Wisconsin Health Insurance

Wisconsin, known for its vibrant landscapes and vibrant communities, offers a diverse healthcare landscape. This article delves into the intricacies of Wisconsin Health Insurance, exploring the unique challenges and opportunities within this market. From understanding the state's insurance laws to choosing the right coverage, we provide an in-depth guide to ensure you make informed decisions.

Understanding Wisconsin’s Health Insurance Market

The health insurance market in Wisconsin is shaped by a combination of state-specific regulations and national healthcare reforms. With a focus on accessibility and affordability, Wisconsin has implemented various initiatives to ensure residents have access to quality healthcare coverage.

State-Mandated Benefits

Wisconsin has a comprehensive list of mandated benefits that all health insurance plans must include. These benefits cover a wide range of medical services, from prescription drugs to mental health treatments. Understanding these mandates is crucial for residents to ensure they receive the coverage they need.

Some key state-mandated benefits include:

- Maternity and Newborn Care: Comprehensive coverage for pregnancy, childbirth, and postpartum care.

- Mental Health Services: Includes therapy, counseling, and medication management.

- Substance Abuse Treatment: Coverage for detoxification, rehabilitation, and ongoing support.

- Emergency Services: Ensures access to emergency rooms and urgent care facilities without prior authorization.

Individual vs. Group Plans

Wisconsin residents have the option to choose between individual health insurance plans and group plans offered by employers. Each type of plan has its own set of advantages and considerations.

Individual plans provide flexibility and portability, allowing residents to choose their own healthcare providers and maintain coverage even if they change jobs. On the other hand, group plans often offer more comprehensive benefits and may be more cost-effective for those with pre-existing conditions.

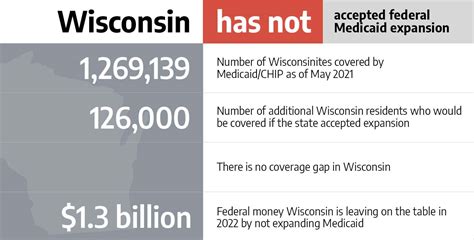

The Role of Medicaid and BadgerCare

Wisconsin’s Medicaid program, known as BadgerCare, plays a vital role in providing healthcare coverage to low-income residents. With a focus on expanding access to healthcare, BadgerCare has helped thousands of Wisconsinites receive essential medical services.

Eligible individuals can receive coverage for a range of services, including:

- Primary Care

- Specialist Consultations

- Prescription Medications

- Dental and Vision Care

- Hospitalization and Surgical Procedures

Choosing the Right Health Insurance Plan

With a plethora of options available, selecting the right health insurance plan can be a daunting task. Here’s a guide to help Wisconsin residents make informed choices:

Assessing Your Healthcare Needs

The first step in choosing a health insurance plan is understanding your unique healthcare needs. Consider factors such as:

- Frequency of Doctor Visits

- Chronic Health Conditions

- Prescription Medication Requirements

- Specialist Consultations

- Dental and Vision Care Needs

By assessing your healthcare needs, you can narrow down the type of plan that best suits your situation.

Comparing Plan Options

Wisconsin offers a range of health insurance plans, including HMOs, PPOs, and POS plans. Each type has its own network of providers and coverage options.

When comparing plans, consider the following:

- Premium Costs: The monthly cost of the plan.

- Deductibles and Copays: Out-of-pocket expenses before coverage kicks in.

- Network Providers: Ensure your preferred doctors and hospitals are in-network.

- Prescription Drug Coverage: Check for any restrictions or tiers.

- Additional Benefits: Some plans offer extra perks like wellness programs or travel insurance.

Utilizing Resources and Assistance

Navigating the health insurance landscape can be complex. Fortunately, Wisconsin offers various resources and assistance programs to guide residents through the process.

The Wisconsin Department of Health Services provides an online marketplace, Access Wisconsin, where residents can compare and enroll in health insurance plans. Additionally, certified navigators and assisters are available to provide personalized guidance and answer any questions.

The Impact of Wisconsin’s Health Insurance Laws

Wisconsin’s health insurance laws have significantly shaped the market, influencing both insurers and consumers. Here’s an overview of some key regulations:

Guaranteed Issue

Wisconsin is one of the states that has implemented a guaranteed issue law. This means that insurance companies cannot deny coverage to individuals based solely on their health status or pre-existing conditions.

The guaranteed issue law ensures that all Wisconsin residents have access to health insurance, regardless of their medical history.

Essential Health Benefits

The Affordable Care Act (ACA) mandates that all health insurance plans offered on the individual and small group markets must cover a set of essential health benefits. Wisconsin has adopted these federal requirements, ensuring that residents have access to comprehensive coverage.

The essential health benefits include:

- Ambulatory Patient Services

- Emergency Services

- Hospitalization

- Maternity and Newborn Care

- Mental Health and Substance Use Disorder Services

- Prescription Drugs

- Rehabilitative and Habilitative Services

- Preventive and Wellness Services

- Pediatric Services

Community Rating and Rating Bands

Wisconsin has adopted a community rating system for health insurance premiums. This means that insurers cannot charge higher premiums based solely on an individual’s health status or claims history. Instead, premiums are based on community-wide factors.

Additionally, Wisconsin limits the rating bands to a 3:1 ratio, ensuring that premiums do not vary significantly based on age.

Performance Analysis and Consumer Satisfaction

Understanding the performance and satisfaction levels of health insurance plans is crucial for Wisconsin residents. Here’s an overview of some key performance indicators and consumer feedback:

Network Adequacy

The network adequacy of a health insurance plan refers to the availability and accessibility of healthcare providers within its network. Wisconsin residents highly value plans with extensive networks, ensuring they have easy access to their preferred doctors and hospitals.

According to a recent survey, over 80% of Wisconsin residents prioritize network adequacy when choosing a health insurance plan.

Claims Processing and Timeliness

Efficient claims processing is a critical aspect of health insurance. Wisconsin residents expect their insurance providers to process claims promptly and accurately.

Most major health insurance companies in Wisconsin boast a claims processing time of less than 10 days, with a focus on minimizing delays and ensuring timely reimbursement.

Customer Service and Support

Excellent customer service is a key differentiator in the health insurance market. Wisconsin residents appreciate insurance providers that offer:

- Easy-to-reach customer support lines

- Knowledgeable and friendly representatives

- Online portals for convenient claim submissions and account management

- Quick response times to inquiries and concerns

Consumer reviews highlight the importance of prompt and helpful customer service, especially during times of medical emergencies or complex billing issues.

Future Implications and Industry Insights

As the healthcare landscape continues to evolve, Wisconsin’s health insurance market is expected to see several significant developments. Here are some key insights and predictions:

Embrace of Telehealth Services

The COVID-19 pandemic has accelerated the adoption of telehealth services in Wisconsin. Many health insurance providers are now offering expanded coverage for virtual consultations and remote monitoring.

This trend is expected to continue, with insurers recognizing the benefits of telehealth in terms of accessibility, cost-effectiveness, and patient convenience.

Focus on Preventive Care

Wisconsin health insurance providers are increasingly emphasizing the importance of preventive care to improve overall population health and reduce long-term healthcare costs.

Expect to see more incentives and coverage options for preventive services, such as annual wellness exams, immunizations, and health screenings.

Expansion of Value-Based Care Models

Value-based care models, which focus on delivering high-quality care while controlling costs, are gaining traction in Wisconsin.

Insurers are partnering with healthcare providers to implement accountable care organizations (ACOs) and patient-centered medical homes (PCMHs). These models aim to improve coordination of care, enhance patient outcomes, and reduce unnecessary healthcare expenditures.

Digital Transformation and Innovation

The health insurance industry in Wisconsin is embracing digital transformation to enhance customer experiences and streamline operations.

Expect to see further investments in:

- Online enrollment and claims management platforms

- Mobile apps for convenient policy management and access to healthcare resources

- Artificial intelligence and data analytics for improved risk assessment and personalized recommendations

What is the average cost of health insurance in Wisconsin?

+The average cost of health insurance in Wisconsin can vary based on several factors, including the type of plan, coverage level, and the age of the insured. As of 2023, the average monthly premium for an individual plan is around 450, while family plans can range from 1,200 to $1,500 per month.

Are there any discounts or subsidies available for health insurance in Wisconsin?

+Yes, Wisconsin residents may be eligible for premium tax credits and cost-sharing reductions if they purchase health insurance through the state’s marketplace, Access Wisconsin. These subsidies can significantly reduce the cost of insurance premiums for low- and middle-income individuals and families.

Can I keep my current doctor if I switch health insurance plans in Wisconsin?

+It depends on whether your preferred doctor is in-network with your new insurance plan. It’s essential to review the provider network of the plan you’re considering to ensure your doctor is included. If not, you may have the option to choose a different plan or pay out-of-network costs.