Roadside Insurance

Roadside insurance, often an optional add-on to standard auto insurance policies, is a valuable coverage option that provides peace of mind for drivers. With an ever-growing network of roads and highways, the potential for vehicle breakdowns or emergencies is higher than ever. This type of insurance steps in as a reliable partner, offering prompt assistance and necessary services to get motorists back on the road quickly and safely.

In this comprehensive guide, we delve into the world of roadside insurance, exploring its various facets, benefits, and how it can be a critical component of your overall vehicle coverage. From understanding the different services offered to knowing when and how to utilize this coverage, we aim to provide an expert analysis that will help you make informed decisions about your auto insurance needs.

Understanding Roadside Insurance: Definition and Purpose

Roadside insurance, also known as roadside assistance or emergency roadside service, is a specialized insurance coverage that provides immediate help and assistance to drivers in the event of a vehicle breakdown or emergency. This coverage is designed to offer a range of services, ensuring that motorists are not stranded for long periods and can get back on the road as soon as possible.

The primary purpose of roadside insurance is to offer a swift and effective response to vehicle-related issues, whether it's a flat tire, a dead battery, or even a vehicle that won't start. By having this coverage, drivers can access professional help and avoid the potential risks and inconveniences associated with being stranded by the side of the road.

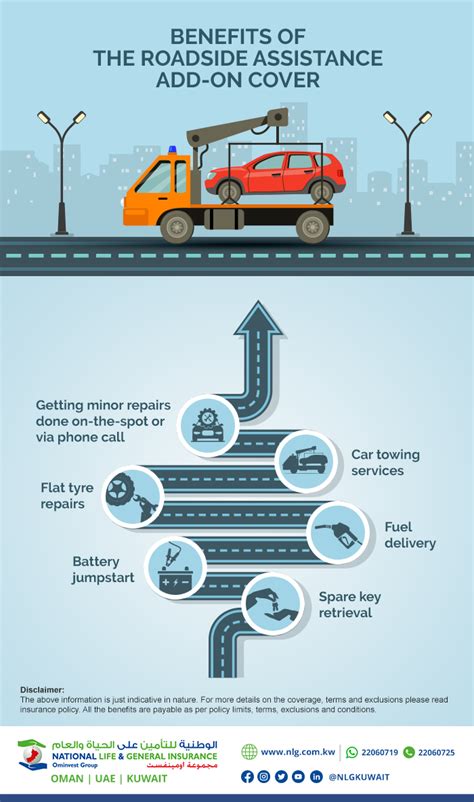

Key Benefits of Roadside Insurance

- 24⁄7 Assistance: One of the most significant advantages of roadside insurance is the availability of assistance around the clock. No matter the time or day, if your vehicle breaks down, you can call for help and expect a prompt response.

- Wide Range of Services: Roadside insurance typically offers a comprehensive suite of services, including towing, battery jump-starts, flat tire changes, fuel delivery, and even locksmith services for locked-out drivers. This means you’re covered for a variety of common roadside emergencies.

- Cost Savings: Having roadside insurance can save you significant costs in the long run. Instead of paying out-of-pocket for each roadside service, which can be expensive, you pay a single premium for a year’s worth of coverage. This can be especially beneficial for those who frequently travel long distances.

- Peace of Mind: Knowing that help is just a phone call away provides immense peace of mind. Whether you’re traveling alone, with family, or on a business trip, roadside insurance ensures you’re never truly stranded, enhancing your safety and security on the road.

How Roadside Insurance Works: A Comprehensive Overview

Roadside insurance operates as an additional layer of protection, providing specific services and benefits that are not typically covered by standard auto insurance policies. These services are designed to address common vehicle issues and emergencies, ensuring that drivers can quickly resume their journey or make necessary arrangements.

The Process of Utilizing Roadside Insurance

- Identify the Issue: The first step in utilizing roadside insurance is to identify the problem with your vehicle. Whether it’s a flat tire, a dead battery, or a mechanical issue, understanding the problem is crucial to determining the appropriate course of action.

- Contact Your Insurance Provider: Once you’ve identified the issue, contact your insurance provider’s roadside assistance hotline. Most providers offer 24⁄7 assistance, so you can reach out at any time of the day or night.

- Provide Vehicle and Location Details: When you contact your insurance provider, be prepared to provide specific details about your vehicle and your location. This information is essential for the provider to dispatch the appropriate help and ensure they can find you quickly.

- Wait for Assistance: After providing the necessary details, you’ll need to wait for the roadside assistance team to arrive. The response time can vary depending on your location and the availability of service providers, but most providers aim for a quick turnaround to minimize your inconvenience.

- Receive Assistance: The roadside assistance team will arrive at your location and provide the necessary service. This could involve a simple battery jump-start, a tire change, or more complex mechanical assistance. The team will work to get your vehicle running again or, if necessary, arrange for a tow to a nearby repair facility.

Common Roadside Services Offered

Roadside insurance typically covers a range of services to address various vehicle emergencies. Here are some of the most common services included in roadside insurance policies:

| Service | Description |

|---|---|

| Towing | If your vehicle is unable to be repaired on the spot, towing services will transport your vehicle to the nearest repair facility or a location of your choice. |

| Battery Jump-Start | In the event of a dead battery, roadside assistance providers can jump-start your vehicle to get you back on the road quickly. |

| Flat Tire Changes | If you experience a flat tire, roadside assistance teams can change the tire for you, ensuring you can continue your journey safely. |

| Fuel Delivery | If you run out of fuel, roadside insurance can arrange for fuel delivery to your location, so you can refill your tank and continue driving. |

| Locksmith Services | If you lock your keys in your vehicle, roadside assistance can provide locksmith services to unlock your car without causing damage. |

| Mechanical Assistance | In some cases, roadside insurance may offer mechanical assistance, such as diagnosing and repairing minor mechanical issues on the spot. |

The Importance of Roadside Insurance: Real-Life Scenarios

Roadside insurance is not just a convenience; it can be a critical component of your overall safety and security on the road. Here are some real-life scenarios that highlight the importance of having this coverage:

Scenario 1: Unexpected Vehicle Breakdown

Imagine you’re on a long-distance road trip with your family when your vehicle suddenly breaks down in a remote area. Without roadside insurance, you’d be faced with the challenge of finding a reliable tow truck and potentially paying high costs for the service. With roadside insurance, you can simply call for assistance, and a tow truck will arrive promptly to transport your vehicle to the nearest repair shop.

Scenario 2: Stranded in Inclement Weather

During a heavy snowfall, your vehicle gets stuck in the snow, and you’re unable to move. Without roadside insurance, you might be stranded for hours, facing the elements and potential safety risks. With roadside insurance, you can call for assistance, and a tow truck equipped with the necessary tools will arrive to extricate your vehicle from the snow.

Scenario 3: Locked Out of Your Vehicle

You arrive at a parking lot after a long day at work, only to realize you’ve locked your keys inside your vehicle. Without roadside insurance, you’d be faced with the dilemma of breaking into your own car or calling a locksmith, both of which can be costly and time-consuming. With roadside insurance, you can call for locksmith services, and a professional will arrive to unlock your vehicle without causing damage.

Choosing the Right Roadside Insurance: Factors to Consider

When selecting roadside insurance, it’s essential to consider various factors to ensure you choose the coverage that best meets your needs. Here are some key considerations:

Coverage Limits and Exclusions

Review the coverage limits and exclusions of the roadside insurance policy. Some policies may have limits on the number of tows or the distance covered. Understanding these limits will help you determine if the policy aligns with your potential needs.

Response Time and Reliability

Consider the response time of the insurance provider. A prompt response is crucial when you’re stranded on the side of the road. Check reviews and ratings to gauge the reliability and efficiency of the provider’s roadside assistance services.

Network of Service Providers

Investigate the network of service providers the insurance company works with. A robust network ensures that you have access to a wide range of services and that you’re not limited to a specific set of providers.

Additional Services and Benefits

Look for roadside insurance policies that offer additional services and benefits. This could include things like rental car coverage while your vehicle is being repaired, travel planning assistance, or even identity theft protection. These additional benefits can enhance the value of your roadside insurance.

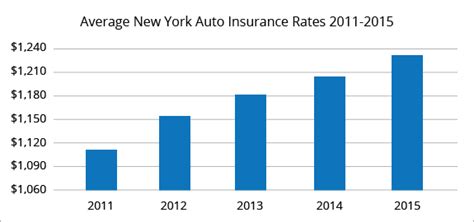

The Cost of Roadside Insurance: Value and Savings

While roadside insurance offers a wealth of benefits, many drivers wonder about the cost of this coverage. The truth is, the value of roadside insurance often far outweighs the cost, especially when you consider the potential expenses of out-of-pocket roadside services.

Comparing Costs: Roadside Insurance vs. Out-of-Pocket Expenses

A single roadside service, such as a tow truck or a battery jump-start, can cost upwards of $100 or more. With roadside insurance, you typically pay a flat rate for a year’s worth of coverage, which can include multiple services. This means that even if you only utilize one service during the year, you’re likely saving money compared to paying out-of-pocket.

Value-Added Benefits: More Than Just Roadside Assistance

Many roadside insurance policies offer additional benefits beyond the standard services. These can include things like trip interruption coverage, which provides reimbursement for additional expenses incurred due to a covered roadside emergency, or even travel planning assistance, which can help you make the most of your journeys.

Future of Roadside Insurance: Technological Advancements and Innovations

As technology continues to advance, the future of roadside insurance looks increasingly promising. Here are some of the ways in which technological advancements are shaping the landscape of roadside assistance:

Smartphone Apps and Digital Services

Many insurance providers are now offering digital services and smartphone apps that allow policyholders to request roadside assistance with a few taps on their screens. These apps often provide real-time updates on the status of the service, allowing drivers to track the progress of their assistance.

Telematics and Connected Vehicles

With the rise of connected vehicles and telematics, roadside insurance providers can now offer more precise and efficient services. Telematics devices can monitor vehicle health and performance, providing real-time data that can help diagnose issues and dispatch the appropriate assistance.

Artificial Intelligence and Machine Learning

AI and machine learning are being utilized to enhance the efficiency and accuracy of roadside insurance services. These technologies can analyze data to predict potential vehicle issues, allowing providers to be proactive in offering assistance and potentially preventing breakdowns before they occur.

Conclusion: Empowering Drivers with Roadside Insurance

Roadside insurance is more than just an optional add-on to your auto insurance policy; it’s a critical component of your overall driving safety and peace of mind. By understanding the benefits, services, and value of roadside insurance, you can make informed decisions about your coverage and ensure you’re prepared for any roadside emergencies.

As technology continues to advance, roadside insurance will only become more efficient and effective, providing drivers with the assistance they need, when they need it. With the right coverage, you can embrace the open road with confidence, knowing that help is always just a call away.

How much does roadside insurance typically cost?

+The cost of roadside insurance can vary depending on several factors, including the insurance provider, the level of coverage, and the location. On average, roadside insurance can range from 50 to 200 per year. However, it’s essential to review the specific details of the policy to understand the coverage limits and any additional fees or exclusions.

Can I add roadside insurance to my existing auto insurance policy?

+Yes, roadside insurance is often an optional add-on to standard auto insurance policies. You can contact your insurance provider to discuss adding this coverage to your existing policy. The process is typically straightforward, and the additional cost can provide significant peace of mind.

Are there any limitations to roadside insurance coverage?

+Yes, roadside insurance policies typically have certain limitations and exclusions. These may include limits on the number of tows or the distance covered, as well as exclusions for certain types of emergencies, such as off-road recoveries or mechanical breakdowns caused by wear and tear.