Liability Insurance For Llc

Protecting your business is an essential aspect of entrepreneurship, and one of the most crucial steps is securing the right insurance coverage. For Limited Liability Companies (LLCs), liability insurance plays a vital role in safeguarding the company and its owners from potential financial risks and legal liabilities. In this comprehensive guide, we will delve into the world of liability insurance for LLCs, exploring its importance, types, coverage, and the benefits it brings to your business.

Understanding Liability Insurance for LLCs

Liability insurance is a form of coverage designed to protect businesses and their owners from claims arising from accidents, injuries, property damage, or negligence attributed to their operations. It serves as a financial safety net, ensuring that your LLC can withstand the potential costs associated with lawsuits, settlements, and legal defense.

For LLCs, which offer limited personal liability protection to their owners, liability insurance provides an extra layer of security. It shields the personal assets of the owners, known as members, from being at risk in the event of a lawsuit or claim. By understanding the different types of liability insurance and the specific needs of your LLC, you can make informed decisions to secure the best coverage for your business.

Types of Liability Insurance for LLCs

When it comes to liability insurance, there are several types tailored to different aspects of your business operations. Here are some of the key coverage options to consider for your LLC:

General Liability Insurance

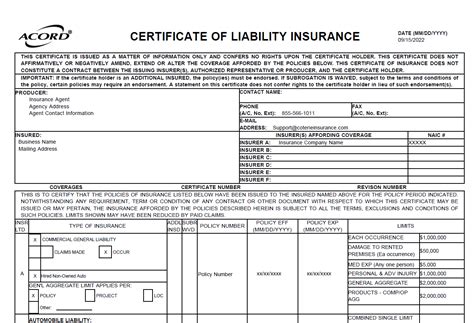

General liability insurance, often referred to as commercial general liability (CGL), is a fundamental coverage for most businesses. It provides protection against a wide range of common risks, including bodily injury, property damage, personal and advertising injury, and medical payments. General liability insurance covers incidents that occur on your business premises or as a result of your products or services.

For LLCs, general liability insurance is particularly important as it safeguards the company and its members from claims arising from accidents that occur on your business property. It covers the costs associated with medical expenses, legal defense, and potential settlements or judgments. General liability insurance is often required by vendors, clients, or landlords when entering into contracts or leasing commercial spaces.

Product Liability Insurance

If your LLC manufactures, distributes, or sells products, product liability insurance is a crucial coverage to consider. This type of insurance protects your business from claims arising from defective products, including injuries caused by the products or any subsequent lawsuits. Product liability insurance covers the costs associated with defending against such claims, as well as potential settlements or judgments.

For LLCs involved in product-related industries, product liability insurance provides peace of mind, knowing that your business is protected against the financial risks associated with product-related incidents. It is especially important if your products have the potential to cause harm or if you operate in an industry with a higher risk of product-related accidents.

Professional Liability Insurance (Errors and Omissions)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is essential for LLCs that provide professional services. This coverage protects your business from claims arising from mistakes, negligence, or failure to perform services as promised. It covers the costs associated with legal defense and potential settlements or judgments in cases where your services are alleged to have caused financial loss or harm to a client.

Professional liability insurance is particularly relevant for industries such as consulting, accounting, legal services, architecture, engineering, and other professions where advice or services are provided. By having this coverage, your LLC can mitigate the financial risks associated with client claims, ensuring the stability and reputation of your business.

Cyber Liability Insurance

In today's digital age, cyber liability insurance has become increasingly important for businesses of all sizes, including LLCs. This coverage protects your business from risks associated with cyber attacks, data breaches, and other online security threats. It covers the costs of investigating and resolving security incidents, as well as potential legal expenses and liabilities arising from data privacy violations.

For LLCs that handle sensitive client information, store data online, or rely heavily on technology, cyber liability insurance is a must-have. It provides financial protection against the growing threat of cybercrime and helps your business recover from potential data breaches, ensuring the continuity and reputation of your operations.

Other Specialized Coverages

Depending on the nature of your LLC's operations, there may be other specialized liability insurance options to consider. These could include employment practices liability insurance (EPLI) to protect against claims of workplace discrimination or harassment, or directors and officers (D&O) liability insurance to safeguard your LLC's leadership from claims arising from their management decisions.

Assessing your business's unique risks and consulting with an insurance professional can help you identify any specialized coverages that may be necessary to fully protect your LLC and its members.

Factors to Consider When Choosing Liability Insurance

When selecting liability insurance for your LLC, there are several key factors to keep in mind to ensure you obtain the most appropriate and comprehensive coverage:

Business Operations and Risks

Evaluate the specific operations and risks associated with your LLC. Consider the nature of your business, the products or services you provide, and any unique factors that could potentially lead to liability claims. By understanding your business's unique risks, you can tailor your insurance coverage accordingly.

Coverage Limits and Deductibles

Liability insurance policies typically come with coverage limits, which define the maximum amount the insurer will pay for covered claims. Choose coverage limits that align with your business's potential liabilities and financial capacity. Additionally, consider the deductibles associated with the policy. Higher deductibles can result in lower premiums, but it's important to ensure you have the financial means to cover the deductible in the event of a claim.

Policy Exclusions and Endorsements

Carefully review the policy exclusions to understand what is not covered by the insurance. Exclusions can vary between insurers and policies, so it's essential to choose a policy that aligns with your business's needs. Additionally, consider any available endorsements or add-ons that can enhance your coverage and provide protection for specific risks that may not be covered under the standard policy.

Claims Handling and Reputation

Research the insurer's reputation for handling claims efficiently and fairly. Look for insurers with a track record of prompt claim processing and fair settlements. Consider customer reviews and industry ratings to ensure you choose an insurer that prioritizes customer satisfaction and provides reliable support during the claims process.

Price and Coverage Comparison

Obtain quotes from multiple insurance providers to compare prices and coverage options. While cost is an important factor, it should not be the sole deciding factor. Ensure that you are comparing policies with similar coverage limits, deductibles, and exclusions to make an informed decision. Finding a balance between cost and comprehensive coverage is essential for protecting your LLC's financial interests.

Benefits of Liability Insurance for LLCs

Securing liability insurance for your LLC offers numerous benefits that contribute to the overall stability and success of your business. Here are some key advantages:

Financial Protection

Liability insurance provides a financial safety net, protecting your LLC from potentially devastating financial losses resulting from lawsuits, settlements, or legal defense costs. It ensures that your business can continue operating without the threat of financial ruin due to unexpected liabilities.

Risk Management

By identifying and understanding the risks associated with your business, you can take proactive measures to mitigate those risks. Liability insurance encourages a culture of risk management within your LLC, helping you implement safety protocols, training programs, and other measures to reduce the likelihood of accidents or incidents that could lead to claims.

Peace of Mind

Knowing that you have comprehensive liability insurance coverage in place provides peace of mind for both you and your LLC's members. It allows you to focus on growing your business and serving your clients without constant worry about potential liabilities. With the right insurance, you can confidently pursue business opportunities and expand your operations.

Client and Vendor Confidence

Having liability insurance demonstrates your commitment to professional conduct and responsibility. It instills confidence in your clients and vendors, assuring them that you are taking the necessary steps to protect their interests and mitigate potential risks associated with your business operations. This can lead to stronger business relationships and increased trust.

Legal Defense and Settlement Support

In the event of a claim or lawsuit, liability insurance provides critical support for your legal defense. It covers the costs of hiring legal professionals to represent your LLC, ensuring you have the resources to navigate the legal process effectively. Additionally, liability insurance often includes settlement support, helping you reach favorable resolutions in a timely manner.

Obtaining Liability Insurance for Your LLC

To obtain liability insurance for your LLC, follow these steps:

Assess Your Coverage Needs

Evaluate the specific risks and operations of your LLC to determine the types of liability insurance you require. Consider the coverage options discussed earlier and assess which ones align with your business's needs.

Research Insurers and Policies

Research reputable insurance providers that offer liability insurance tailored to LLCs. Compare policies, coverage limits, deductibles, and exclusions to find the best fit for your business. Consider seeking recommendations from other business owners or industry associations to identify trusted insurers.

Obtain Quotes and Review Coverage

Contact multiple insurers to obtain quotes for the desired coverage. Compare the quotes based on price, coverage limits, and any additional benefits or perks offered. Review the policy documents carefully to ensure you understand the terms and conditions, including any exclusions or limitations.

Select the Right Policy

Based on your assessment of coverage needs, research, and quotes, select the liability insurance policy that best aligns with your LLC's requirements. Ensure that the coverage limits and deductibles are appropriate for your business's financial capacity and potential liabilities.

Purchase the Policy

Once you have chosen the right policy, proceed with the purchase. Provide the necessary information and documentation to the insurer, including details about your business, its operations, and any specific risks or exposures. Ensure that the policy is in force and that you receive a copy of the policy documents for your records.

FAQs

Is liability insurance mandatory for LLCs?

+While liability insurance is not legally mandated for all LLCs, it is highly recommended. LLCs offer limited personal liability protection, but certain types of claims can still impact the personal assets of members. Liability insurance provides an additional layer of protection, ensuring that your business and personal finances are shielded from potential liabilities.

How much does liability insurance cost for LLCs?

+The cost of liability insurance for LLCs can vary depending on several factors, including the type of business, the industry, the coverage limits chosen, and the insurer. Premiums can range from a few hundred dollars to several thousand dollars per year. It's essential to obtain quotes from multiple insurers to find the most competitive rates for your specific business needs.

Can I customize my liability insurance policy to fit my LLC's needs?

+Yes, many liability insurance policies offer customization options to tailor the coverage to your LLC's specific needs. You can choose different coverage limits, add endorsements or riders to address unique risks, and select additional coverages that align with your business operations. Working with an insurance professional can help you create a customized policy that provides the right protection.

What happens if I don't have liability insurance and a claim is made against my LLC?

+If you don't have liability insurance and a claim is made against your LLC, you and the other members may be personally liable for any damages or settlements awarded. This could result in significant financial losses and potentially impact your personal assets. Without insurance, you would be responsible for covering all legal and settlement costs out of pocket, which could be detrimental to your business and personal finances.

How often should I review and update my liability insurance coverage for my LLC?

+It's recommended to review your liability insurance coverage annually or whenever there are significant changes to your business operations or risks. As your LLC grows and evolves, your insurance needs may also change. Regularly reviewing your coverage ensures that you have the appropriate protection in place and allows you to make any necessary adjustments to maintain adequate coverage.

Liability insurance is a crucial aspect of protecting your LLC and its members from potential financial and legal liabilities. By understanding the different types of coverage, assessing your business’s unique risks, and selecting the right policy, you can ensure that your LLC is well-equipped to handle any unexpected claims or lawsuits. With the right liability insurance in place, you can focus on growing your business with confidence and peace of mind.