Call Geico Insurance

Navigating the world of insurance can be a daunting task, especially when it comes to choosing the right provider for your needs. One name that often comes up in the conversation is GEICO, a well-known insurance company with a rich history and a wide range of services. In this comprehensive guide, we will delve into the world of GEICO Insurance, exploring its origins, services, and the unique benefits it offers to its customers.

The History of GEICO: A Legacy of Innovation

To truly understand the impact of GEICO Insurance, we must first explore its remarkable journey. Government Employees Insurance Company, better known as GEICO, was founded in 1936 by Leo and Lillian Goodwin with a vision to provide affordable auto insurance to government employees. From its humble beginnings, GEICO has grown into one of the largest and most trusted insurance providers in the United States.

The company's early success can be attributed to its innovative approach. GEICO was one of the first insurance companies to embrace direct marketing, eliminating the need for costly intermediaries. This strategy not only reduced expenses but also allowed GEICO to offer competitive rates to its customers. Over the years, GEICO expanded its services beyond auto insurance, branching into various lines of insurance, including homeowners, renters, and even life insurance.

A Comprehensive Suite of Services

GEICO Insurance offers a diverse range of services to cater to the unique needs of its customers. Here’s an overview of their key offerings:

Auto Insurance

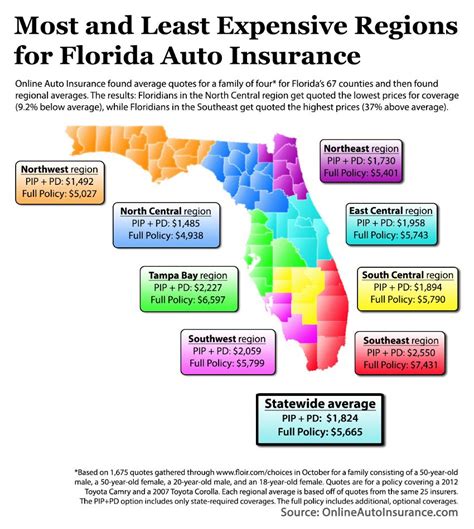

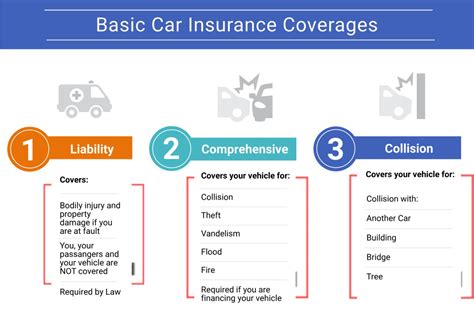

At the core of GEICO’s business is its auto insurance division. With a focus on providing comprehensive coverage, GEICO offers policies that include liability, collision, comprehensive, and personal injury protection (PIP). They also provide additional coverage options such as rental car reimbursement and roadside assistance.

One of the standout features of GEICO's auto insurance is its discount program. Policyholders can enjoy significant savings by taking advantage of discounts for safe driving, multiple vehicles, and even for being a federal employee or military service member.

Homeowners Insurance

GEICO understands the importance of protecting your home, which is why they offer homeowners insurance tailored to meet the needs of various homeowners. Their policies cover damage to your home and personal belongings, as well as liability protection. GEICO also provides optional coverage for additional expenses, such as temporary living arrangements in case of a covered loss.

Renters Insurance

For renters, GEICO provides renters insurance to safeguard their personal property and provide liability protection. This type of insurance is essential for anyone renting a home, apartment, or condo, as it offers peace of mind in case of theft, damage, or accidents.

Life Insurance

GEICO recognizes the importance of financial security and offers a range of life insurance products. Their policies include term life insurance, which provides coverage for a specific period, and permanent life insurance, which offers lifelong protection. GEICO’s life insurance plans can help secure your family’s financial future in the event of an unexpected tragedy.

The GEICO Experience: Customer-Centric Approach

GEICO’s success can be attributed not only to its comprehensive suite of services but also to its unwavering commitment to its customers. The company prides itself on delivering an exceptional customer experience, ensuring that policyholders receive the support and guidance they need every step of the way.

One of the key aspects of the GEICO experience is its 24/7 customer service. Policyholders can reach out to GEICO's dedicated team of representatives at any time, ensuring prompt assistance in case of emergencies or queries. GEICO's online platform also allows customers to manage their policies, make payments, and access important documents with ease.

Additionally, GEICO offers a mobile app that enhances the customer experience. The app provides convenient access to policy information, allows for quick filing of claims, and even offers roadside assistance services at the touch of a button. This level of accessibility and convenience sets GEICO apart in the insurance industry.

GEICO’s Unique Benefits: Going Beyond Insurance

GEICO Insurance stands out not only for its comprehensive services but also for the unique benefits it offers to its customers. Here are some of the standout features that make GEICO a preferred choice for many:

Discounts and Rewards

GEICO is renowned for its generous discounts and rewards program. Policyholders can enjoy significant savings by taking advantage of various discounts, such as the Military and Veterans Discount, the Good Student Discount, and the Multi-Policy Discount. These incentives make GEICO’s insurance products even more affordable and accessible.

Digital Convenience

In today’s digital age, convenience is key. GEICO understands this and has invested in a robust digital platform to ensure a seamless experience for its customers. From online policy management to quick and easy claims filing, GEICO’s website and mobile app make insurance-related tasks a breeze. Policyholders can access their information, make changes, and even pay their premiums with just a few clicks.

Educational Resources

GEICO goes beyond providing insurance coverage; it also aims to educate its customers. The company offers a wealth of educational resources on its website, covering a wide range of insurance-related topics. These resources empower policyholders to make informed decisions and better understand their coverage. From articles on car safety to guides on choosing the right homeowners insurance, GEICO’s educational materials are a valuable asset.

Community Involvement

GEICO believes in giving back to the communities it serves. The company actively participates in community initiatives and supports various charitable causes. From sponsoring local events to partnering with non-profit organizations, GEICO demonstrates its commitment to making a positive impact beyond its business operations. This dedication to community involvement fosters a sense of trust and loyalty among its customers.

Performance Analysis: A Trusted Choice

When considering an insurance provider, it’s essential to evaluate their performance and reputation. GEICO Insurance has consistently demonstrated its reliability and commitment to its customers. Here’s a closer look at GEICO’s performance and the reasons why it remains a trusted choice for many:

Financial Strength

GEICO is backed by the financial strength of its parent company, Berkshire Hathaway. This solid financial foundation ensures that GEICO has the resources to fulfill its obligations to policyholders. With a strong financial rating from reputable agencies, GEICO provides customers with peace of mind, knowing their insurance needs are in capable hands.

| Financial Rating Agency | Rating |

|---|---|

| A.M. Best | A++ (Superior) |

| Standard & Poor's | AA- (Very Strong) |

| Moody's | Aa2 (Excellent) |

Customer Satisfaction

GEICO places a strong emphasis on customer satisfaction, and this dedication is reflected in its impressive customer ratings. The company consistently receives high marks for its claim handling, customer service, and overall value for money. Positive customer reviews and testimonials further reinforce GEICO’s reputation as a reliable and trustworthy insurance provider.

Claim Handling Efficiency

One of the most critical aspects of any insurance company is its claim handling process. GEICO has streamlined its claims procedure, ensuring a quick and efficient experience for policyholders. With a dedicated claims team and a user-friendly online claims portal, GEICO makes it easy for customers to file and track their claims, providing timely updates and prompt resolutions.

Future Implications: Staying Ahead of the Curve

In an ever-evolving insurance landscape, GEICO remains committed to innovation and staying ahead of the curve. The company continuously invests in technology and leverages data analytics to enhance its services and provide an even better customer experience. Here’s a glimpse into GEICO’s future implications and its ongoing efforts to stay at the forefront of the industry:

Digital Transformation

GEICO recognizes the importance of digital transformation and is committed to enhancing its digital platforms. The company is continually updating its website and mobile app, introducing new features and improvements to make insurance-related tasks even more convenient and efficient. From streamlined policy management to advanced claim filing options, GEICO is leading the way in digital insurance solutions.

Personalized Insurance

In an effort to provide tailored coverage to its customers, GEICO is exploring the concept of personalized insurance. By leveraging data analytics and customer insights, GEICO aims to offer customized insurance plans that meet the unique needs of each policyholder. This approach ensures that customers receive the right level of coverage at a fair price, fostering a deeper sense of trust and satisfaction.

Sustainable Practices

As sustainability becomes an increasingly important consideration for businesses and consumers alike, GEICO is taking steps to incorporate sustainable practices into its operations. The company is exploring eco-friendly initiatives, such as paperless billing and digital claim submissions, to reduce its environmental impact. By embracing sustainability, GEICO aligns itself with the values of environmentally conscious consumers.

Expanding Services

GEICO’s success and customer-centric approach have led to steady growth and expansion. The company is continuously evaluating new opportunities to broaden its service offerings. Whether it’s expanding into new insurance lines or introducing innovative products, GEICO remains dedicated to meeting the evolving needs of its customers and staying relevant in the dynamic insurance market.

Conclusion: A Trusted Companion for Your Insurance Journey

In a world where insurance is a necessity, choosing the right provider can make all the difference. GEICO Insurance has proven time and again that it is a trusted companion for individuals and families seeking comprehensive and affordable coverage. With its rich history, diverse suite of services, and unwavering commitment to its customers, GEICO stands as a reliable choice in the insurance industry.

From its innovative beginnings to its modern-day digital offerings, GEICO has consistently evolved to meet the changing needs of its customers. The company's focus on customer satisfaction, financial strength, and continuous improvement positions it as a leader in the insurance space. Whether you're looking for auto, homeowners, renters, or life insurance, GEICO offers a range of options to suit your unique circumstances.

As you embark on your insurance journey, consider the benefits and expertise that GEICO brings to the table. With GEICO by your side, you can have the confidence and peace of mind that come with knowing you're protected by a company that truly cares about its customers.

How can I get a quote from GEICO Insurance?

+Getting a quote from GEICO is easy! You can start by visiting their website and using the online quote tool. Simply provide some basic information about yourself, your vehicle (if applicable), and your insurance needs. Alternatively, you can call their customer service hotline or visit a local GEICO office to speak with a representative who can guide you through the quoting process.

What discounts does GEICO offer?

+GEICO offers a wide range of discounts to help you save on your insurance premiums. Some of the notable discounts include the Military and Veterans Discount, the Good Student Discount, the Multi-Policy Discount, and the Safe Driver Discount. Be sure to ask about these discounts when getting your quote to see if you’re eligible.

How does GEICO’s claim process work?

+GEICO has a streamlined claim process to ensure a smooth and efficient experience. You can start by filing a claim online or by calling their 24⁄7 customer service hotline. Once your claim is filed, a dedicated claims representative will guide you through the process, providing regular updates and assistance. GEICO aims to resolve claims promptly, ensuring a hassle-free experience for its policyholders.