as their needs evolve.

However, there are some considerations to keep in mind:

- Limited Coverage: Term life insurance provides coverage only for the specified term, after which the policyholder may need to explore other options or renew.

- Increasing Premiums: While premiums are level during the term, they may increase significantly upon renewal, especially for older individuals.

- No Cash Value: Unlike whole life insurance, term life policies do not accumulate cash value, so there is no investment component.

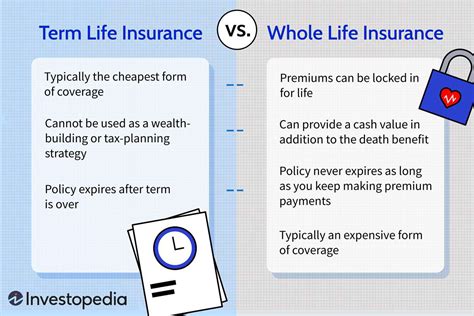

Comparative Analysis: Whole vs. Term Life Insurance

When deciding between whole life and term life insurance, it's essential to consider individual financial goals and circumstances. Here's a breakdown of the key differences:

| Characteristic | Whole Life Insurance | Term Life Insurance |

|---|---|---|

| Coverage Period | Lifetime | Specific Term (10-30 years) |

| Premium Stability | Level throughout | Level during the term |

| Death Benefit | Guaranteed | Guaranteed during the term |

| Cash Value | Accumulates over time | None |

| Cost | Higher | Lower |

| Flexibility | Flexible premiums, policy riders | Renewal or conversion options |

Choosing the Right Policy

The choice between whole life and term life insurance depends on individual needs and financial goals. Whole life insurance is ideal for those seeking long-term financial protection and planning, especially for estate building or funding specific financial goals. On the other hand, term life insurance is a cost-effective solution for those with temporary financial needs, such as covering a mortgage or providing for dependents during their dependent years.

It's important to consult with a financial advisor or insurance professional to assess personal circumstances and make an informed decision. They can provide guidance based on factors such as age, health, family situation, and financial goals.

Future Implications and Industry Trends

The life insurance industry is constantly evolving, with new products and innovations shaping the landscape. Here are some future implications and trends to consider:

Digital Transformation

The insurance industry is embracing digital technologies, with online platforms and apps making it easier and more convenient for individuals to compare policies, apply for coverage, and manage their policies.

Personalized Insurance

Advances in data analytics and artificial intelligence are enabling insurers to offer more personalized policies, tailoring coverage and premiums to individual health, lifestyle, and financial circumstances.

Health and Wellness Integration

Some insurers are exploring ways to integrate health and wellness programs into life insurance policies, offering incentives and discounts for healthy lifestyle choices.

Sustainability and ESG Considerations

With growing awareness of environmental, social, and governance (ESG) issues, insurers are increasingly focusing on sustainable practices and offering products that align with these values.

Conclusion

Whole life and term life insurance policies each have their unique advantages and considerations. Understanding these policies and their features is crucial for making informed decisions about financial protection. As the insurance industry continues to evolve, individuals can expect more innovative and personalized options to meet their specific needs.

What is the primary difference between whole life and term life insurance?

+Whole life insurance provides lifetime coverage with a guaranteed death benefit and cash value accumulation, while term life insurance offers coverage for a specified term with a guaranteed death benefit during that term but no cash value.

Is whole life insurance a good investment option?

+Whole life insurance can be a good investment option for those seeking long-term financial planning and protection. The cash value accumulation can be used for various financial goals, and the guaranteed death benefit provides peace of mind. However, it’s important to consider the higher costs and limited investment potential compared to other options.

When is term life insurance the better choice?

+Term life insurance is often the better choice for individuals with temporary financial needs, such as covering a mortgage or providing for dependents during their dependent years. It offers affordable coverage for a specified term and is a cost-effective solution for those who don’t require lifetime coverage.

Can term life insurance be renewed or converted?

+Yes, many term life policies offer the option to renew or convert the policy to a permanent life insurance policy without a medical exam. This ensures that individuals can maintain coverage even as their needs change over time.

What factors should I consider when choosing between whole and term life insurance?

+When choosing between whole and term life insurance, consider factors such as your age, health, financial goals, and family situation. Whole life insurance is ideal for long-term financial planning and estate building, while term life insurance is more affordable and suitable for temporary financial needs. Consulting with a financial advisor can help you make an informed decision.