Cancel Progressive Insurance

Canceling an insurance policy, especially one as comprehensive as Progressive Insurance, requires careful consideration and adherence to specific procedures. Progressive Insurance is a well-known provider offering various insurance services, from auto insurance to home and life coverage. In this comprehensive guide, we will delve into the process of canceling Progressive Insurance policies, exploring the steps, potential consequences, and important factors to keep in mind.

Understanding the Cancellation Process

Canceling a Progressive Insurance policy involves more than just a simple phone call. It is a formal process that requires attention to detail and timely action to avoid unnecessary complications or financial repercussions.

Initiating the Cancellation

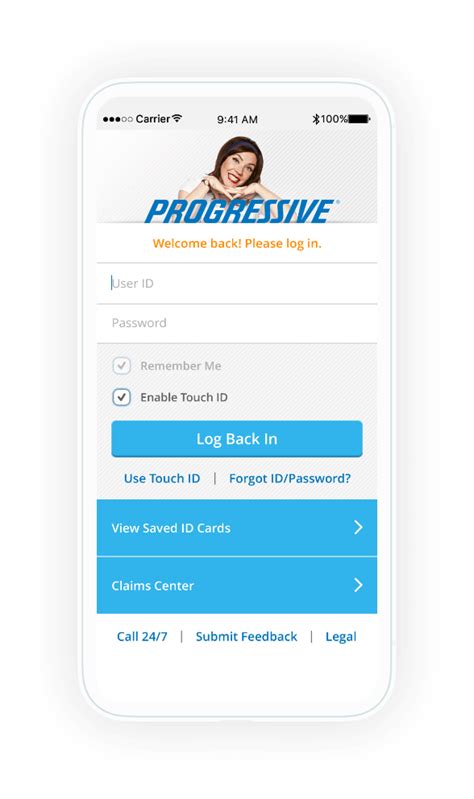

The first step in canceling your Progressive Insurance policy is to contact the company directly. You can do this by calling their customer service hotline, which is typically available 24⁄7. Alternatively, you may choose to visit their official website and use the online chat feature or send an email to their customer support team. Ensure you have your policy number and other relevant details handy to expedite the process.

When reaching out to Progressive, be prepared to provide specific reasons for your cancellation. The company may inquire about your motives to understand your decision better. This information is valuable as it helps them improve their services and address any underlying issues that may be driving customers away.

Gathering Necessary Documentation

Before canceling your policy, it is crucial to ensure you have all the necessary documentation in order. This includes any recent policy documents, payment receipts, and correspondence with Progressive. Having these documents readily available will streamline the cancellation process and ensure that you have a clear record of your insurance history.

If you have any outstanding payments or premiums due, it is essential to settle these before initiating the cancellation. Progressive may require proof of payment to process your request smoothly. By resolving any outstanding financial obligations, you can avoid potential complications and ensure a seamless transition.

Reviewing Policy Terms and Conditions

Before taking any further steps, carefully review your Progressive Insurance policy’s terms and conditions. This document outlines the rights and responsibilities of both the insurer and the policyholder. It is crucial to understand any provisions related to cancellation, including any penalties or fees that may apply.

Pay close attention to the cancellation policy, which typically specifies the required notice period and any specific procedures you must follow. Some policies may have a minimum term or a grace period, during which cancellation may not be possible without incurring additional charges. Understanding these terms will help you navigate the cancellation process more effectively.

Potential Consequences and Considerations

Canceling your Progressive Insurance policy may have several implications, both financial and logistical. It is essential to consider these carefully before making a final decision.

Financial Impact

One of the most significant considerations when canceling insurance is the potential financial impact. Progressive, like most insurance providers, may charge a cancellation fee, especially if you cancel your policy before the end of the agreed-upon term. These fees can vary depending on the type of insurance, the coverage period, and the specific circumstances of your cancellation.

Additionally, canceling your policy may result in a loss of any discounts or promotions you were eligible for. Progressive may have offered you a multi-policy discount or a loyalty discount for maintaining your coverage over an extended period. By canceling, you forfeit these benefits, which could lead to higher insurance costs in the future.

| Policy Type | Cancellation Fee |

|---|---|

| Auto Insurance | $50 - $100 |

| Home Insurance | $25 - $75 |

| Life Insurance | Varies based on policy |

It is crucial to weigh the financial implications against your reasons for canceling. If the cancellation fee and potential loss of discounts outweigh the benefits of canceling, you may want to reconsider your decision or explore other options, such as adjusting your coverage or seeking alternative providers.

Logistical Considerations

Canceling your Progressive Insurance policy may also have logistical implications, especially if you have multiple policies or are insured under a group plan. In such cases, it is essential to coordinate with all relevant parties to ensure a smooth transition.

If you have multiple policies with Progressive, such as auto and home insurance, canceling one policy may impact the others. It is advisable to discuss your options with a Progressive representative to understand how canceling one policy may affect your overall coverage and premiums. You may need to consider alternative arrangements or explore other providers to maintain comprehensive coverage.

Similarly, if you are insured under a group plan through your employer or a professional organization, canceling your Progressive policy may require coordination with the group administrator. They may have specific procedures or requirements for canceling coverage, and you should ensure you follow these to avoid any disruptions to your overall insurance portfolio.

Step-by-Step Guide to Cancellation

Now that we have covered the essential considerations, let’s walk through the step-by-step process of canceling your Progressive Insurance policy.

Contact Progressive Customer Service

The first step is to reach out to Progressive’s customer service team. You can do this by calling their hotline, using the online chat feature, or sending an email. When contacting them, be prepared to provide your policy number, personal details, and the reason for your cancellation. Explain your situation clearly and concisely, and be ready to answer any questions they may have.

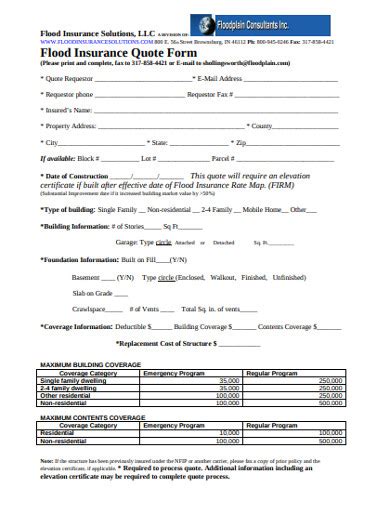

Request a Cancellation Form

Once you have initiated the cancellation process, Progressive may provide you with a cancellation form. This form typically requires you to specify the effective date of cancellation, provide your contact information, and sign to confirm your request. Ensure you review the form carefully and complete it accurately to avoid any delays or complications.

Submit the Cancellation Form

After completing the cancellation form, you must submit it to Progressive. You can do this by uploading the form through their secure online portal, emailing it to their designated address, or mailing it via regular post. Ensure you keep a copy of the form for your records and confirm the receipt of your submission with Progressive.

Verify Cancellation

Once you have submitted your cancellation request, it is crucial to verify that the process has been completed successfully. You can do this by contacting Progressive again and requesting confirmation of your cancellation. They should provide you with a cancellation certificate or a letter confirming the effective date of cancellation and any relevant details.

Update Your Records

After receiving confirmation of your cancellation, update your personal records accordingly. This includes updating any insurance-related documents, such as your policy binder, and ensuring that your financial records reflect the cancellation. It is essential to keep accurate records to avoid any confusion or complications in the future.

Alternative Options to Consider

Before finalizing your decision to cancel your Progressive Insurance policy, it is worth exploring alternative options that may better suit your needs and circumstances.

Adjusting Your Coverage

If you are considering canceling your Progressive policy due to financial constraints or a change in your insurance needs, you may want to explore the option of adjusting your coverage instead. Progressive offers various coverage options and customization features that can help you tailor your policy to your specific requirements.

For example, if you feel your current coverage is too expensive, you may consider reducing your coverage limits or opting for a higher deductible. These adjustments can significantly impact your premium costs without compromising your overall protection. Progressive's customer service team can guide you through these options and help you find a more affordable coverage plan.

Exploring Other Providers

If you are dissatisfied with Progressive’s services or believe you can find better coverage elsewhere, exploring alternative insurance providers is an option. The insurance market is competitive, and different companies offer unique features, coverage options, and pricing structures. By shopping around and comparing quotes, you may find a provider that better aligns with your needs and budget.

When researching alternative providers, consider factors such as coverage options, customer reviews, financial stability, and any additional perks or benefits they offer. Progressive is a well-established insurer, but there may be other companies that provide more specialized coverage or better rates for your specific circumstances.

Conclusion: Making an Informed Decision

Canceling your Progressive Insurance policy is a significant decision that requires careful consideration and attention to detail. By understanding the cancellation process, potential consequences, and alternative options, you can make an informed choice that aligns with your best interests.

Remember, insurance is a vital aspect of financial planning, and it is essential to maintain adequate coverage to protect yourself and your assets. Whether you decide to cancel your Progressive policy or explore other options, ensure you approach the process with a strategic mindset and seek professional guidance if needed.

Progressive Insurance offers a range of services, and canceling any of them should be a well-thought-out decision. By following the steps outlined in this guide and considering the potential implications, you can navigate the cancellation process smoothly and make the best decision for your insurance needs.

How much is the cancellation fee for Progressive Insurance policies?

+The cancellation fee for Progressive Insurance policies can vary depending on the type of insurance and the circumstances surrounding the cancellation. Auto insurance policies typically have a cancellation fee ranging from 50 to 100, while home insurance policies may have a fee between 25 and 75. Life insurance policies may have varying cancellation fees based on the specific policy terms.

What happens if I cancel my Progressive Insurance policy mid-term?

+Canceling your Progressive Insurance policy mid-term may result in a penalty or fee. The exact consequences depend on the policy terms and conditions. Progressive may require you to pay a pro-rated premium for the remaining coverage period or assess a cancellation fee. It is essential to review your policy documents and consult with Progressive’s customer service team to understand the specific implications of mid-term cancellation.

Can I cancel my Progressive Insurance policy online?

+Yes, Progressive Insurance offers an online cancellation option through their official website. You can access your account, navigate to the cancellation section, and follow the prompts to submit your cancellation request. However, it is recommended to verify the cancellation process and ensure all necessary steps are completed to avoid any complications.