Low Price Health Insurance

Health insurance is an essential aspect of financial planning and well-being, yet it can often be a complex and costly endeavor. For individuals and families on a tight budget, finding affordable and comprehensive health coverage is a challenging task. However, with the right knowledge and strategies, it is possible to secure low-price health insurance plans that provide adequate protection without breaking the bank. This article aims to guide you through the process of obtaining affordable health insurance, offering valuable insights and practical tips based on industry expertise.

Understanding the Health Insurance Landscape

The health insurance market is diverse, offering a range of plans with varying levels of coverage and costs. To navigate this landscape effectively, it’s crucial to understand the different types of health insurance plans available and how they work.

Public Health Insurance Plans

Public health insurance plans, such as Medicare and Medicaid, are government-funded programs designed to provide health coverage to specific groups of people. Medicare primarily serves individuals aged 65 and older, while Medicaid caters to low-income individuals and families. These plans offer comprehensive coverage at little to no cost, making them an excellent option for those who qualify.

Medicare, for instance, is divided into several parts, including Part A (hospital insurance), Part B (medical insurance), and Part D (prescription drug coverage). Understanding the nuances of each part is essential to ensure you receive the right coverage for your needs.

Additionally, certain states offer expanded Medicaid coverage, which can benefit individuals with slightly higher incomes. Staying informed about these expansions and eligibility criteria is crucial for accessing affordable healthcare.

Private Health Insurance Plans

Private health insurance plans are typically offered through employers or purchased individually on the open market. These plans come in various forms, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each type offers unique features and networks of healthcare providers.

HMOs, for example, generally have lower premiums but require you to choose a primary care physician and obtain referrals for specialist visits. PPOs offer more flexibility, allowing you to see any healthcare provider within their network without referrals, but at a higher cost.

When considering private health insurance, it's essential to evaluate the plan's coverage, network of providers, and any potential exclusions or limitations. Understanding your healthcare needs and preferences will help you make an informed decision.

Strategies for Finding Low-Price Health Insurance

Securing low-price health insurance requires a strategic approach. Here are some effective strategies to help you find affordable coverage:

Assess Your Healthcare Needs

Before shopping for health insurance, take the time to assess your specific healthcare needs. Consider factors such as your age, pre-existing conditions, prescription medication requirements, and the frequency of doctor visits. Understanding your needs will help you choose a plan that provides adequate coverage without unnecessary expenses.

For instance, if you're generally healthy and don't require frequent medical attention, a high-deductible health plan (HDHP) coupled with a Health Savings Account (HSA) might be a cost-effective option. HDHPs typically have lower premiums, while HSAs allow you to save and invest pre-tax dollars for future medical expenses.

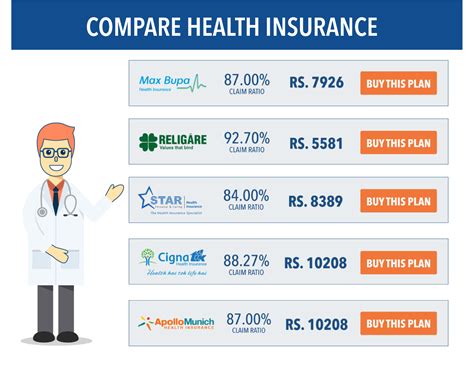

Compare Multiple Plans

The key to finding the best deal on health insurance is to compare multiple plans. Utilize online comparison tools and insurance marketplaces to evaluate different options based on coverage, premiums, deductibles, and co-pays. Consider both short-term and long-term costs to ensure the plan aligns with your financial goals.

When comparing plans, pay attention to the network of providers. Ensure that your preferred doctors and specialists are included in the network to avoid out-of-network charges, which can be significantly higher.

Explore Government Programs

Government-funded health insurance programs, such as Medicaid and the Children’s Health Insurance Program (CHIP), provide valuable coverage to eligible individuals and families. These programs often have minimal or no cost associated with them, making them an attractive option for those who qualify.

To determine your eligibility for these programs, visit the official government websites or contact your local healthcare agency. They can guide you through the application process and help you understand the benefits and requirements of each program.

Take Advantage of Employer-Sponsored Plans

If you’re employed, consider enrolling in your company’s health insurance plan. Many employers offer comprehensive coverage at a reduced cost, as they negotiate group rates with insurance providers. Additionally, some employers contribute towards the cost of premiums, making it an even more attractive option.

When evaluating employer-sponsored plans, pay attention to the level of coverage, any potential exclusions, and the annual out-of-pocket maximum. Ensure the plan meets your healthcare needs and provides adequate protection for you and your family.

Consider Short-Term Health Insurance

If you’re between jobs, transitioning to a new plan, or simply looking for temporary coverage, short-term health insurance plans can be a cost-effective solution. These plans offer limited coverage for a specified period, typically ranging from a few months to a year. They are generally more affordable than traditional plans but may have restrictions and limitations.

It's essential to read the fine print when considering short-term health insurance. Understand the plan's coverage limits, any pre-existing condition exclusions, and the renewal process to ensure you're adequately protected during your transition period.

Maximizing Your Health Insurance Benefits

Once you’ve secured low-price health insurance, it’s important to make the most of your benefits. Here are some tips to help you optimize your coverage:

Stay Informed About Your Plan’s Details

Familiarize yourself with the specifics of your health insurance plan. Understand the coverage limits, deductibles, co-pays, and any potential exclusions. This knowledge will help you make informed decisions about your healthcare and avoid unexpected expenses.

Keep a record of your plan's summary of benefits and coverage, as well as any changes or updates that may occur during the year. This information will be invaluable when navigating the healthcare system and seeking reimbursement for expenses.

Choose In-Network Providers

When selecting healthcare providers, prioritize those within your insurance plan’s network. In-network providers have negotiated rates with your insurance company, resulting in lower costs for you. Out-of-network providers, on the other hand, may charge significantly higher fees, which could impact your out-of-pocket expenses.

Utilize your insurance company's provider search tool to find in-network doctors, hospitals, and specialists in your area. This simple step can save you money and ensure you receive the best possible care within your plan's coverage.

Utilize Preventive Care Services

Many health insurance plans offer preventive care services at no additional cost. These services, such as annual physicals, immunizations, and screenings, are designed to maintain your health and detect potential issues early on. Taking advantage of these services can help prevent more serious health issues down the line, reducing your overall healthcare costs.

Stay informed about the preventive care services covered by your plan and schedule regular appointments with your healthcare providers. This proactive approach to healthcare can lead to better long-term health outcomes and lower expenses.

Manage Your Prescription Medication Costs

Prescription medications can be a significant expense, but there are strategies to manage these costs effectively. First, ask your doctor about generic alternatives to brand-name medications. Generics are typically much more affordable and just as effective.

Additionally, explore prescription drug discount programs offered by your insurance company or through online platforms. These programs can provide substantial savings on your medication costs, especially if you require long-term treatment.

Finally, consider purchasing a larger quantity of your prescription medication when possible. Buying in bulk can often result in lower per-unit costs, helping you save money over time.

The Future of Affordable Health Insurance

The healthcare industry is constantly evolving, and the landscape of affordable health insurance is no exception. As technology advances and new models of healthcare delivery emerge, we can expect to see innovative solutions that make healthcare more accessible and affordable.

One emerging trend is the rise of telemedicine and virtual healthcare services. These platforms allow patients to consult with healthcare professionals remotely, reducing the need for in-person visits and associated costs. Telemedicine can be particularly beneficial for individuals in rural areas or those with limited access to healthcare facilities.

Additionally, the integration of artificial intelligence (AI) and machine learning into healthcare systems is expected to revolutionize the industry. AI-powered tools can analyze vast amounts of medical data, identify trends, and improve the accuracy of diagnoses, leading to more efficient and cost-effective healthcare delivery.

As we move towards a more digital and data-driven healthcare system, it's essential for individuals to stay informed about these advancements. Embracing new technologies and adapting to changing healthcare models can help ensure access to affordable, high-quality healthcare in the future.

| Insurance Type | Key Features |

|---|---|

| Public Health Insurance | Government-funded, often low-cost or free, with specific eligibility criteria |

| Private Health Insurance | Offered by employers or purchased individually, with varying coverage and costs |

| Short-Term Health Insurance | Temporary coverage with limited benefits and restrictions |

How do I know if I qualify for public health insurance programs like Medicaid or Medicare?

+

Eligibility for public health insurance programs depends on various factors, including income, age, and disability status. To determine your eligibility, you can visit the official government websites for Medicaid and Medicare, or contact your local healthcare agency for guidance. They will provide information on the specific requirements and application process for each program.

What is the difference between an HMO and a PPO health insurance plan?

+

An HMO (Health Maintenance Organization) typically requires you to choose a primary care physician and obtain referrals for specialist visits. HMOs often have lower premiums but may have more restrictions on provider choice. A PPO (Preferred Provider Organization) offers more flexibility, allowing you to see any healthcare provider within their network without referrals, but at a higher cost. PPOs usually have higher premiums but provide greater freedom in choosing providers.

Can I switch health insurance plans during the year, or am I locked into my current plan?

+

In most cases, you can switch health insurance plans during the year, but there may be limitations or penalties associated with the change. Open Enrollment Periods, which typically occur once a year, are the standard times when you can make changes to your health insurance coverage. However, certain life events, such as losing your job or getting married, may qualify you for a Special Enrollment Period, allowing you to switch plans outside of the Open Enrollment Period. It’s essential to understand the rules and timelines for switching plans to ensure a smooth transition.

How can I reduce my out-of-pocket expenses when using my health insurance plan?

+

To minimize out-of-pocket expenses, it’s crucial to stay within your insurance plan’s network of providers. Out-of-network care can result in significantly higher costs. Additionally, understanding your plan’s coverage limits and deductibles can help you plan and budget for healthcare expenses. Taking advantage of preventive care services and generic prescription medications can also reduce your out-of-pocket costs over time.