Car Insurance Pricing

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers worldwide. The pricing of car insurance policies is a complex topic that involves various factors, including individual risk profiles, geographic locations, coverage types, and insurance company practices. Understanding how these factors interplay to determine the cost of car insurance is crucial for consumers aiming to make informed decisions and secure the best coverage for their needs.

The Fundamentals of Car Insurance Pricing

Car insurance pricing is a meticulous process that involves a careful assessment of risk. Insurance companies employ actuarial science to evaluate and quantify the likelihood of various events, such as accidents, theft, or natural disasters, that could lead to insurance claims. By analyzing historical data and statistical models, they can assign a monetary value to the risk associated with insuring a particular vehicle and driver.

One of the primary factors influencing car insurance prices is the level of coverage chosen by the policyholder. Car insurance typically consists of several coverage types, including liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. Each coverage type protects against specific risks, and the extent of coverage chosen will impact the overall insurance premium. For instance, a policy with higher liability limits or additional coverage options, such as rental car reimbursement or roadside assistance, will generally result in a higher premium.

The driver's risk profile is another critical factor in insurance pricing. Insurance companies assess various characteristics of the driver to determine their risk level. This includes age, gender, driving record, and years of driving experience. Younger drivers, particularly those under 25, are often considered higher-risk due to their limited driving experience and higher propensity for accidents. Similarly, drivers with a history of accidents or traffic violations may face higher insurance premiums as they are statistically more likely to file claims.

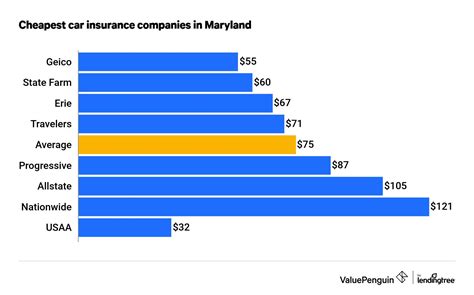

The Role of Geographic Location

Geographic location plays a significant role in car insurance pricing. Insurance rates can vary considerably from one region to another, even within the same state. This variation is due to a range of factors, including the frequency of accidents, theft rates, weather conditions, and the cost of living in a particular area. For instance, regions with a high incidence of natural disasters like hurricanes or earthquakes may have higher insurance rates due to the increased risk of property damage.

The density of traffic and the prevalence of accidents in a specific area are also considered. Urban areas with high traffic volumes and a history of frequent accidents or claims tend to have higher insurance rates compared to rural areas. Additionally, the cost of labor and parts in a particular region can impact insurance rates, as these factors influence the expense of repairing vehicles after an accident.

Vehicle-Related Factors

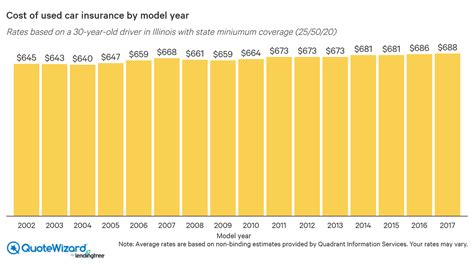

The make, model, and age of the insured vehicle are important considerations in insurance pricing. Certain vehicle types, such as sports cars or luxury vehicles, may be more expensive to insure due to their higher repair costs or increased likelihood of theft. Similarly, older vehicles may have lower insurance premiums as they are generally less expensive to repair or replace.

The safety features and anti-theft devices installed in a vehicle can also influence insurance rates. Vehicles equipped with advanced safety systems, such as lane departure warnings or collision avoidance systems, may qualify for insurance discounts as they are less likely to be involved in accidents. Similarly, vehicles with anti-theft devices like immobilizers or tracking systems may also be eligible for reduced insurance rates.

| Vehicle Type | Average Insurance Premium |

|---|---|

| Sports Cars | $2,500 annually |

| Luxury Sedans | $1,800 annually |

| SUVs | $1,500 annually |

| Economy Cars | $1,200 annually |

Discounts and Special Considerations

Insurance companies frequently offer a range of discounts to attract customers and reward safe driving behaviors. These discounts can significantly reduce the overall insurance premium and are worth exploring when shopping for car insurance.

Common Discounts

- Safe Driver Discounts: Insurance companies often reward drivers with clean driving records, offering discounts for accident-free periods. Some companies may also provide discounts for completing defensive driving courses.

- Multi-Policy Discounts: Bundling car insurance with other policies, such as home or renters’ insurance, can result in substantial savings. Many insurance companies offer discounts when customers purchase multiple policies from them.

- Loyalty Discounts: Staying with the same insurance company for an extended period may lead to loyalty discounts. These discounts recognize long-term customers and encourage loyalty.

- Good Student Discounts: Young drivers who maintain good academic standing may be eligible for insurance discounts. This incentive encourages academic excellence and responsible driving.

Special Considerations for High-Risk Drivers

High-risk drivers, such as those with a history of accidents or traffic violations, may face higher insurance premiums. However, insurance companies often provide specialized programs or policies designed to help these drivers get back on track and rebuild their driving records. These programs may involve additional monitoring, driver training, or other requirements to help reduce the risk associated with insuring these drivers.

The Impact of Credit Scores

In many states, credit scores are considered a factor in car insurance pricing. Insurance companies use credit-based insurance scores to assess a customer’s financial responsibility and predict their likelihood of filing an insurance claim. Customers with higher credit scores are often seen as more financially stable and may receive lower insurance rates. However, it’s important to note that the use of credit scores in insurance pricing is a controversial practice and is not allowed in all states.

Understanding Credit-Based Insurance Scores

Credit-based insurance scores are calculated using a variety of factors, including payment history, the length of credit history, types of credit used, and the number of recent credit inquiries. These scores are used as a proxy for assessing a customer’s financial responsibility and their likelihood of filing an insurance claim. While credit scores are not the sole determining factor in insurance pricing, they can have a significant impact on the overall premium.

| Credit Score Range | Average Insurance Premium |

|---|---|

| Excellent (800+) | $1,000 annually |

| Good (700-799) | $1,200 annually |

| Fair (600-699) | $1,500 annually |

| Poor (500-599) | $2,000 annually |

Shopping for Car Insurance: Tips and Strategies

When shopping for car insurance, it’s essential to be an informed consumer. Here are some tips and strategies to help you navigate the process and find the best coverage at the most competitive price.

Compare Multiple Quotes

Obtain quotes from several insurance companies to compare rates and coverage options. Online comparison tools can be a convenient way to gather multiple quotes in one place, allowing you to quickly assess the market and identify the most competitive offers.

Understand Your Coverage Needs

Assess your specific coverage needs based on your vehicle, driving habits, and financial situation. Consider the level of coverage you require and any additional coverage options that may be beneficial. For instance, if you frequently drive in inclement weather, you may want to consider adding roadside assistance to your policy.

Explore Discounts and Bundling Options

Inquire about the discounts offered by each insurance company and how you can qualify for them. Bundling your car insurance with other policies, such as home or renters’ insurance, can lead to significant savings. Additionally, some insurance companies offer discounts for loyalty, safe driving, or other specific criteria.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is a relatively new concept that allows insurance companies to monitor driving behavior and offer personalized rates based on actual driving habits. This type of insurance may be particularly beneficial for safe drivers who don’t log many miles annually. However, it’s essential to understand the privacy implications and the potential for increased rates if driving habits are not as expected.

The Future of Car Insurance Pricing

The car insurance industry is constantly evolving, and technological advancements are shaping the way insurance is priced and delivered. Here are some trends and developments that are likely to influence the future of car insurance pricing.

Telematics and Data-Driven Pricing

The use of telematics and data-driven pricing is expected to become more prevalent in the coming years. Insurance companies will continue to leverage advanced technologies to monitor driving behavior and assess risk more accurately. This may lead to more personalized insurance rates based on real-time data, offering benefits to safe drivers while also helping insurance companies manage their risk more effectively.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning algorithms are already being used to streamline insurance processes, from underwriting to claims handling. These technologies can analyze vast amounts of data to identify patterns and trends, helping insurance companies make more informed decisions about pricing and coverage. As AI continues to advance, it is likely to play an even larger role in the insurance industry, improving efficiency and accuracy.

Connected Car Technology

The rise of connected car technology, where vehicles are equipped with advanced sensors and communication systems, is set to transform the insurance industry. These vehicles can provide real-time data on driving behavior, vehicle health, and even traffic conditions. Insurance companies can use this data to offer more tailored coverage and pricing, incentivizing safe driving behaviors and providing benefits to drivers who adopt these technologies.

Autonomous Vehicles and the Future of Liability

The advent of autonomous vehicles raises important questions about liability and insurance coverage. As self-driving cars become more prevalent, the traditional model of assigning liability to the driver may need to be reevaluated. Insurance companies will need to adapt their policies and pricing structures to accommodate the unique risks and responsibilities associated with autonomous vehicles.

How do insurance companies determine risk and set prices for car insurance policies?

+Insurance companies use actuarial science and historical data to assess risk and set prices for car insurance policies. They analyze factors such as the driver’s age, gender, driving record, and years of driving experience, as well as geographic location, vehicle type, and coverage levels. This data helps insurance companies quantify the likelihood of various events leading to insurance claims and assign a monetary value to the associated risk.

What are some common discounts available for car insurance policies, and how can I qualify for them?

+Common discounts for car insurance policies include safe driver discounts, multi-policy discounts, loyalty discounts, and good student discounts. To qualify for safe driver discounts, maintain a clean driving record and consider completing defensive driving courses. For multi-policy discounts, bundle your car insurance with other policies, such as home or renters’ insurance. Loyalty discounts are often offered to long-term customers, so staying with the same insurance company can lead to savings. Good student discounts are available for young drivers who maintain good academic standing.

How do credit scores impact car insurance pricing, and is this practice allowed in all states?

+In many states, credit scores are considered a factor in car insurance pricing. Insurance companies use credit-based insurance scores to assess a customer’s financial responsibility and predict their likelihood of filing an insurance claim. Customers with higher credit scores are often seen as more financially stable and may receive lower insurance rates. However, the use of credit scores in insurance pricing is a controversial practice and is not allowed in all states.

What is usage-based insurance, and how does it impact insurance rates for drivers?

+Usage-based insurance, also known as pay-as-you-drive or telematics insurance, allows insurance companies to monitor driving behavior and offer personalized rates based on actual driving habits. This type of insurance can benefit safe drivers who don’t log many miles annually, as their rates may be lower based on their driving data. However, it’s important to understand the privacy implications and the potential for increased rates if driving habits are not as expected.