Social Security Insurance

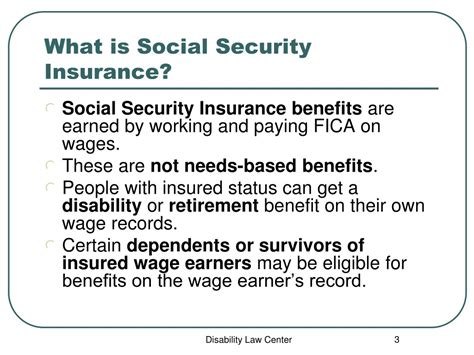

Social Security Insurance (SSI) is a vital program in the United States that provides financial support to individuals who are aged, blind, or have disabilities and have limited income and resources. This essential safety net ensures that vulnerable members of society can access basic necessities and maintain a decent standard of living. As an expert in the field, I aim to provide an in-depth analysis of SSI, exploring its history, eligibility criteria, benefits, and the impact it has on the lives of millions of Americans.

A Brief History of Social Security Insurance

The roots of Social Security Insurance can be traced back to the Social Security Act of 1935, a landmark legislation enacted during the Great Depression. This act, signed into law by President Franklin D. Roosevelt, aimed to provide economic security for the elderly and prevent them from falling into poverty. Over the years, the program has evolved and expanded to include benefits for disabled individuals and their families.

The SSI program, as we know it today, was established in 1974 with the goal of consolidating various federal assistance programs into a single, comprehensive initiative. This consolidation aimed to simplify the application process and ensure a more consistent level of support for those in need.

Eligibility and Application Process

To qualify for SSI benefits, individuals must meet specific criteria set by the Social Security Administration (SSA). The eligibility requirements include:

- Age: Individuals must be 65 years or older, blind, or disabled. For disabled adults, they must meet the SSA's definition of disability, which includes both physical and mental impairments that prevent substantial gainful activity for at least 12 months or result in death.

- Income and Resources: SSI benefits are means-tested, meaning applicants' income and resources must fall below certain thresholds. These limits vary depending on the individual's living arrangement and marital status. The SSA considers income from various sources, including wages, pensions, and investment earnings, while resources include cash, bank accounts, and property.

- Citizenship and Residency: Applicants must be U.S. citizens, nationals, or have qualified alien status. They must also reside in one of the 50 states, the District of Columbia, or the Northern Mariana Islands. However, there are certain exceptions and provisions for those with limited residency.

The application process for SSI involves several steps. Applicants can apply online through the SSA's website, by phone, or in person at their local SSA office. During the application, individuals will need to provide detailed information about their medical conditions, income, and resources. The SSA will then review the application and determine eligibility based on the provided information.

Benefits and Impact of Social Security Insurance

SSI benefits are designed to provide a monthly cash payment to eligible individuals to help cover their basic needs, such as food, clothing, and shelter. The amount of the monthly benefit depends on various factors, including the individual’s living situation and income.

For instance, consider the case of Ms. Johnson, a 72-year-old widow who lives alone in a small apartment. Ms. Johnson has limited income from a small pension and some savings. With her SSI benefits, she is able to afford her rent, purchase nutritious food, and cover her utility bills. This support allows her to maintain her independence and dignity in her golden years.

Impact on Vulnerable Populations

SSI has a profound impact on vulnerable populations, including the elderly, disabled individuals, and their families. For older adults, SSI provides a vital safety net, ensuring they can age with dignity and access the healthcare and support services they need. For disabled individuals, SSI offers financial stability, allowing them to focus on their health and well-being without the constant worry of financial insecurity.

The program also extends its support to the caregivers of disabled individuals. By providing financial assistance, SSI helps alleviate some of the financial burdens faced by caregivers, enabling them to provide the necessary care and support without sacrificing their own financial stability.

Economic Stimulus and Social Security

Beyond its direct impact on individuals, SSI plays a crucial role in stimulating the economy. The benefits provided through SSI are spent in local communities, supporting businesses and creating jobs. A study by the Center on Budget and Policy Priorities found that every dollar spent on SSI generates $1.65 in economic activity. This multiplier effect underscores the program’s importance in supporting local economies and promoting financial stability.

Promoting Health and Well-being

The financial support offered by SSI has a positive impact on the health and well-being of beneficiaries. With access to stable income, individuals can afford healthcare services, medications, and healthy food choices. This, in turn, leads to improved health outcomes and reduced healthcare costs for both individuals and society as a whole.

| Year | SSI Benefit Increase |

|---|---|

| 2021 | 1.3% |

| 2022 | 5.9% |

| 2023 | 3.0% |

Challenges and Future Implications

While SSI has been a successful program, it faces certain challenges and uncertainties. One of the key challenges is the rising cost of living, which often outpaces the program’s benefit increases. This can leave beneficiaries struggling to keep up with the increasing costs of healthcare, housing, and other necessities.

Additionally, the SSI program's funding relies heavily on general revenue from the federal government. This funding structure makes the program vulnerable to budget constraints and political priorities. Ensuring the long-term sustainability of SSI requires careful consideration and proactive measures to secure adequate funding.

Potential Solutions and Innovations

To address these challenges, various solutions and innovations are being explored. One potential solution is the implementation of a more robust asset test, which would consider not only income but also the value of assets when determining eligibility. This approach could ensure that benefits are targeted towards those with the greatest financial need.

Furthermore, there is a growing recognition of the importance of work incentives within the SSI program. By providing incentives and support for beneficiaries to enter or re-enter the workforce, the program can promote financial independence and reduce long-term reliance on benefits.

Advocacy and Policy Reform

Advocacy plays a crucial role in shaping the future of SSI. Organizations and individuals passionate about social justice and the well-being of vulnerable populations must continue to advocate for policy reforms that strengthen and improve the program. This includes efforts to increase benefit levels, simplify the application process, and enhance work incentives.

By engaging in policy discussions and raising awareness about the importance of SSI, advocates can ensure that the program remains a vital safety net for those who need it most.

Conclusion

Social Security Insurance is a cornerstone of the U.S. social safety net, providing essential financial support to millions of Americans who are aged, blind, or have disabilities. The program’s history, eligibility criteria, and impact on vulnerable populations highlight its significance in promoting economic security and social justice.

As we look to the future, it is crucial to address the challenges facing SSI and work towards innovative solutions that ensure the program's long-term sustainability and effectiveness. By continuing to advocate for and support this vital program, we can ensure that the most vulnerable among us have the opportunity to lead dignified and fulfilling lives.

What is the difference between Social Security Insurance (SSI) and Social Security Disability Insurance (SSDI)?

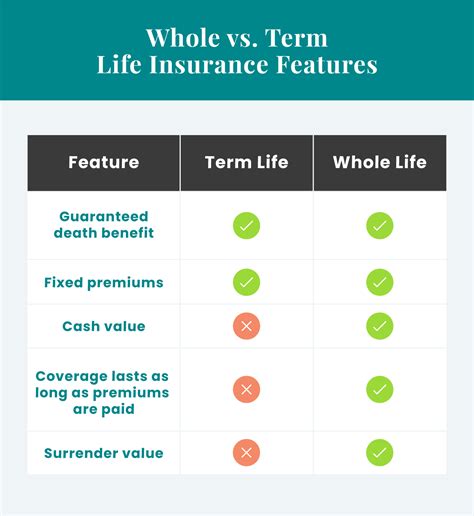

+SSI and SSDI are both programs administered by the Social Security Administration, but they serve different populations. SSI provides benefits to individuals with limited income and resources who are aged, blind, or disabled. SSDI, on the other hand, is for disabled workers who have paid into the Social Security system through payroll taxes. SSDI benefits are based on the individual’s work history, while SSI benefits are means-tested and not dependent on work history.

How often are SSI benefit amounts adjusted for inflation?

+SSI benefit amounts are typically adjusted annually based on the cost-of-living adjustment (COLA). The COLA takes into account the increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The SSA announces the COLA for the upcoming year in October, and the new benefit amounts take effect in January of the following year.

Can SSI beneficiaries work and still receive benefits?

+Yes, SSI beneficiaries can work and receive partial benefits. The SSA encourages beneficiaries to engage in work activities and provides work incentives to help them become financially independent. These incentives include the ability to earn a certain amount of income without affecting their SSI benefits, as well as continued Medicaid coverage and access to vocational training.