Home Insurance For Renters

Renting a home comes with its own set of responsibilities and considerations, one of which is protecting your personal belongings and ensuring your liability coverage. Home insurance for renters, often referred to as renters insurance, is an essential safeguard that every tenant should understand and consider.

Understanding Renters Insurance

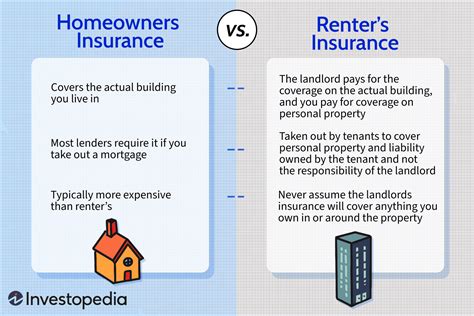

Renters insurance is a type of property insurance specifically designed to cover the personal belongings of tenants living in rental properties. Unlike homeowners insurance, which covers the structure of the home itself, renters insurance primarily focuses on the contents within the rental unit and provides liability coverage for the tenant.

This insurance policy offers financial protection against various risks, including damage to personal property due to unforeseen events like fire, theft, or natural disasters. It also covers the policyholder's liability in case someone gets injured within the rental property and decides to take legal action.

One of the critical aspects of renters insurance is that it provides coverage for personal belongings even when the tenant is away from home. This means that if your laptop gets stolen from a cafe, or your luggage is lost during a vacation, your renters insurance policy might come to your rescue.

Furthermore, renters insurance often includes additional living expenses coverage. In the event that your rental property becomes uninhabitable due to a covered incident, this coverage can help pay for temporary housing and other necessary expenses until you can return to your home.

Why Renters Insurance is Essential

Renters insurance is an indispensable tool for anyone living in a rental property, offering numerous benefits and peace of mind. Here’s why it’s essential:

Protection Against Unexpected Losses

Life is full of surprises, and some of them can be costly. Renters insurance ensures that you’re financially protected against unexpected losses due to theft, fire, or other covered perils. For instance, if your apartment catches fire and your belongings are damaged or destroyed, renters insurance can help you replace them.

Liability Coverage

Accidents can happen, and if someone gets injured in your rental property due to your negligence, you could be held liable. Renters insurance provides liability coverage, which can help cover the costs associated with legal fees and any settlements or judgments against you.

Peace of Mind

Knowing that your personal belongings and liability are covered can bring immense peace of mind. Renters insurance allows you to focus on your daily life without worrying about the financial implications of potential disasters or accidents.

Affordability

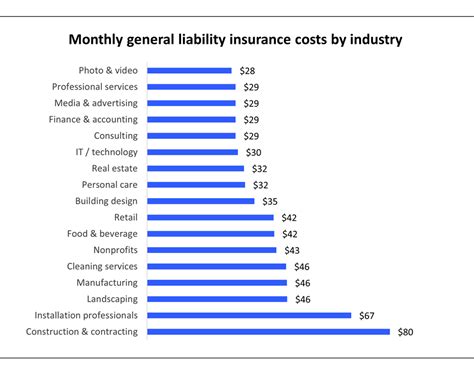

One of the most appealing aspects of renters insurance is its affordability. Compared to homeowners insurance, renters insurance policies are typically much more cost-effective. The exact cost will depend on various factors, including the value of your belongings, the coverage limits you choose, and the location of your rental property.

What Renters Insurance Covers

Renters insurance policies can vary in terms of coverage, but here are some common aspects that are typically included:

Personal Property Coverage

This is the cornerstone of renters insurance, providing coverage for your personal belongings, such as furniture, electronics, clothing, and appliances. The coverage amount is typically based on the actual cash value or replacement cost of your belongings.

Liability Coverage

Liability coverage protects you if someone gets injured or their property is damaged due to your actions or negligence within your rental property. This coverage can help pay for medical bills, property damage, and legal expenses.

Additional Living Expenses

If a covered event makes your rental property uninhabitable, additional living expenses coverage can help cover the costs of temporary housing, meals, and other necessary expenses until you can return to your home.

Medical Payments Coverage

This coverage pays for the medical expenses of guests who get injured on your rental property, regardless of fault. It provides a quick and straightforward way to cover these expenses without involving liability coverage or legal proceedings.

Loss of Use Coverage

In the event that your rental property is damaged and you need to relocate temporarily, loss of use coverage can help reimburse you for any additional living expenses incurred during this period, such as hotel stays or increased utility costs.

How to Choose the Right Renters Insurance

Selecting the appropriate renters insurance policy involves considering various factors to ensure you get the right coverage for your needs. Here are some key steps to guide you:

Assess Your Belongings

Start by making an inventory of your personal belongings. Consider the value of your furniture, electronics, clothing, and other valuable items. This will help you determine the appropriate amount of coverage you need.

Understand Your Risk Profile

Evaluate the potential risks associated with your rental property. For instance, if you live in an area prone to natural disasters like hurricanes or earthquakes, you might want to consider additional coverage for such events.

Compare Providers and Policies

Shop around and compare different renters insurance providers and policies. Look for reputable companies with a solid financial standing and positive customer reviews. Compare coverage limits, deductibles, and any additional perks or discounts offered.

Consider Bundling Options

Many insurance companies offer discounts when you bundle multiple policies together. If you already have auto insurance with a particular provider, inquire about potential discounts if you were to add renters insurance to your policy.

Read the Fine Print

Before finalizing your decision, carefully review the policy documents. Pay attention to the coverage limits, exclusions, and any conditions that might affect your claim eligibility. Ensure you understand the terms and conditions of the policy.

Real-Life Examples and Case Studies

Renters insurance can provide invaluable protection in various real-life situations. Here are a few scenarios to illustrate its importance:

Fire Damage

Imagine a fire breaks out in your apartment building, causing significant damage to your rental unit. Without renters insurance, you would be responsible for replacing all your belongings out of pocket, which could be a substantial financial burden.

Theft of Valuable Items

If you own valuable items like jewelry, artwork, or collectibles, renters insurance can provide specialized coverage for these items. In the event of theft or loss, your insurance policy can help you recover the cost of replacing these items.

Guest Injury

Suppose a friend slips and falls while visiting your rental property, resulting in a serious injury. Renters insurance’s liability coverage can help cover the medical expenses and any legal costs associated with the incident.

Natural Disasters

Renters insurance often provides coverage for natural disasters like floods, hurricanes, or earthquakes, depending on the policy and the location of your rental property. This coverage can be crucial in helping you rebuild your life after a devastating natural event.

Renters Insurance and Landlord-Tenant Responsibilities

It’s essential to understand the distinction between a landlord’s responsibilities and those of a tenant when it comes to insurance. Landlords typically carry landlord insurance, which covers the structure of the building and their liability as property owners. However, it does not cover the personal belongings of tenants.

As a tenant, you are responsible for insuring your personal belongings and liability. Renters insurance is a way for you to fulfill this responsibility and ensure that you're protected in case of unforeseen events.

The Future of Renters Insurance

The renters insurance market is evolving, and insurers are continuously adapting to meet the changing needs of tenants. Here are some potential future trends and developments:

Digital Transformation

The insurance industry is moving towards digital solutions, and renters insurance is no exception. Expect to see more online platforms and apps that simplify the process of purchasing and managing renters insurance policies.

Personalized Coverage

Insurance providers are likely to offer more personalized coverage options, allowing tenants to tailor their policies to their specific needs and circumstances. This could include flexible coverage limits, additional endorsements, and customizable deductibles.

Enhanced Risk Assessment

With advancements in technology, insurers might employ more sophisticated risk assessment methods. This could involve using data analytics and artificial intelligence to better understand and manage risks associated with rental properties.

Expanded Coverage Options

Renters insurance policies might expand to include additional coverage options, such as identity theft protection, pet liability coverage, or coverage for high-value items like musical instruments or sporting equipment.

Incentivizing Safety Measures

Insurers might introduce incentives for tenants who take proactive steps to enhance the safety of their rental properties. For instance, discounts could be offered for tenants who install security systems, smoke detectors, or smart home devices that improve overall safety.

Conclusion

Renters insurance is an invaluable tool for anyone living in a rental property, offering financial protection and peace of mind. By understanding the coverage options, assessing your needs, and choosing the right policy, you can ensure that you’re adequately protected against unexpected losses and liabilities.

As the renters insurance market evolves, tenants can look forward to more innovative and personalized coverage options, making it easier than ever to secure the protection they need.

What is the average cost of renters insurance?

+

The average cost of renters insurance can vary depending on factors such as location, coverage limits, and deductibles. However, renters insurance is generally affordable, with average monthly premiums ranging from 15 to 30. It’s always a good idea to shop around and compare quotes from different providers to find the best coverage at the most competitive price.

Is renters insurance mandatory for tenants?

+

Renters insurance is typically not mandatory for tenants, but it is highly recommended. While it is not a legal requirement, landlords may have certain lease requirements or preferences regarding insurance coverage. Additionally, having renters insurance is a responsible way to protect your belongings and ensure your liability coverage.

How do I file a claim with my renters insurance policy?

+

To file a claim with your renters insurance policy, you’ll need to contact your insurance provider and provide details about the incident and the damages or losses incurred. It’s important to gather evidence, such as photos or receipts, to support your claim. Your insurance provider will guide you through the claims process and assess your eligibility for coverage.

Can renters insurance cover my belongings if they are stolen while I’m on vacation?

+

Yes, renters insurance often provides coverage for your belongings even when they are away from your rental property. This means that if your luggage or personal items are stolen while you’re on vacation, your renters insurance policy may help reimburse you for the loss, subject to the policy’s terms and conditions.

What should I do if I’m unsure about the coverage limits or exclusions in my renters insurance policy?

+

If you have questions or concerns about your renters insurance policy, it’s best to reach out to your insurance provider directly. They can provide you with detailed information about your coverage limits, exclusions, and any specific conditions that might affect your claim eligibility. Don’t hesitate to ask for clarification to ensure you fully understand your policy.