The Best Life Insurance Policy

Securing a life insurance policy is a crucial step towards protecting your loved ones and ensuring their financial well-being, especially in the event of unforeseen circumstances. With numerous options available in the market, finding the best life insurance policy that suits your specific needs and provides adequate coverage can be a daunting task. In this comprehensive guide, we will delve into the world of life insurance, exploring various types of policies, their benefits, and the key factors to consider when making an informed decision. By the end of this article, you'll have a clear understanding of the landscape and be equipped to choose the policy that best aligns with your financial goals and peace of mind.

Understanding Life Insurance Policies

Life insurance policies are financial contracts designed to provide a monetary benefit to the policyholder’s beneficiaries upon their death. These policies serve as a safety net, ensuring that your loved ones can maintain their standard of living and meet financial obligations even in your absence. The two primary types of life insurance policies are term life insurance and permanent life insurance, each with its unique features and considerations.

Term Life Insurance

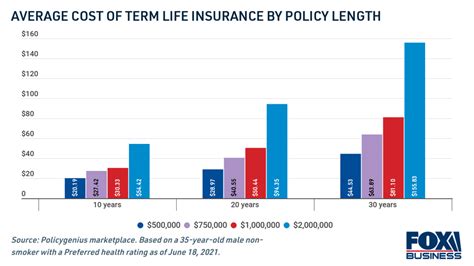

Term life insurance is a straightforward and affordable option, offering coverage for a specific period, typically ranging from 10 to 30 years. During the term, the policyholder pays a fixed premium, and in the event of their death, the beneficiaries receive a lump-sum payment known as the death benefit. This type of policy is ideal for individuals seeking coverage for a defined period, such as during their working years when financial obligations are high.

Key advantages of term life insurance include:

- Cost-Effectiveness: Term policies are generally more affordable compared to permanent life insurance, making them accessible to a wider range of individuals.

- Flexibility: Policyholders can choose the coverage amount and term length based on their specific needs and financial goals.

- No Cash Value: Unlike permanent policies, term life insurance does not accumulate cash value, ensuring that the premium is dedicated solely to providing coverage.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides coverage for the policyholder's entire life, as long as premiums are paid. This type of policy typically offers a fixed death benefit and accumulates cash value over time, which can be accessed through loans or withdrawals. Permanent life insurance includes variants such as whole life insurance, universal life insurance, and variable life insurance, each with unique features.

Key benefits of permanent life insurance include:

- Lifetime Coverage: Policyholders have the assurance of coverage throughout their lives, regardless of their age or health status.

- Cash Value Accumulation: The policy's cash value can be utilized for various financial goals, such as retirement planning or funding emergencies.

- Guaranteed Death Benefit: The policy's death benefit is guaranteed, providing peace of mind to both the policyholder and their beneficiaries.

Factors to Consider When Choosing a Life Insurance Policy

Selecting the best life insurance policy involves careful consideration of several factors. Here are some key aspects to evaluate:

Your Financial Goals

Start by assessing your financial objectives and the specific reasons why you need life insurance. Do you want to provide financial security for your family in the event of your untimely death? Are you looking to cover specific expenses such as mortgage payments, college funds, or business debts? Understanding your financial goals will help you determine the appropriate coverage amount and type of policy.

Coverage Amount

The coverage amount, or the death benefit, is a critical factor in choosing a life insurance policy. It should be sufficient to cover your financial obligations and provide for your loved ones’ needs. Consider factors such as outstanding debts, funeral expenses, ongoing living expenses, and future financial goals when determining the appropriate coverage amount.

Policy Duration

The duration of your policy depends on your life stage and financial responsibilities. Term life insurance is ideal for individuals with short-term financial goals or those who only require coverage during specific periods, such as while their children are young or during their peak earning years. On the other hand, permanent life insurance is suitable for long-term financial planning and provides coverage throughout your lifetime.

Premium Affordability

Life insurance premiums can vary significantly based on the type of policy, coverage amount, and your personal health and lifestyle factors. It’s essential to choose a policy with premiums that align with your budget and financial capabilities. While it’s tempting to opt for the lowest premium, ensure that the coverage amount and policy type adequately meet your needs.

Policy Flexibility

Consider the flexibility of the policy to adapt to changing circumstances. Some policies allow policyholders to increase coverage amounts or convert term policies to permanent ones without undergoing additional medical underwriting. Others may offer riders or additional benefits that can enhance the policy’s value.

Rider Options

Riders are optional additions to a life insurance policy that provide extra benefits or coverage. Common riders include accelerated death benefits, waiver of premium, and long-term care coverage. Evaluate the rider options available and choose those that align with your specific needs and concerns.

Company Reputation and Financial Strength

When selecting a life insurance policy, it’s crucial to choose a reputable insurance company with a strong financial standing. A financially stable company ensures that your policy will remain in force and that your beneficiaries will receive the death benefit as promised. Research the company’s history, customer reviews, and financial ratings to make an informed decision.

Performance Analysis: Term vs. Permanent Life Insurance

To illustrate the differences between term and permanent life insurance, let’s compare the performance of these policies based on real-world examples and industry data.

| Policy Type | Coverage Period | Premium Cost | Death Benefit | Cash Value Accumulation |

|---|---|---|---|---|

| Term Life Insurance | 10-30 years | Low to Moderate | Fixed | None |

| Permanent Life Insurance | Lifetime | Moderate to High | Fixed | Accumulates over time |

Consider the following scenarios to understand how these policies perform in different situations:

Scenario 1: Young Family with Financial Obligations

John, a 35-year-old with a wife and two young children, wants to ensure his family’s financial security. He opts for a 20-year term life insurance policy with a coverage amount of 500,000. John's annual premium is 500, which is affordable for his budget. This policy provides peace of mind during his family’s crucial years, covering mortgage payments, education expenses, and other financial obligations.

Scenario 2: Business Owner with Long-Term Planning

Sarah, a 45-year-old business owner, seeks life insurance to protect her business and provide for her family’s future. She chooses a whole life insurance policy with a coverage amount of 1 million. Sarah's annual premium is 2,500, and the policy accumulates cash value over time. This permanent policy ensures lifetime coverage for Sarah and provides her with a financial tool for retirement planning and business succession.

Future Implications and Industry Trends

The life insurance industry is continually evolving, with new products and innovations emerging to meet the changing needs of policyholders. Here are some key trends and future implications to consider:

Increasing Customization

Insurance companies are offering more customizable policies, allowing individuals to tailor their coverage based on their unique circumstances and preferences. From adjustable death benefits to flexible premium payment options, policyholders can create a plan that suits their needs.

Technological Advancements

The integration of technology is transforming the life insurance landscape. Digital applications and online platforms are streamlining the application and claims processes, making it more convenient for policyholders. Additionally, advanced analytics and data-driven insights are helping insurers offer more accurate and personalized quotes.

Wellness and Lifestyle Programs

Incentivizing healthy lifestyles, some insurance companies are introducing wellness programs that reward policyholders for maintaining good health. These programs offer discounts on premiums or additional benefits, encouraging policyholders to adopt healthier habits.

Environmental and Social Considerations

With growing awareness of environmental and social issues, some insurance companies are incorporating sustainable and ethical practices into their operations. This includes offering eco-friendly investment options and supporting community initiatives, appealing to policyholders who value these aspects.

Can I change my life insurance policy if my circumstances change?

+Yes, life insurance policies often offer flexibility to adapt to changing circumstances. You may have the option to increase coverage, convert a term policy to permanent, or make other adjustments based on your needs. However, it’s important to review the terms and conditions of your policy and consult with your insurance provider to understand the specific options available to you.

What happens if I miss a premium payment?

+Missing a premium payment can have varying consequences depending on your policy type and the grace period allowed by your insurance provider. In some cases, a missed payment may result in a lapse of coverage, while others may offer a grace period before the policy terminates. It’s crucial to maintain timely premium payments to ensure uninterrupted coverage.

Can I have multiple life insurance policies?

+Yes, it is possible to have multiple life insurance policies. Some individuals choose to have a combination of term and permanent policies to meet different financial goals. However, it’s important to carefully consider the coverage amounts and ensure that the combined premiums are within your budget.

How do I know if I’m getting a fair premium for my policy?

+To determine if you’re getting a fair premium, it’s essential to compare quotes from multiple insurance providers. Consider factors such as coverage amount, policy type, and your personal health and lifestyle. Additionally, seeking advice from a financial advisor or insurance broker can help you evaluate the competitiveness of the premium.