Cheapest Insurance

Finding the cheapest insurance is a common goal for many individuals and businesses, as it can significantly impact their financial well-being and planning. While the term "cheapest insurance" may suggest a straightforward objective, it's essential to understand that the most affordable option is not always the best choice. This article aims to delve into the complexities of insurance pricing, exploring the factors that influence costs, and providing insights into how to secure the most suitable and cost-effective coverage.

Understanding Insurance Costs

Insurance premiums are calculated based on a variety of factors, and these calculations can be complex. Insurance companies consider risk assessment as a fundamental aspect of their pricing strategies. The level of risk associated with insuring an individual or entity plays a pivotal role in determining the cost of coverage.

When it comes to personal insurance, such as health, life, or auto insurance, various factors come into play. These can include age, gender, health status, driving record, and even geographical location. For instance, younger individuals often pay higher premiums for car insurance due to their higher risk of accidents. Similarly, individuals with pre-existing health conditions may face higher health insurance premiums.

For business insurance, the assessment is equally intricate. Insurance providers consider the nature of the business, its location, the number of employees, and the level of risk associated with the industry. High-risk industries like construction or manufacturing may attract higher premiums due to the increased likelihood of accidents or property damage.

Additionally, the coverage limits and deductibles chosen by the policyholder significantly impact the cost of insurance. Higher coverage limits and lower deductibles typically result in higher premiums, as the insurance company assumes more financial responsibility.

Comparing Insurance Quotes

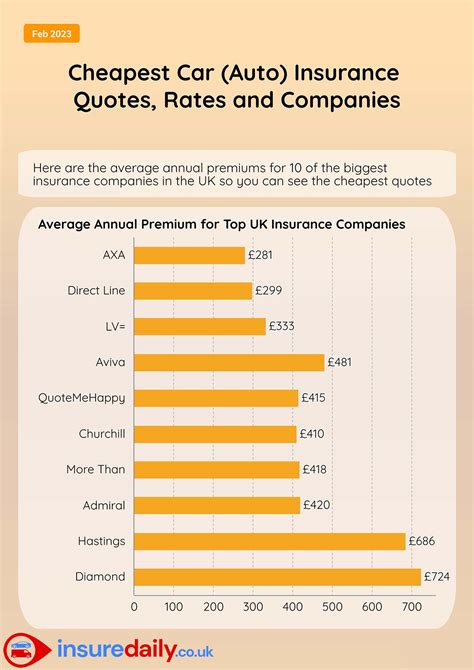

To find the cheapest insurance, it’s crucial to compare quotes from multiple providers. This process allows individuals and businesses to assess the range of prices and coverage options available in the market.

Online insurance comparison platforms have made this task significantly easier. These platforms aggregate insurance quotes from various providers, allowing users to input their specific details and receive tailored quotes. However, it's important to note that not all insurance providers participate in these platforms, so a thorough search may still be necessary.

When comparing quotes, pay attention to the coverage details and not just the price. The cheapest quote may not always offer the best value if it lacks adequate coverage. It's essential to review the policy's terms and conditions to understand what is and isn't covered.

Consider seeking assistance from an insurance broker or agent. These professionals have extensive knowledge of the insurance market and can provide personalized advice. They can help you navigate the complex world of insurance, ensuring you find a policy that suits your needs and budget.

Factors Influencing Insurance Costs

Several factors contribute to the cost of insurance, and understanding these can help individuals and businesses make informed decisions.

Risk Assessment

As mentioned earlier, risk assessment is a critical component of insurance pricing. Insurance companies use sophisticated models to assess the likelihood of a claim being made. The higher the perceived risk, the higher the premium is likely to be.

Location

The geographical location of the insured individual or business can significantly impact insurance costs. Areas with a higher risk of natural disasters, such as hurricanes or earthquakes, may attract higher premiums. Similarly, regions with higher crime rates or traffic accidents can also lead to increased insurance costs.

Lifestyle and Behavior

Certain lifestyle choices and behaviors can influence insurance premiums. For instance, individuals who lead a healthy lifestyle and maintain a good fitness level may enjoy lower health insurance premiums. Similarly, safe driving habits and a clean driving record can result in reduced auto insurance costs.

Claims History

The claims history of the insured individual or business is another critical factor. Insurance companies carefully analyze past claims to assess the likelihood of future claims. Those with a history of frequent or costly claims may face higher premiums or even difficulty obtaining coverage.

Tips for Securing Affordable Insurance

While finding the cheapest insurance is a desirable goal, it’s important to strike a balance between cost and coverage. Here are some tips to help you secure affordable insurance without compromising on quality:

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. This can result in significant savings.

- Increase Deductibles: Opting for higher deductibles can lower your premium costs. However, ensure that you can afford the deductible in the event of a claim.

- Review Coverage Regularly: Insurance needs can change over time. Regularly review your policies to ensure you have the right coverage and aren't paying for unnecessary add-ons.

- Shop Around: Don't settle for the first quote you receive. Compare prices and coverage from multiple providers to find the best value.

- Improve Risk Profile: Take steps to improve your risk profile, such as maintaining a healthy lifestyle, driving safely, or implementing security measures for your business.

The Importance of Adequate Coverage

While cost is an essential consideration when choosing insurance, it’s crucial not to sacrifice adequate coverage. The cheapest insurance may not provide sufficient protection in the event of a claim. This can lead to financial hardship and unexpected out-of-pocket expenses.

It's recommended to work with an insurance professional who can guide you in selecting a policy that offers the right balance between cost and coverage. They can help you understand the potential risks and ensure you have the necessary protection.

Future Trends in Insurance

The insurance industry is evolving, and new technologies and trends are shaping the way insurance is priced and delivered.

Telematics and Usage-Based Insurance

Telematics technology is increasingly being used to monitor driving behavior and offer personalized insurance rates. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive, uses telematics to collect data on driving habits. This data is then used to calculate insurance premiums, rewarding safe drivers with lower rates.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the insurance industry. These technologies are being used to analyze vast amounts of data, improve risk assessment, and enhance fraud detection. AI-powered chatbots and virtual assistants are also becoming common, providing customers with instant support and information.

Blockchain Technology

Blockchain technology is expected to revolutionize the insurance industry by improving transparency, security, and efficiency. It can enhance data sharing between insurers, reduce fraud, and streamline the claims process. Additionally, blockchain-based smart contracts can automate certain insurance processes, further reducing costs.

Conclusion

Finding the cheapest insurance is a complex task that requires a thorough understanding of the factors influencing insurance costs. While cost is an important consideration, it’s crucial to strike a balance between affordability and adequate coverage. By comparing quotes, understanding risk factors, and implementing strategies to improve your risk profile, you can secure the most suitable and cost-effective insurance coverage.

How often should I review my insurance policies?

+It’s recommended to review your insurance policies annually or whenever there is a significant life change, such as a marriage, birth, or career change. This ensures that your coverage remains adequate and aligned with your current needs.

Can I negotiate insurance premiums?

+While insurance premiums are typically non-negotiable, you can try to negotiate with your insurance provider by highlighting your loyalty, good payment history, or any changes in your risk profile that may reduce the likelihood of claims.

What are some common mistakes to avoid when buying insurance?

+Common mistakes include choosing the cheapest policy without considering coverage, not reading the policy terms and conditions, and failing to disclose relevant information to your insurer. It’s important to understand your needs and make informed decisions.