Insureance Claim

In the realm of financial services, insurance claims hold a pivotal role, offering policyholders a safety net during unforeseen events. This comprehensive guide delves into the intricate process of insurance claims, exploring the steps, challenges, and strategies to ensure a seamless experience. From understanding the fundamentals to navigating complex scenarios, we'll equip you with the knowledge to make informed decisions and maximize the benefits of your insurance coverage.

Understanding the Insurance Claim Process

The insurance claim process is a critical mechanism that allows policyholders to seek compensation for losses or damages covered by their insurance policies. This process is designed to provide financial protection and support during challenging circumstances, whether it’s a medical emergency, a property damage incident, or a liability claim.

At its core, an insurance claim involves a series of steps where the policyholder, also known as the insured, notifies the insurance company about a covered event or loss. This notification triggers a thorough evaluation process, where the insurer assesses the validity and extent of the claim, determines the applicable coverage, and ultimately decides on the compensation or settlement.

The claim process can vary depending on the type of insurance and the specific circumstances of the event. For instance, a health insurance claim for a medical procedure would involve different steps compared to a property insurance claim for a natural disaster. However, there are some fundamental stages that are common across most insurance claim processes.

Step 1: Notification of Loss

The first step in the insurance claim process is to notify the insurance company about the loss or damage. This typically involves contacting the insurer’s claims department, either through a dedicated phone line, an online portal, or by visiting a local branch. It’s crucial to provide accurate and detailed information about the incident, including the date, time, and circumstances leading to the loss.

During this initial notification, the insured should have relevant documentation and information readily available. This may include policy documents, photographs of the damage or loss, and any supporting evidence that can help establish the claim's validity.

Step 2: Claims Assessment

Once the insurance company receives the notification, they initiate an assessment process to evaluate the claim. This assessment aims to determine whether the loss is covered by the policy and to what extent. The insurer will review the policy terms and conditions, the insured’s coverage limits, and the specific details of the incident.

As part of the assessment, the insurer may request additional information or documentation from the insured. This could include medical records, repair estimates, police reports, or any other evidence that can support the claim. The insured should respond promptly to these requests to ensure a smooth claims process.

Step 3: Investigation and Verification

In cases where the claim is complex or involves potential fraud, the insurance company may conduct an investigation. This step aims to verify the details of the claim, ensuring that the insured’s statement aligns with the evidence. The insurer may deploy claims adjusters or investigators to gather more information, inspect the damage, or interview witnesses.

During the investigation, the insured should cooperate fully with the insurance company. Providing accurate and honest information is crucial to maintaining trust and ensuring a fair claims settlement.

Step 4: Settlement and Payment

If the insurance company approves the claim, the next step is to determine the settlement amount. This involves calculating the financial loss incurred by the insured and applying any applicable deductibles or policy limits. The insurer will then issue a payment to the insured, either directly or through a designated payee, to cover the agreed-upon amount.

The settlement process may vary depending on the insurance type and the complexity of the claim. In some cases, the insurer may provide an advance payment to cover immediate expenses, especially in emergency situations.

Maximizing Your Insurance Claim

While the insurance claim process is designed to provide support and compensation, it’s essential for policyholders to understand how to maximize their claims and navigate potential challenges.

Documenting Your Claim

Thorough documentation is a key aspect of a successful insurance claim. Policyholders should gather and preserve all relevant documents and evidence related to the loss or damage. This includes policy documents, receipts, invoices, photographs, and any other supporting materials. Maintaining an organized record of these documents can expedite the claims process and strengthen the insured’s case.

Understanding Your Policy

Before initiating a claim, it’s crucial to have a comprehensive understanding of your insurance policy. Policyholders should review their policy documents, including the terms and conditions, coverage limits, and any exclusions or limitations. This knowledge can help identify potential gaps or areas where the claim may be denied. Consulting with an insurance professional or an agent can also provide valuable insights into your specific policy coverage.

Timely Reporting

Promptly reporting a loss or damage to your insurance company is essential. Many policies have specific timeframes for reporting claims, and failing to do so within these timelines can lead to claim denials or reduced settlements. Policyholders should familiarize themselves with their policy’s reporting requirements and adhere to them diligently.

Engaging with Claims Professionals

During the claims process, policyholders may interact with various insurance professionals, including claims adjusters, investigators, and customer service representatives. It’s important to maintain open and honest communication with these individuals. Providing accurate information and being cooperative can streamline the process and lead to a more favorable outcome.

Seeking Legal Advice (if Needed)

In complex or disputed claims, seeking legal advice from an insurance law attorney can be beneficial. An attorney with expertise in insurance matters can provide guidance, represent your interests, and help navigate any legal challenges that may arise during the claims process.

Challenges and Strategies in Insurance Claims

While the insurance claim process aims to provide support and compensation, it’s not without its challenges. Policyholders may encounter various hurdles, from claim denials to lengthy processing times. Understanding these challenges and developing effective strategies can help navigate these obstacles and ensure a positive claims experience.

Claim Denials and Appeals

One of the most common challenges in insurance claims is the denial of a claim. Insurers may deny claims for various reasons, including policy exclusions, lack of sufficient evidence, or disputes over the extent of the loss. If your claim is denied, it’s important to understand the reasons behind the denial and explore your options for an appeal.

In some cases, a claim denial may be a result of a misunderstanding or missing information. Reaching out to your insurer to clarify the reasons for the denial and providing additional supporting evidence can help overturn the decision. If the denial persists, policyholders can consider engaging an insurance advocate or legal counsel to assist with the appeal process.

Complex Claims and Expert Assistance

Certain insurance claims, such as those involving complex medical conditions, business interruptions, or large-scale property damages, may require specialized expertise. In these cases, engaging the services of experts can be crucial to maximizing the claim’s success.

For example, in a medical insurance claim for a rare disease, consulting with a medical specialist who can provide detailed reports and insights can strengthen the claim. Similarly, in a business interruption claim, hiring a forensic accountant to assess the financial impact can provide valuable evidence to support the claim.

Managing Expectations and Communication

Effective communication with your insurance company is essential throughout the claims process. Policyholders should maintain regular contact with their insurer, providing updates and responding to requests for information. Clear and timely communication can help manage expectations and ensure that the claim progresses smoothly.

It's also important to set realistic expectations regarding the claims timeline and settlement amount. While insurers aim to process claims efficiently, complex cases may require more time and resources. Staying informed and engaged with your insurer can help alleviate potential frustrations and misunderstandings.

Utilizing Insurance Advocacy Services

For policyholders who may not have the time or expertise to navigate the insurance claim process, insurance advocacy services can be a valuable resource. These services are provided by professionals who specialize in assisting policyholders with claim preparation, negotiation, and advocacy. They can help ensure that your claim is presented effectively and that your rights and interests are protected.

Future Trends and Innovations in Insurance Claims

The insurance industry is continuously evolving, and the claims process is no exception. Technological advancements and changing consumer expectations are driving innovations that aim to streamline and enhance the claims experience.

Digital Transformation

The digital transformation of the insurance industry is revolutionizing the claims process. Insurers are increasingly adopting digital tools and platforms to enhance efficiency and customer convenience. This includes online claim portals, mobile apps, and automated claim processing systems.

Digital solutions enable policyholders to initiate and track their claims remotely, upload supporting documentation, and receive real-time updates. These technologies not only expedite the claims process but also reduce administrative burdens for both insurers and policyholders.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are playing an increasingly significant role in insurance claims. These technologies can analyze vast amounts of data, detect patterns, and automate certain claim assessment and processing tasks. For instance, AI algorithms can review and evaluate medical records or property damage reports, streamlining the claims evaluation process.

Additionally, AI-powered chatbots and virtual assistants are being deployed to provide instant support and guidance to policyholders during the claims process. These technologies can answer common questions, guide users through the claim submission process, and even offer preliminary assessments of claim validity.

Enhanced Customer Experience

Insurers are recognizing the importance of delivering a positive customer experience throughout the claims journey. This involves not only efficient claim processing but also providing personalized support and guidance to policyholders. Insurers are investing in customer-centric approaches, such as dedicated claims advocates, who can offer tailored assistance and ensure a seamless experience.

Furthermore, insurers are leveraging data analytics to identify potential customer pain points and improve the overall claims experience. By understanding customer needs and preferences, insurers can develop more effective claims management strategies and enhance customer satisfaction.

| Insurance Type | Common Claims |

|---|---|

| Health Insurance | Medical procedures, prescription drug costs, emergency room visits |

| Property Insurance | Natural disasters (e.g., hurricanes, floods), theft, fire damage |

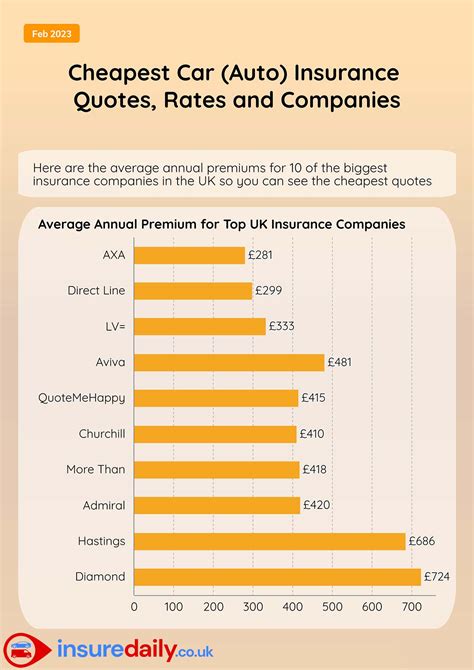

| Auto Insurance | Accidents, vehicle repairs, liability claims |

| Life Insurance | Death benefit claims, critical illness claims |

How long does the insurance claim process typically take?

+The duration of the insurance claim process can vary significantly depending on the type of insurance, the complexity of the claim, and the insurer’s processing capabilities. Simple claims with clear evidence may be resolved within a few days or weeks, while complex claims involving investigations or legal disputes can take several months or even years. It’s important for policyholders to stay informed about the progress of their claim and communicate any concerns with their insurer.

What happens if my insurance claim is denied?

+If your insurance claim is denied, it’s important to understand the reasons for the denial. Insurers are required to provide a written explanation for denied claims. Reviewing this explanation can help you identify any missing information or misunderstandings. You can then consider your options for an appeal, which may involve providing additional evidence or seeking legal advice.

How can I prepare for an insurance claim?

+Preparing for an insurance claim involves several key steps. First, ensure that you have a comprehensive understanding of your insurance policy, including the types of coverage, limits, and exclusions. Keep your policy documents and important contact information readily accessible. In the event of a loss or damage, promptly notify your insurer and provide detailed information about the incident. Gather and preserve all relevant documentation and evidence, such as photographs, receipts, and reports.

What are some common reasons for insurance claim delays?

+Insurance claim delays can occur for various reasons. Common causes include missing or incomplete information, disputes over the extent of the loss, complex investigations, and high claim volumes. Policyholders can help mitigate delays by promptly providing accurate information, cooperating with investigations, and staying engaged with their insurer throughout the claims process.