California Insurance Requirements

In the Golden State, ensuring you're adequately insured is not just a good idea, it's the law. The insurance landscape in California is diverse and intricate, catering to the unique needs of its residents. From the bustling cities of Los Angeles and San Francisco to the serene vineyards of Napa Valley, understanding the insurance requirements is paramount for every Californian.

The Basics of Insurance in California

California, being one of the most populous states in the nation, has developed a comprehensive set of insurance regulations to protect its citizens. These regulations cover a wide range of insurance types, each with its own set of requirements and guidelines.

At its core, insurance in California is designed to provide financial protection and peace of mind to individuals, families, and businesses. It's a safety net, ensuring that in the event of an unexpected loss, whether it's an accident, a natural disaster, or a health emergency, individuals have the means to recover and rebuild.

The state's insurance laws are governed by the California Department of Insurance (CDI), which is responsible for regulating the insurance industry, protecting consumers, and ensuring a competitive marketplace. The CDI plays a vital role in overseeing insurance companies, agents, and brokers, ensuring they operate ethically and in the best interests of the public.

Key Insurance Types and Their Requirements

California’s insurance landscape is diverse, offering a range of coverage options to suit the needs of its residents. Here’s an overview of some of the most common insurance types and their associated requirements:

Auto Insurance

Every vehicle registered in California must be insured with a minimum level of liability coverage. This includes bodily injury liability (15,000 per person and 30,000 per accident) and property damage liability ($5,000 per accident). However, given the high cost of living and potential for severe accidents in California, many experts recommend carrying higher limits.

Additionally, uninsured motorist coverage is a legal requirement in California. This coverage protects insured drivers and their passengers if they are involved in an accident with an uninsured or underinsured driver. It's designed to cover medical expenses, lost wages, and other damages.

Other optional auto insurance coverages in California include collision, comprehensive, personal injury protection (PIP), and medical payments coverage. While not legally required, these coverages can provide additional financial protection in the event of an accident or other vehicle-related incident.

Homeowners Insurance

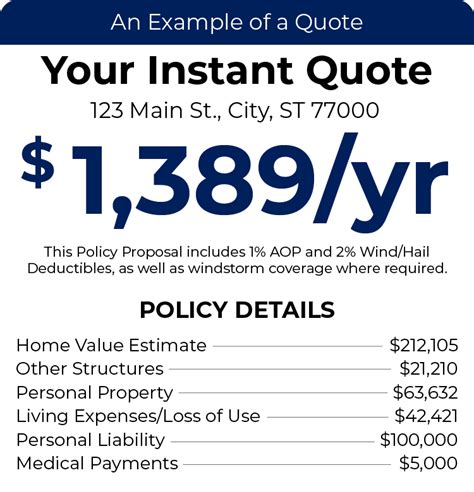

Homeowners insurance is a vital protection for California residents who own a home. It provides coverage for the structure of the home, as well as personal belongings and liability protection. The specific requirements for homeowners insurance vary based on the location and value of the home, as well as the insurance provider.

In California, it's essential to ensure that your homeowners insurance policy provides adequate coverage for natural disasters, such as earthquakes and wildfires. These events are prevalent in certain parts of the state, and standard homeowners insurance policies may not provide sufficient coverage. Consider purchasing additional coverage or specialized policies to protect against these risks.

Additionally, renters in California should consider renters insurance. While it's not a legal requirement, it provides coverage for personal belongings and liability protection, which can be invaluable in the event of a loss or accident.

Health Insurance

Health insurance is a critical component of financial protection in California. The state has implemented several initiatives to increase access to affordable health insurance, including the Covered California marketplace. Under the Affordable Care Act (ACA), individuals in California are required to have health insurance coverage or pay a penalty.

The specific requirements for health insurance in California include coverage for essential health benefits, such as ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services, and chronic disease management. Additionally, California has implemented several state-specific health insurance mandates.

California residents can obtain health insurance through various means, including employer-sponsored plans, individual market plans, Medicaid, and Medicare. The Covered California marketplace offers a range of health insurance options for individuals and families, with financial assistance available for those who qualify.

Life Insurance

Life insurance is not legally required in California, but it is an important consideration for individuals and families. It provides financial protection for loved ones in the event of the policyholder’s death. The specific type and amount of life insurance coverage depend on individual needs and circumstances.

There are two primary types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and is often more affordable. Permanent life insurance, such as whole life or universal life insurance, provides coverage for the policyholder's entire life and also includes a cash value component that can be accessed or borrowed against.

When choosing life insurance in California, it's essential to consider factors such as your financial obligations, the number of dependents you have, and your long-term financial goals. Consulting with a qualified insurance professional can help you determine the right type and amount of coverage for your needs.

Business Insurance

California’s business landscape is diverse, ranging from small startups to large corporations. As such, the insurance needs of businesses in the state are varied. While there are no specific legal requirements for business insurance, certain types of coverage are essential to protect against potential risks and liabilities.

General liability insurance is a cornerstone of business insurance in California. It provides coverage for bodily injury, property damage, personal and advertising injury, and medical payments. This coverage is vital for protecting businesses against claims that may arise from their operations, products, or services.

Other important business insurance coverages in California include commercial property insurance, which protects against damage or loss to the business's physical assets, and workers' compensation insurance, which is required by law for businesses with employees. Workers' compensation insurance provides coverage for employees who are injured or become ill as a result of their work, ensuring they receive medical treatment and compensation for lost wages.

Additionally, businesses in California should consider professional liability insurance, also known as errors and omissions (E&O) insurance. This coverage protects professionals, such as consultants, accountants, and lawyers, against claims of negligence, errors, or omissions in the performance of their services. It is particularly important for businesses that provide advice or services to clients.

Understanding California’s Insurance Landscape

Navigating the insurance landscape in California can be complex, given the diverse range of coverage options and requirements. It’s essential to understand your specific needs and the risks you face to ensure you have the right insurance coverage in place.

Working with a qualified insurance agent or broker in California can be invaluable. These professionals can guide you through the insurance options available, help you understand the nuances of different policies, and tailor a coverage plan that meets your unique needs. They can also assist with any changes or updates to your insurance coverage as your circumstances evolve.

In addition to seeking professional guidance, it's important to stay informed about insurance-related developments in California. The state's insurance regulations and requirements can evolve over time, and staying up-to-date can help ensure you're always meeting the necessary standards.

The Importance of Compliance

Compliance with California’s insurance requirements is not just a legal obligation; it’s also a matter of financial protection and peace of mind. By ensuring you have the appropriate insurance coverage in place, you’re safeguarding your assets, protecting your loved ones, and mitigating potential financial risks.

Failure to comply with insurance requirements can result in legal consequences, such as fines or penalties, as well as personal financial hardship. For example, driving without the required auto insurance coverage in California can lead to significant fines, license suspension, and even criminal charges in certain cases.

Similarly, businesses that fail to obtain the necessary insurance coverage may face legal action, damage to their reputation, and financial loss if they are unable to cover the costs associated with a claim or lawsuit. Proper insurance coverage is a critical component of risk management for businesses, protecting against potential liabilities and ensuring their long-term viability.

The Benefits of Adequate Insurance Coverage

Beyond the legal requirements, having adequate insurance coverage in California offers numerous benefits. It provides financial security and peace of mind, knowing that you and your loved ones are protected in the event of an unexpected loss or accident.

For individuals, adequate insurance coverage can mean the difference between financial stability and financial ruin. It ensures that in the event of a medical emergency, a natural disaster, or an accident, you have the resources to recover and rebuild. It can provide access to quality healthcare, cover the costs of repairing or replacing damaged property, and offer financial support during times of hardship.

For businesses, adequate insurance coverage is a cornerstone of risk management and financial stability. It protects against potential liabilities, ensuring that the business can continue to operate even in the face of unexpected events. Insurance coverage can provide peace of mind to business owners, knowing that they have taken the necessary steps to safeguard their assets and their employees.

Staying Informed and Prepared

In a state as dynamic and diverse as California, staying informed about insurance requirements and options is essential. The insurance landscape can evolve rapidly, with new regulations, coverage options, and potential risks emerging regularly.

By regularly reviewing your insurance coverage and staying updated on industry developments, you can ensure that you're always protected. This may involve periodic policy reviews, consulting with insurance professionals, and staying informed about changes to state regulations and industry trends.

In addition to keeping your insurance coverage up-to-date, it's important to understand your policy terms and conditions. Familiarize yourself with the specifics of your coverage, including any exclusions or limitations, so that you know exactly what is and isn't covered. This can help prevent misunderstandings and ensure that you're fully protected when you need it most.

The Role of Technology in Insurance

Technology is playing an increasingly significant role in the insurance industry, and California is no exception. From online insurance marketplaces to mobile apps and digital tools, technology is transforming the way Californians interact with their insurance providers and access coverage.

Online insurance platforms, such as the Covered California marketplace, offer a convenient and accessible way for individuals and businesses to compare insurance options, obtain quotes, and purchase coverage. These platforms provide a wealth of information and resources, empowering consumers to make informed decisions about their insurance needs.

Mobile apps and digital tools are also revolutionizing the insurance experience. Many insurance providers now offer mobile apps that allow policyholders to manage their policies, file claims, and access important documents and resources from their smartphones or tablets. These apps provide real-time updates and notifications, ensuring policyholders are always informed and in control of their insurance coverage.

Additionally, technology is enhancing the claims process, making it faster and more efficient. Insurance providers are leveraging advanced technologies, such as artificial intelligence and machine learning, to streamline claims handling and provide better customer service. This can result in quicker claim approvals, more accurate assessments, and improved overall customer satisfaction.

Future Trends and Considerations

Looking ahead, the insurance landscape in California is likely to continue evolving, influenced by technological advancements, changing regulations, and shifting consumer needs. As the state’s population grows and diversifies, the insurance industry will need to adapt to meet the unique needs of its residents.

One key trend to watch is the increasing focus on personalized insurance coverage. As technology advances, insurance providers are leveraging data analytics and artificial intelligence to offer more tailored coverage options. This shift towards personalized insurance can provide Californians with coverage that is better suited to their individual needs and circumstances.

Additionally, the rise of telemedicine and virtual healthcare services is likely to have an impact on health insurance coverage in California. As more individuals turn to virtual healthcare for convenience and accessibility, insurance providers may need to adapt their coverage options to accommodate these new models of healthcare delivery.

In conclusion, navigating the insurance requirements and options in California is a critical task for every resident and business owner. From auto insurance to health insurance and business coverage, understanding the legal requirements and choosing the right policies can provide essential financial protection and peace of mind.

By staying informed, seeking professional guidance, and leveraging the latest technological tools, Californians can ensure they have the coverage they need to protect their assets, their health, and their livelihoods. The insurance landscape may be complex, but with the right knowledge and resources, it's a landscape that can be navigated with confidence and security.

What are the minimum auto insurance requirements in California?

+California requires a minimum of 15,000 in bodily injury liability per person and 30,000 per accident, as well as $5,000 in property damage liability. Uninsured motorist coverage is also mandatory.

Is homeowners insurance mandatory in California?

+Homeowners insurance is not legally required in California, but it is strongly recommended to protect your home and belongings. It provides coverage for the structure, personal belongings, and liability protection.

What health insurance options are available in California?

+California offers a range of health insurance options through the Covered California marketplace. These plans provide essential health benefits and may be eligible for financial assistance. Other options include employer-sponsored plans, Medicaid, and Medicare.

Do I need life insurance in California?

+Life insurance is not legally required in California, but it is an important consideration for individuals and families. It provides financial protection for loved ones in the event of the policyholder’s death.

What types of business insurance are essential for California businesses?

+General liability insurance is a cornerstone of business insurance in California. Other important coverages include commercial property insurance, workers’ compensation insurance, and professional liability insurance (E&O insurance) for professionals.