All States Insurance Near Me

Are you searching for reliable insurance options in your area? "All States Insurance Near Me" is a popular query for those seeking comprehensive coverage and convenient access to insurance services. This guide will delve into the world of insurance, providing an in-depth look at what you can expect when searching for All States Insurance and how it can cater to your specific needs.

Understanding All States Insurance

All States Insurance is a renowned insurance provider known for its extensive network and tailored coverage plans. With a focus on customer satisfaction and a wide range of insurance products, it has become a go-to choice for individuals and businesses alike. Understanding the services and benefits offered by All States Insurance is crucial when considering your insurance options.

Comprehensive Insurance Packages

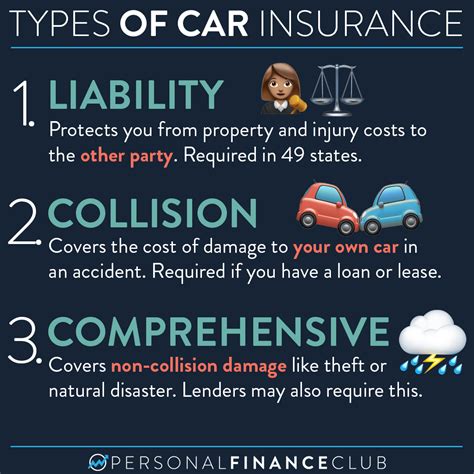

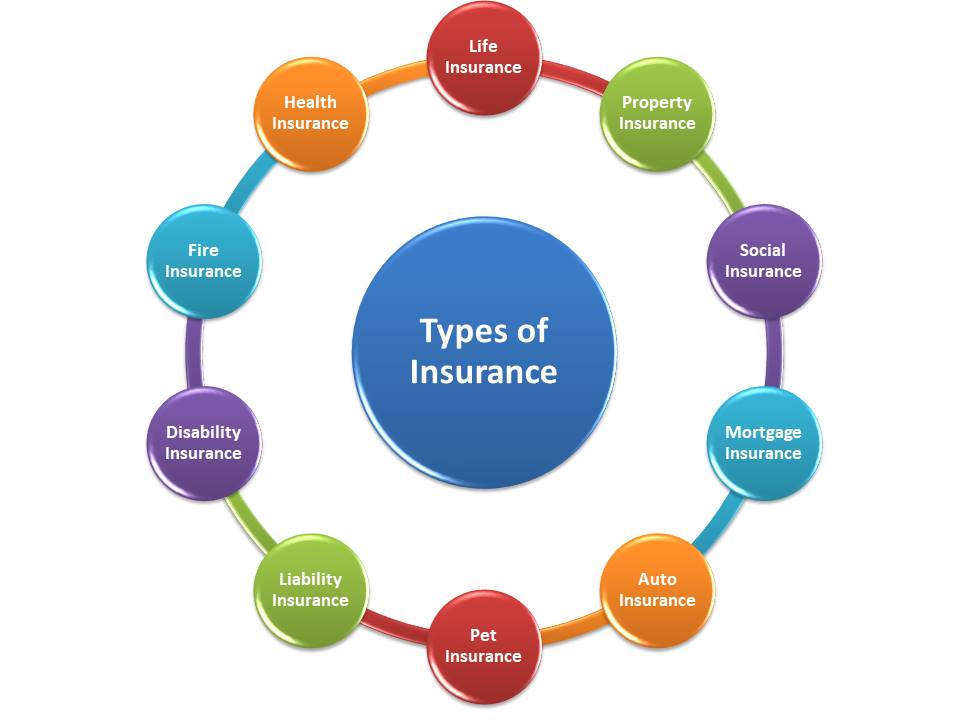

One of the standout features of All States Insurance is its ability to offer comprehensive insurance packages. Whether you're looking for auto, home, life, or business insurance, All States Insurance has you covered. Their packages are designed to provide maximum protection with customizable options, ensuring you get the coverage that fits your unique situation.

For instance, their auto insurance plans offer more than just standard liability coverage. You can choose from a range of additional benefits, such as rental car reimbursement, emergency road service, and glass repair coverage. This level of customization ensures you're not paying for coverage you don't need while still enjoying the peace of mind that comes with comprehensive protection.

| Insurance Type | Key Benefits |

|---|---|

| Auto Insurance | Comprehensive coverage, rental car reimbursement, emergency services |

| Home Insurance | Customizable policies, disaster protection, personal liability coverage |

| Life Insurance | Term and whole life options, death benefit flexibility, accelerated benefit riders |

| Business Insurance | Liability protection, property coverage, business interruption insurance |

Convenient Access and Local Presence

When you search for "All States Insurance Near Me," you're not just looking for coverage; you're seeking convenience and local expertise. All States Insurance understands this, which is why they've established a strong network of local agents and offices across the country.

With a local presence, All States Insurance agents are well-versed in the unique insurance needs of your area. They can provide personalized advice, guide you through the often-complex world of insurance, and ensure you understand the fine print. Whether you're dealing with a claim or just have questions about your policy, having a local agent can make a world of difference.

Additionally, their online platform offers a seamless experience for managing your insurance needs. From policy inquiries and claim submissions to payment options, their digital tools make insurance management accessible and efficient. You can even use their website to find the nearest All States Insurance office or agent, making it easy to connect with local experts.

How to Find All States Insurance Near You

Finding All States Insurance in your area is straightforward and can be done through a variety of methods. Here are some steps to help you locate the closest All States Insurance office or agent:

- Online Search: Start by performing an online search using keywords like "All States Insurance Near Me." This will often yield results for the closest offices or agents, along with their contact information and services offered.

- Visit the Official Website: Navigate to the All States Insurance website, where you'll find a dedicated "Find an Agent" or "Office Locator" section. Simply enter your zip code or city, and you'll be presented with a list of nearby offices or agents, along with their contact details and office hours.

- Check Local Directories: Local business directories, both online and offline, can be a great resource. Look for All States Insurance listings in these directories, which often provide detailed contact information and even customer reviews.

- Ask for Referrals: If you know someone who is insured with All States Insurance, they can be a valuable source of information. Ask for referrals and recommendations based on their personal experiences with local agents or offices.

- Social Media and Reviews: Social media platforms and online review sites can provide insights into the local presence of All States Insurance. Search for their business pages or read reviews from customers in your area to get an idea of their services and reputation.

The Benefits of Choosing All States Insurance

Selecting All States Insurance as your provider comes with a host of advantages. Beyond their comprehensive insurance packages and local presence, they offer a range of benefits that set them apart in the insurance industry.

Exceptional Customer Service

All States Insurance prides itself on delivering exceptional customer service. Their team of dedicated professionals is trained to provide prompt, friendly, and knowledgeable assistance. Whether you're a new customer seeking guidance or an existing policyholder with a claim, their customer service representatives are there to help every step of the way.

Additionally, their customer service extends beyond the initial purchase of a policy. They offer ongoing support, ensuring you understand your coverage and feel confident in your insurance decisions. With a focus on building long-term relationships, All States Insurance aims to be more than just an insurance provider; they want to be your trusted partner for all your insurance needs.

Innovative Technology and Digital Tools

In today's digital age, All States Insurance recognizes the importance of technology in delivering efficient and accessible services. They've invested in innovative digital tools and platforms to enhance the customer experience. From their user-friendly website to mobile apps, they've made it easier than ever to manage your insurance needs on the go.

With their online platform, you can access your policy details, make payments, submit claims, and even download important documents. The app, available for both iOS and Android devices, offers added convenience, allowing you to manage your insurance anytime, anywhere. These digital advancements not only save time but also provide a level of flexibility that traditional insurance providers may lack.

Competitive Pricing and Discounts

All States Insurance understands that insurance can be a significant expense. That's why they strive to offer competitive pricing and a range of discounts to make insurance more affordable. By offering various discounts, they ensure that you're getting the best value for your money.

For example, they often provide multi-policy discounts, meaning you can save by bundling your auto, home, and life insurance policies together. Additionally, they offer discounts for safe driving records, loyalty rewards, and even for adopting energy-efficient measures in your home. These incentives not only save you money but also encourage responsible behavior, creating a win-win situation.

Frequently Asked Questions

What types of insurance does All States Insurance offer?

+

All States Insurance provides a comprehensive range of insurance products, including auto, home, life, and business insurance. They offer customizable policies to suit individual needs and preferences.

How can I find the nearest All States Insurance office or agent?

+

You can use the “Find an Agent” or “Office Locator” feature on their website, perform an online search, check local directories, or ask for referrals from existing customers.

What makes All States Insurance different from other insurance providers?

+

All States Insurance stands out for its comprehensive insurance packages, local presence, exceptional customer service, innovative digital tools, and competitive pricing with various discounts.

Can I manage my insurance policy online with All States Insurance?

+

Absolutely! All States Insurance offers a user-friendly online platform and mobile apps, allowing you to access your policy details, make payments, submit claims, and more, all from the convenience of your device.

Are there any discounts available with All States Insurance?

+

Yes, All States Insurance provides various discounts, including multi-policy discounts, safe driving record discounts, loyalty rewards, and incentives for adopting energy-efficient practices. These discounts make insurance more affordable and encourage responsible behavior.