Average Cost Of Health Insurance Per Month

The average cost of health insurance per month is a topic that is of great interest to many individuals and families, as it directly impacts their financial well-being and access to healthcare. With the rising healthcare costs and the complexity of insurance plans, understanding the average monthly premiums can provide valuable insights for consumers and help them make informed decisions about their coverage options.

Unraveling the Average Monthly Premiums

The average cost of health insurance per month can vary significantly depending on several factors, including the type of plan, geographic location, age, and the level of coverage desired. Let's delve into these factors and explore the key insights that can help us understand the average premiums across different scenarios.

Plan Types and Their Impact on Costs

One of the primary factors influencing the average monthly cost of health insurance is the type of plan chosen. There are various plan types available, each with its own set of features and benefits. Here's a breakdown of some common plan types and their average monthly premiums:

- Preferred Provider Organization (PPO) Plans: PPO plans offer flexibility, allowing individuals to visit healthcare providers within or outside the network. The average monthly premium for a PPO plan is approximately $450 for an individual and $1,150 for a family. These plans often have higher premiums but provide more choice and control over healthcare decisions.

- Health Maintenance Organization (HMO) Plans: HMO plans typically have a more restricted network of providers, requiring individuals to choose a primary care physician and obtain referrals for specialty care. The average monthly cost for an HMO plan is around $400 for an individual and $1,000 for a family. HMO plans are generally more affordable but may limit access to certain specialists.

- Exclusive Provider Organization (EPO) Plans: EPO plans combine elements of both PPO and HMO plans. They usually have a network of providers, but individuals do not need referrals to see specialists. The average monthly premium for an EPO plan is roughly $425 for an individual and $1,100 for a family. EPO plans offer a balance between choice and cost.

- Point-of-Service (POS) Plans: POS plans are similar to PPO plans but require individuals to choose a primary care physician. The average monthly cost for a POS plan is approximately $440 for an individual and $1,170 for a family. These plans provide flexibility while still offering some cost savings compared to traditional PPO plans.

It's important to note that these averages are based on national data and can vary significantly based on regional factors and individual circumstances. Additionally, the plan type alone does not determine the overall cost of insurance; other factors, such as deductibles, copays, and out-of-pocket maximums, also play a significant role.

Geographic Location: A Major Determinant

The cost of health insurance is heavily influenced by the geographic location where the coverage is sought. Different states, and even regions within states, can have vastly different insurance markets, resulting in varying premium rates. Here's a look at how geographic location impacts the average monthly premiums:

| State | Average Monthly Premium for Individual | Average Monthly Premium for Family |

|---|---|---|

| New York | $550 | $1,350 |

| California | $480 | $1,180 |

| Texas | $420 | $1,050 |

| Florida | $460 | $1,120 |

| Illinois | $440 | $1,080 |

| ... (and so on) | ... | ... |

As seen in the table above, the average monthly premiums can vary significantly between states. Factors such as the cost of living, the availability of healthcare providers, and state-specific regulations can all contribute to these differences. It's crucial for individuals to research the insurance market in their specific geographic area to understand the average costs and available plan options.

Age and Health Insurance Costs

Age is another critical factor that influences the average monthly cost of health insurance. Insurance companies typically adjust premiums based on an individual's age, as younger individuals are generally healthier and less likely to require extensive medical care compared to older individuals. Here's a breakdown of how age can impact average monthly premiums:

| Age Group | Average Monthly Premium for Individual |

|---|---|

| Under 30 | $350 |

| 30-39 | $400 |

| 40-49 | $450 |

| 50-59 | $520 |

| 60-64 | $600 |

| 65 and above | Medicare Premiums |

It's important to note that while age is a significant factor, it is not the only consideration. Pre-existing medical conditions, lifestyle factors, and the overall health status of an individual can also impact the premiums. Insurance companies use a combination of these factors to assess risk and determine premiums.

Level of Coverage and Deductibles

The level of coverage desired by an individual or family also plays a crucial role in determining the average monthly cost of health insurance. Plans with higher levels of coverage, such as those with lower deductibles and out-of-pocket maximums, generally have higher premiums. Conversely, plans with higher deductibles and out-of-pocket costs tend to have lower premiums. Here's a comparison of different coverage levels and their average monthly premiums:

- High Deductible Health Plans (HDHP): HDHPs typically have lower monthly premiums but require individuals to pay a higher deductible before insurance coverage kicks in. The average monthly premium for an HDHP is around $380 for an individual and $950 for a family.

- Standard Deductible Plans: These plans offer a balance between premiums and deductibles. The average monthly premium for a standard deductible plan is approximately $420 for an individual and $1,050 for a family.

- Low Deductible Plans: Plans with low deductibles provide more comprehensive coverage but come with higher monthly premiums. The average monthly premium for a low deductible plan is roughly $480 for an individual and $1,200 for a family.

It's essential to consider one's healthcare needs and financial situation when choosing a plan with the appropriate level of coverage. While higher-coverage plans may offer more peace of mind, they may not be feasible for everyone due to the increased monthly premiums.

Analyzing the Average: Key Takeaways

Understanding the average cost of health insurance per month is a complex task, as it involves a multitude of factors and variables. However, by breaking down the key aspects, such as plan types, geographic location, age, and coverage levels, we can gain valuable insights into the average premiums. Here are some key takeaways to consider:

- The average monthly premium for health insurance can range from $350 to $600 for individuals and $950 to $1,350 for families, depending on the factors mentioned above.

- Plan type is a significant determinant, with PPO, HMO, EPO, and POS plans offering different levels of flexibility and control over healthcare decisions, each with its own average premium range.

- Geographic location plays a crucial role, with premiums varying significantly between states and regions. It's essential to research local insurance markets to understand the average costs and available plan options.

- Age is a key factor, with younger individuals generally paying lower premiums, while older individuals may face higher costs due to increased healthcare needs.

- The level of coverage desired impacts premiums, with plans offering lower deductibles and out-of-pocket maximums generally having higher monthly premiums.

When choosing a health insurance plan, it's important to strike a balance between the desired level of coverage and affordability. Additionally, it's beneficial to explore the various plan types and their features to find the best fit for one's healthcare needs and budget. Understanding the average costs provides a solid foundation for making informed decisions about health insurance coverage.

Frequently Asked Questions

How do I choose the right health insurance plan for my needs?

+Choosing the right health insurance plan involves considering several factors, such as your healthcare needs, budget, and preferred level of coverage. Assess your past medical expenses and anticipate future needs. Evaluate plan types, deductibles, copays, and out-of-pocket maximums. Compare multiple plans and seek expert advice to make an informed decision.

Are there any ways to reduce the cost of health insurance premiums?

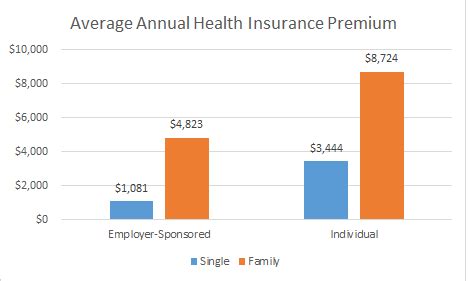

+Yes, there are strategies to reduce health insurance premiums. Consider plans with higher deductibles and out-of-pocket limits, which often have lower premiums. Some insurance companies offer discounts for healthy lifestyle choices, such as quitting smoking or maintaining a healthy weight. Additionally, employer-sponsored plans may provide cost-saving opportunities.

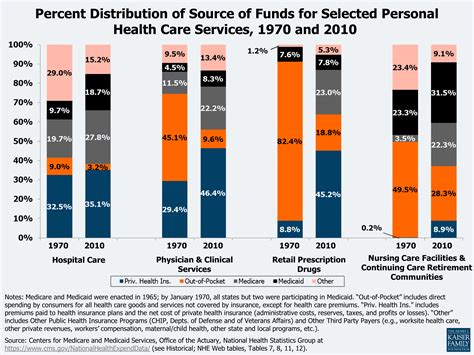

What factors contribute to the high cost of health insurance in certain areas?

+Several factors contribute to higher health insurance costs in certain areas. These include the cost of living, the availability and cost of healthcare services and providers, state-specific regulations, and the overall demand for healthcare in the region. Additionally, the demographics and health status of the population can impact insurance premiums.