Compare Medical Insurance Plans

Navigating Medical Insurance: A Comprehensive Guide to Choosing the Right Plan

When it comes to medical insurance, making an informed decision is crucial to ensuring your health and financial well-being. With a myriad of options available, from traditional health maintenance organizations (HMOs) to flexible preferred provider organizations (PPOs), finding the perfect fit can be daunting. In this comprehensive guide, we'll explore the key aspects of different medical insurance plans, helping you navigate the complex world of healthcare coverage and make a confident choice.

As an expert in the field, I'll provide you with an in-depth analysis, real-world examples, and practical insights to empower your decision-making process. Let's delve into the world of medical insurance and uncover the plan that best suits your unique needs.

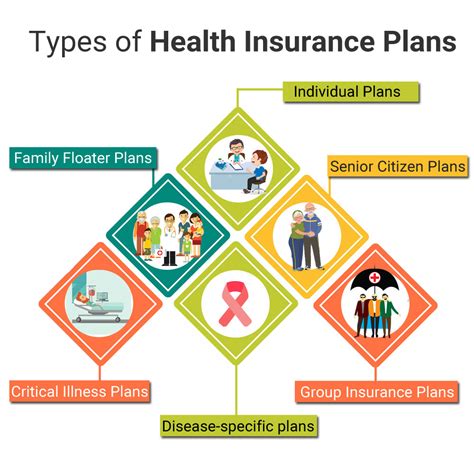

Understanding the Basics: Types of Medical Insurance Plans

Medical insurance plans can be broadly categorized into several types, each with its own set of features and coverage options. Understanding these categories is essential to making an informed choice.

Health Maintenance Organizations (HMOs)

HMOs are known for their comprehensive and cost-effective approach to healthcare. These plans typically require you to choose a primary care physician (PCP) who will coordinate your healthcare services. HMOs often have a network of preferred providers, and you may need referrals to see specialists. Here's a quick overview:

- Network: Limited network of preferred providers.

- Referrals: Required for specialist visits.

- Cost: Generally, lower premiums and out-of-pocket costs.

- Example: Blue Cross Blue Shield HMO plans offer a wide range of benefits, including preventive care and wellness programs.

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility compared to HMOs. With a PPO, you have the freedom to choose any healthcare provider, whether in or out of the network. While out-of-network care may be more expensive, PPOs provide a wider range of options. Key features include:

- Network: Larger network of providers, including both in-network and out-of-network options.

- Referrals: Usually not required for specialist visits.

- Cost: Premiums and out-of-pocket costs can vary, but PPOs often provide more coverage options.

- Example: UnitedHealthcare’s PPO plans provide access to a vast network of healthcare providers, offering convenience and flexibility.

Exclusive Provider Organizations (EPOs)

EPOs strike a balance between HMOs and PPOs. Like HMOs, EPOs have a network of preferred providers, but unlike HMOs, referrals are typically not required for specialist visits. Here's a breakdown:

- Network: Similar to HMOs, EPOs have a network of preferred providers.

- Referrals: Usually not needed for specialist visits.

- Cost: Premiums and out-of-pocket costs are often lower compared to PPOs.

- Example: Aetna’s EPO plans provide comprehensive coverage with a focus on network providers.

Point-of-Service (POS) Plans

POS plans offer a blend of HMO and PPO features. You choose a primary care physician and have the option to receive care within the network or outside it. Referrals are generally required for out-of-network care. Key characteristics include:

- Network: Like HMOs, POS plans have a network of preferred providers.

- Referrals: Required for out-of-network care.

- Cost: Premiums and out-of-pocket costs can vary, depending on network usage.

- Example: Cigna’s POS plans provide flexibility, allowing members to choose between in-network and out-of-network care.

High-Deductible Health Plans (HDHPs)

HDHPs are paired with health savings accounts (HSAs) and are designed for those seeking lower premiums and the ability to save for future healthcare expenses. These plans have higher deductibles, meaning you pay more out of pocket before insurance coverage kicks in. Key aspects include:

- Deductible: High deductible, typically over 1,400 for individuals and 2,800 for families.

- HSA: Allows you to save pre-tax dollars for qualified medical expenses.

- Cost: Lower premiums but higher out-of-pocket costs until the deductible is met.

- Example: AHDHP paired with an HSA can be a cost-effective option for those who prioritize savings and have few medical expenses.

Evaluating Coverage and Benefits

When comparing medical insurance plans, it's crucial to assess the coverage and benefits they offer. Here are some key factors to consider:

Preventive Care and Wellness Programs

Many insurance plans now prioritize preventive care, offering coverage for services like annual physicals, immunizations, and wellness programs. These services can help catch potential health issues early and promote overall well-being. Look for plans that provide comprehensive preventive care coverage.

Prescription Drug Coverage

Prescription medications can be a significant expense. Ensure that your chosen plan offers robust prescription drug coverage, including a wide range of medications and potential discounts. Some plans may have preferred pharmacies, so consider your preferred pharmacy options.

Specialist Care and Referral Policies

If you have specific healthcare needs or require regular specialist visits, understanding the referral policies and specialist coverage is essential. Some plans may require referrals, while others offer direct access to specialists. Evaluate the ease of accessing specialist care based on your needs.

Out-of-Pocket Costs and Deductibles

Out-of-pocket costs, including deductibles, copayments, and coinsurance, can significantly impact your healthcare expenses. Compare the out-of-pocket costs across different plans, especially if you anticipate frequent medical visits or procedures. Consider your healthcare needs and budget when evaluating these costs.

Personalizing Your Plan: Key Considerations

Choosing the right medical insurance plan involves considering your unique circumstances and preferences. Here are some factors to personalize your decision:

Health Status and Needs

Evaluate your current and potential future health needs. If you have a chronic condition or require ongoing medical care, plans with comprehensive coverage and lower out-of-pocket costs may be ideal. Conversely, if you're generally healthy, a plan with a higher deductible and lower premiums could be a suitable choice.

Preferred Providers and Networks

Consider your preferred healthcare providers and the network of providers offered by different plans. If you have a trusted physician or specialist, ensure they are in-network to avoid higher out-of-pocket expenses. Research the plan's network to understand the availability of providers in your area.

Cost-Effectiveness and Budget

Evaluate the cost-effectiveness of each plan based on your budget and healthcare needs. Consider not only the premiums but also the potential out-of-pocket costs, including deductibles, copayments, and coinsurance. Remember that while lower premiums may be attractive, higher out-of-pocket costs can impact your overall expenses.

Real-World Examples: Comparing Plans in Action

Let's explore some real-world scenarios to better understand the practical implications of choosing different medical insurance plans.

Scenario 1: Young and Healthy Individual

Sarah, a 25-year-old healthy individual, is looking for an affordable insurance plan. She doesn't anticipate frequent medical visits but wants basic coverage for emergencies and preventive care. In this case, an HDHP with a health savings account (HSA) could be a cost-effective choice, allowing her to save for future healthcare expenses while enjoying lower premiums.

Scenario 2: Family with Chronic Conditions

John and his family have a history of chronic conditions and require regular specialist visits. They prioritize comprehensive coverage and ease of access to healthcare services. In their situation, a PPO plan with a larger network and direct access to specialists would be ideal, ensuring they can receive the necessary care without the hassle of referrals.

Scenario 3: Elderly Individual with Complex Healthcare Needs

Elderly individuals often have complex healthcare needs. Maria, an elderly individual with multiple chronic conditions, requires regular medical care and prescriptions. In her case, an HMO plan with a focus on coordinated care and preventive services, coupled with robust prescription drug coverage, would be a suitable choice to manage her healthcare effectively.

Navigating the Fine Print: Understanding Policy Details

When comparing medical insurance plans, it's essential to delve into the fine print and understand the nuances of each policy. Here are some key aspects to consider:

Exclusions and Limitations

Insurance plans may have exclusions or limitations on certain services or treatments. Carefully review the policy to understand what is and isn't covered. Some common exclusions include cosmetic procedures, experimental treatments, and certain mental health services.

Pre-existing Condition Coverage

If you have a pre-existing condition, ensure that the plan provides coverage for it. Some plans may have waiting periods or exclusions for pre-existing conditions, so clarify these details before making a decision.

Coverage for Specific Procedures or Treatments

If you have specific medical needs or anticipate certain procedures, confirm that the plan covers those services. For example, if you require ongoing dialysis, ensure that the plan includes coverage for dialysis treatments.

Maternity and Family Planning Coverage

For individuals planning to start a family, understanding maternity and family planning coverage is crucial. Some plans may have specific benefits for prenatal care, childbirth, and postnatal services. Ensure that the plan aligns with your family planning goals.

The Future of Medical Insurance: Trends and Innovations

The world of medical insurance is evolving, and keeping up with the latest trends and innovations can help you make informed decisions for the future. Here's a glimpse into the future of healthcare coverage:

Telehealth and Virtual Care

Telehealth services have gained popularity, especially in recent years. Many insurance plans now offer coverage for virtual doctor visits, mental health counseling, and remote monitoring. This trend is expected to continue, offering convenient and accessible healthcare options.

Value-Based Care Models

Value-based care models focus on delivering high-quality healthcare while controlling costs. These models incentivize healthcare providers to improve patient outcomes and reduce unnecessary treatments. As value-based care gains traction, insurance plans may increasingly adopt these models, offering more cost-effective and efficient healthcare.

Integration of Wearable Technology

Wearable technology, such as fitness trackers and smartwatches, is becoming an integral part of healthcare. Some insurance plans are now offering incentives and discounts for using these devices to track health metrics and promote healthy lifestyles. The integration of wearable technology is expected to grow, offering personalized health insights and preventive care.

Frequently Asked Questions (FAQ)

How do I choose the right medical insurance plan for my family?

+When selecting a plan for your family, consider your collective healthcare needs, budget, and preferred providers. Assess the coverage for common family health concerns, such as pediatric care, prescription drugs, and specialist visits. Opt for a plan that offers comprehensive coverage and aligns with your family's priorities.

What if I have a pre-existing condition? Will I be able to find coverage?

+Yes, thanks to the Affordable Care Act (ACA), insurance companies cannot deny coverage based on pre-existing conditions. However, it's essential to review the plan's details to understand any waiting periods or exclusions. Some plans may offer specific coverage for pre-existing conditions, so explore your options carefully.

Can I change my insurance plan if I'm not satisfied with my current coverage?

+Depending on your situation, you may have the option to switch plans during open enrollment periods or if you experience a qualifying life event, such as a job change or marriage. Review the guidelines for changing plans and explore your options to find a better fit for your needs.

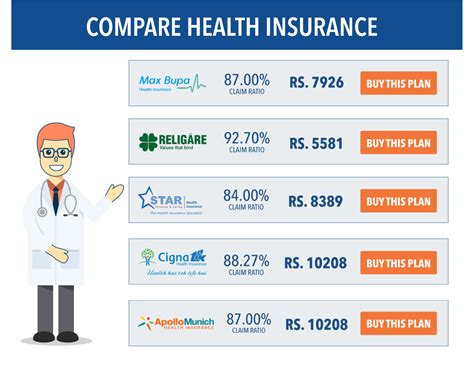

How can I compare the costs of different medical insurance plans?

+To compare costs, evaluate the premiums, deductibles, copayments, and coinsurance for each plan. Consider your anticipated healthcare needs and budget. Remember that while premiums are important, out-of-pocket costs can also impact your overall expenses. Calculate the potential costs for your specific healthcare scenarios.

Are there any discounts or incentives available for choosing certain plans?

+Yes, some insurance plans offer discounts or incentives for enrolling in specific programs or adopting healthy lifestyle choices. For example, you may receive discounts for using generic medications, completing wellness programs, or participating in preventive care initiatives. Explore these incentives to maximize your savings.

In the complex world of medical insurance, making an informed decision is paramount. By understanding the different types of plans, evaluating coverage and benefits, and considering your unique needs, you can choose a plan that provides comprehensive and cost-effective healthcare coverage. Stay informed, explore your options, and take control of your healthcare future.