Whole Life Insurance Versus Term Life

In the realm of financial planning and insurance, one of the most fundamental decisions an individual or a family faces is choosing between whole life insurance and term life insurance. These two types of life insurance policies offer distinct features and benefits, catering to different needs and financial goals. Understanding the nuances of each can significantly impact your long-term financial strategy and provide peace of mind for you and your loved ones.

Whole Life Insurance: A Comprehensive Coverage Option

Whole life insurance, also known as permanent life insurance, is a type of policy that provides coverage for the insured’s entire life, assuming they continue to pay the premiums. It is designed to offer not just a death benefit but also a savings or investment component. The policy accumulates cash value over time, which can be accessed through loans or withdrawals during the insured’s lifetime. This makes whole life insurance an attractive option for those seeking long-term financial protection and stability.

Key Features of Whole Life Insurance

- Lifetime Coverage: As the name suggests, whole life insurance policies remain in force as long as the premiums are paid. This provides a guarantee of coverage regardless of the insured’s age or health status.

- Cash Value Accumulation: A portion of the premiums goes towards building cash value within the policy. This cash value grows tax-deferred and can be used for various financial needs, such as retirement planning or emergency funds.

- Fixed Premiums: The premiums for whole life insurance remain the same throughout the policy term. This predictability allows for better financial planning and budgeting.

- Death Benefit Guarantee: The policy provides a guaranteed death benefit, ensuring that the beneficiaries receive a predetermined sum upon the insured’s passing.

Example: Consider John, a 35-year-old professional, who purchases a whole life insurance policy with a $500,000 death benefit. Over the years, John consistently pays his premiums, and by the time he reaches retirement age, his policy has accumulated a substantial cash value, which he can use to supplement his retirement income.

| Whole Life Insurance Key Metrics | Value |

|---|---|

| Average Premium Increase | 0% (Fixed) |

| Cash Value Growth Rate | 4-6% (Average) |

| Maximum Loan Amount | Up to 90% of Cash Value |

Term Life Insurance: Temporary Protection with Flexibility

Term life insurance, on the other hand, offers coverage for a specified period, often ranging from 10 to 30 years. It is designed to provide financial protection during specific life stages, such as when individuals have young children or significant financial responsibilities. Term life policies are generally more affordable than whole life policies, making them a popular choice for those on a budget.

Key Features of Term Life Insurance

- Temporary Coverage: Term life policies offer coverage for a set period, typically 10, 20, or 30 years. This makes it suitable for individuals with short-term financial obligations or those who anticipate a decrease in financial responsibilities over time.

- Affordable Premiums: Term life insurance is known for its relatively low premiums, making it accessible to a broader range of individuals. The cost-effectiveness of term life policies often makes them the preferred choice for young families or those with tight budgets.

- Renewable or Convertible Options: Many term life policies offer the option to renew the policy or convert it to a permanent life insurance policy without a medical exam. This provides flexibility and the ability to adapt the coverage as life circumstances change.

- No Cash Value: Unlike whole life insurance, term life policies do not accumulate cash value. The premiums paid are solely for the cost of insurance, ensuring the lowest possible rates.

Example: Sarah, a 28-year-old mother of two, opts for a 20-year term life insurance policy with a $1 million death benefit. During this period, she pays relatively low premiums, ensuring that her family is financially protected should any unforeseen events occur. Once the children are grown and her financial responsibilities decrease, she can reassess her insurance needs and potentially opt for a different type of policy.

| Term Life Insurance Key Metrics | Value |

|---|---|

| Average Premium Increase | Varies by Policy and Age |

| Renewal Options | Available with Most Policies |

| Conversion to Permanent Life | Offered by Many Insurers |

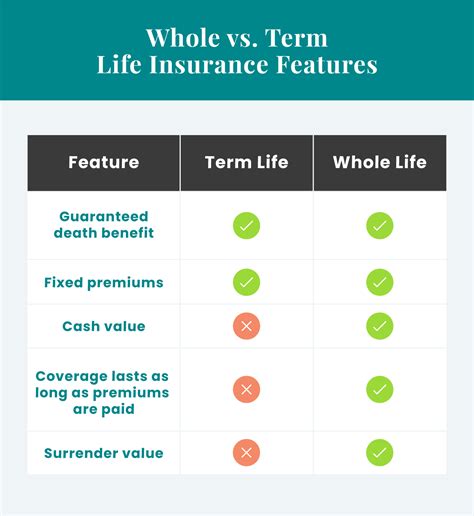

Comparing Whole Life and Term Life Insurance

When deciding between whole life and term life insurance, several factors come into play, including financial goals, budget, and personal circumstances. Here’s a comparative analysis to help you make an informed decision.

Cost Comparison

One of the most significant differences between whole life and term life insurance is the cost. Whole life insurance tends to have higher premiums due to the added cash value component and the guarantee of coverage for life. In contrast, term life insurance offers lower premiums, making it a more affordable option for those on a budget. However, it’s essential to consider the long-term financial implications, as the accumulated cash value in whole life insurance can provide substantial benefits over time.

Flexibility and Customization

Whole life insurance policies offer a high degree of flexibility and customization. Policyholders can choose the amount of coverage they need, and the cash value accumulation allows for additional financial planning options. On the other hand, term life insurance provides flexibility through renewable or convertible options, allowing policyholders to adjust their coverage as their financial needs change.

Long-Term Financial Planning

Whole life insurance is often considered a more comprehensive long-term financial planning tool. The cash value accumulation can be used for various financial goals, such as retirement planning, estate planning, or funding college education. Term life insurance, while offering temporary protection, may not provide the same level of financial flexibility and long-term benefits.

Suitability for Different Life Stages

Whole life insurance is well-suited for individuals seeking permanent coverage and those who value the peace of mind that comes with a guaranteed death benefit and cash value accumulation. It is particularly attractive to those with long-term financial goals and a desire for stability. Term life insurance, on the other hand, is ideal for young families or individuals with specific financial responsibilities that will decrease over time. It provides an affordable way to secure financial protection during critical life stages.

Performance Analysis

The performance of whole life insurance policies is measured by the growth of the cash value over time. The average growth rate of cash value in whole life policies ranges from 4% to 6% annually. Term life insurance, being a pure protection policy, does not offer cash value accumulation, so its performance is primarily measured by the affordability of the premiums and the suitability of the coverage for the insured’s needs.

Future Implications

Whole life insurance policies offer a stable financial foundation for the future. The guaranteed coverage and cash value accumulation provide a solid base for retirement planning and estate building. Term life insurance, while offering financial protection during specific life stages, may require individuals to reassess their insurance needs and potentially switch to a different type of policy as their circumstances change.

Conclusion: Finding the Right Fit

The decision between whole life and term life insurance ultimately depends on your individual financial goals, budget, and life circumstances. Whole life insurance offers a comprehensive, long-term solution with the added benefit of cash value accumulation. Term life insurance, with its affordability and flexibility, is an excellent choice for those seeking temporary protection during specific life stages. By understanding the features and benefits of each type of policy, you can make an informed decision that aligns with your financial strategy and provides the peace of mind that comes with adequate insurance coverage.

Can I switch from term life to whole life insurance later in life?

+Yes, many term life insurance policies offer the option to convert to a permanent life insurance policy, often without a medical exam. This provides flexibility to adjust your coverage as your financial needs change.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage ends, and you will no longer have insurance protection. However, some policies offer renewable options, allowing you to extend the coverage for a specific period.

How does the cash value in whole life insurance work?

+The cash value in whole life insurance grows over time, tax-deferred, and can be used for various financial needs. Policyholders can access this cash value through loans or withdrawals, providing a flexible source of funds.